Here's How Lowe's (LOW) is Placed Ahead of its Q4 Earnings

Lowe's Companies, Inc. LOW is likely to register a decrease in the top line when it reports fourth-quarter fiscal 2023 earnings on Feb 27, before market open. The Zacks Consensus Estimate for revenues stands at $18,338 million, indicating a decline of 18.3% from the prior-year reported figure.

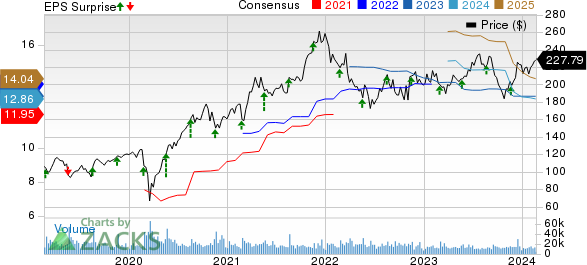

The bottom line is also expected to have decreased year over year. Over the past 30 days, the Zacks Consensus Estimate for fourth-quarter earnings per share has been stable at $1.68, suggesting a decline of 26.3% from the year-ago quarter.

Lowe's has a trailing four-quarter earnings surprise of 2.6%, on average. In the last reported quarter, this improvement retailer beat the Zacks Consensus Estimate by a margin of 0.3%.

Factors to Note

Lowe's revenues might have faced downward pressure in the fourth quarter due to factors such as softness in the Do-It-Yourself (DIY) segment, challenges in online sales, impacts of lumber deflation, competitive pressures and macroeconomic uncertainties.

A significant portion of Lowe's revenues, approximately 75%, is driven by the DIY segment. Any softness in this segment, particularly in categories such as appliances, decor, flooring, and kitchen and bath, could impact sales. Consumers have been displaying cautious spending behavior, postponing purchases of bigger ticket items like appliances. This cautiousness, combined with industrywide pullbacks in appliance sales, has been affecting Lowe's, given its market leadership in the appliance category. We expect comparable sales to decline 7.2% in the final quarter.

On its last earnings call, the company mentioned that its comparable average ticket was impacted by lumber deflation, contributing to a decline despite increases in other merchandise categories. Normalization of appliance promotions also poses challenges in managing product pricing and promotions effectively. As competitors continue to adopt aggressive pricing strategies and value propositions, Lowe's may face pressure on margins, affecting its overall revenues and profitability.

Nonetheless, management has outlined various strategic initiatives aimed at improving DIY performance. These initiatives include targeted efforts to reach value-conscious customers, competitive offers on single-unit appliance purchases, and the launch of Lowe's lowest price guarantee. These efforts reflect the company's proactive approach to addressing challenges and enhancing its competitive position in the market.

Also, Lowe's demonstrated resilience in its Pro sales, delivering positive sales comps in Pro during the third quarter. This indicates the effectiveness of the company's strategies in catering to the needs of its professional customers, who are crucial for its business.

Lowe's Companies, Inc. Price, Consensus and EPS Surprise

Lowe's Companies, Inc. price-consensus-eps-surprise-chart | Lowe's Companies, Inc. Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Lowe's this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here.

Lowe's has an Earnings ESP of +2.10% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks With the Favorable Combination

Here are three other companies you may want to consider as our model shows that these also have the right combination of elements to post an earnings beat this season:

Costco COST currently has an Earnings ESP of +1.58% and carries a Zacks Rank #2. The Zacks Consensus Estimate for second-quarter fiscal 2024 earnings per share is pegged at $3.60, up 9.1% year over year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco’s top line is expected to ascend year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $59.2 billion, which indicates an increase of 7.1% from the figure reported in the prior-year quarter. COST has a trailing four-quarter earnings surprise of 2.6%, on average.

Ollie's Bargain OLLI currently has an Earnings ESP of +1.12% and a Zacks Rank of 3. The company is likely to register an increase in the bottom line when it reports fourth-quarter fiscal 2023 numbers. The Zacks Consensus Estimate for quarterly earnings per share of $1.16 suggests an increase of 38.1% from the year-ago reported number.

Ollie's Bargain’s top line is expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $649.1 million, which suggests an increase of 18.1% from the prior-year quarter. OLLI has a trailing four-quarter earnings surprise of 7%, on average.

Burlington Stores BURL currently has an Earnings ESP of +1.17% and a Zacks Rank #3. The company is expected to register an increase in its bottom line when it reports fourth-quarter fiscal 2023 results. The Zacks Consensus Estimate for quarterly earnings per share of $3.25 suggests a rise of 9.8% from the year-ago quarter.

Burlington Stores’ top line is anticipated to increase year over year. The consensus mark for revenues is pegged at $3.02 billion, indicating an increase of 9.9% from the figure reported in the year-ago quarter. BURL has a trailing four-quarter earnings surprise of 9.4%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report