Here's How Innovation Keeps Colgate (CL) Stock on Growth Track

Colgate-Palmolive Company CL has been benefitting from its innovation strategies and execution, which have been crafting the company’s growth story over the years. Additionally, CL’s bold pricing actions and accelerated revenue growth management plans have been driving organic sales growth.

The company’s innovation strategy is focused on growing in adjacent categories and product segments. It is also focused on the premiumization of its Oral Care portfolio through major innovations.

Backed by its premium innovation, the company’s products like CO. by Colgate, Colgate Elixir toothpaste and Colgate enzyme whitening toothpaste have been performing well. Also, CL’s at-home whitening and professional whitening products have been well-received by customers.

Colgate’s Oral Care business has also been performing well, particularly in Africa. Some other notable efforts include the continued expansion of the Naturals and Therapeutics divisions, as well as the Hello Products LLC buyout.

Additionally, the popularity of Colgate’s professional skincare businesses — Elta MD and PCA Skin — in spas and at dermatologists continues to grow. Colgate has been witnessing positive customer feedback for its elmex and meridol brands, driven by increased investment. The company expanded its premium skincare portfolio with the buyout of the Filorga skincare business. It is witnessing strong market share gains in North America and China, its two largest markets, with increased share gains across all other regions.

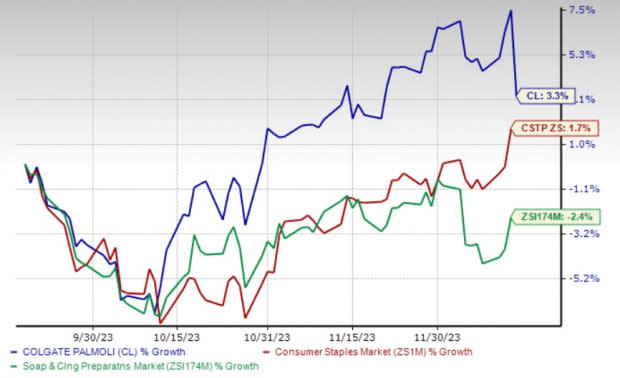

The company’s robust business trends and gains from ongoing innovation have been well reflected in its share price. Shares of this Zacks Rank #3 (Hold) company have gained 3.3% in the past three months against the industry’s decline of 2.4%. CL also fared better than the sector’s growth of 1.7% in the same period.

The Zacks Consensus Estimate for Colgate’s 2023 sales and earnings suggests growth of 7.9% and 8.1%, respectively, from the year-ago reported numbers.

Image Source: Zacks Investment Research

Other Factors Driving Growth

CL has been gaining from strong pricing, and the benefits of funding growth and other productivity efforts. The company’s aggressive pricing actions, along with solid business momentum, boosted the top line and margins in third-quarter 2023.

In third-quarter 2023, net sales increased 10.5% year over year and advanced 9% on an organic basis. The company reported the 19th successive quarter of organic sales growth at or above its long-term target of 3-5% growth in third-quarter 2023. The gross profit margin expanded 130 basis points (bps) to 58.5% on a GAAP basis and 140 bps to 58.6% on an adjusted basis. Consequently, non-GAAP basis earnings advanced 16% from the prior-year period.

Driven by the impressive results, management raised its sales and profit forecast for 2023. It anticipates net sales growth of 6-8% compared with the prior mentioned 5-8%. The current projection reflects gains from the acquisitions of pet food businesses, offset by a low-single-digit adverse currency impact. It anticipates full-year organic sales growth of 7-8% compared with the earlier stated 5-7%. The company expects an adjusted gross profit margin expansion in 2023. It estimates adjusted earnings per share to increase in the high-single digits compared with the prior stated mid-single-digit growth.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely e.l.f. Beauty ELF, Inter Parfums IPAR and Ollie's Bargain Outlet OLLI.

e.l.f. Beauty, operating as a cosmetic company, currently sports a Zacks Rank #1 (Strong Buy). Shares of ELF have rallied 16.4% in the past three months. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for e.l.f. Beauty’s current financial year’s sales and earnings per share suggests growth of 57.8% and 61.5%, respectively, from the year-ago reported figures. ELF has a trailing four-quarter earnings surprise of 90.1%, on average.

Inter Parfums, engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products, has a trailing four-quarter earnings surprise of 45.7%, on average. It currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales and earnings suggests growth of 20.9% and 19.7%, respectively, from the prior-year reported levels. Shares of IPAR have gained 1.7% in the past three months.

Ollie's is a value retailer of brand-name merchandise at drastically reduced prices. It currently carries a Zacks Rank #2. Shares of OLLI have declined 7.3% in the past three months.

The Zacks Consensus Estimate for OLLI’s current financial-year sales and earnings suggests growth of 14.8% and 72.8%, respectively, from the year-earlier actuals. OLLI has a trailing four-quarter earnings surprise of 7.04%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report