Here's What Makes Logitech (LOGI) a Promising Portfolio Pick

Logitech International S.A. LOGI shares have soared 38.3% post the second-quarter fiscal 2024 earnings release, driven by a solid performance. Earnings estimates for the current and next fiscal year have increased, implying robust inherent growth potential.

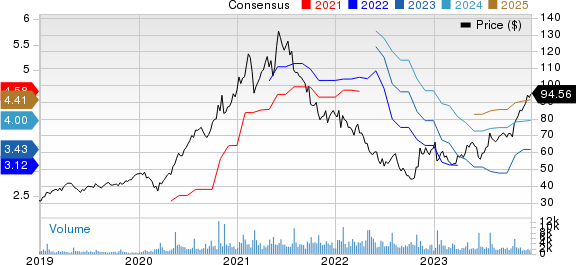

The Zacks Consensus Estimate for fiscal 2024 earnings has been revised 11 cents upward over the past 60 days to $3.43 per share. The consensus mark for fiscal 2025 earnings has been revised a penny upward to $4.00 per share in the past seven days. Additionally, it has a long-term earnings growth expectation of 15.8% and delivered a solid earnings surprise of 30.4%, on average, in the trailing four quarters.

The stock also has a favorable combination of a Zacks Rank #2 (Buy) and a Growth Score of A. The Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 (Strong Buy) or #2 and a Growth Score of A or B offer solid investment opportunities.

With healthy fundamentals, the stock appears to be a solid investment option at the moment.

Logitech International S.A. Price and Consensus

Logitech International S.A. price-consensus-chart | Logitech International S.A. Quote

Growth Drivers

Logitech’s stronger-than-expected second-quarter fiscal 2024 results have boosted investors’ confidence about its recovery from the post-pandemic downturn. Heightening hybrid work trends are likely to boost demand for its video collaboration, keyboards & combos and pointing device tools. Thriving cloud-based video conferencing services continue to be its key catalyst.

The growing adoption of new mobile platforms in both mature and emerging markets is fueling the demand for Logitech’s peripherals and accessories. The company has been able to leverage its software and go-to-market capabilities to drive market share gains and growth.

Logitech intends to tap the high-potential market for accessories by pursuing innovation and expanding its product lines. The company has manufactured innovative offerings like the fastest-performing mouse and keyboard switches, wireless mouse with the longest battery and multi-device keyboards, among others. Over the last few years, Logitech has introduced many offerings to grab a greater market share.

The acquisition of Finland’s Loupedeck in July 2023 will enhance Logitech’s ability to provide customizable and contextual control experiences for the company’s full portfolio of devices, including the Logitech Software Roadmap solution. Loupedeck offers deep native integrations with industry-leading creative software for photo editing, retouching, video editing, color grading design and streaming. Its custom consoles combine analog control with digital precision to offer power and flexibility to all creators. With this buyout, Logitech will leverage Loupedeck’s strong and growing developer community that will unveil advanced innovation, empowering streamers, creators and gamers.

The latest forecast for worldwide IT spending by Gartner is an upside for Logitech. The worldwide IT spending is anticipated to increase 3.5% year over year to $4.7 trillion in 2023 and further grow 8% year over year to $5.07 trillion in 2024 despite the global economic turbulence. The research firm expects that worldwide spending on devices and software will increase 4.8% and 13.8%, respectively, on a year-over-year basis in 2024. This bodes well for the company’s prospects in the near term.

Other Key Picks

Zoom Video Communications Inc. ZM is gaining significant traction from the hybrid working wave, which has accelerated the need for digital transformation among enterprises. The company is benefiting from steady growth in its subscriber base and enterprise customer base, backed by the strong demand for offerings like Zoom Phone. The launch of AI-driven solutions like Zoom Doc and Zoom AI Companion holds promise. Zoom’s expanding international presence is a key catalyst. The company’s freemium business model helps it win customers rapidly, which it can later convert into paying customers.

The Zacks Consensus Estimate for Zoom’s fiscal 2024 earnings has been revised upward by 3 cents to $4.94 per share in the past 30 days, suggesting year-over-year growth of 13%. The long-term estimated earnings growth rate for the stock stands at 33.5%. ZM stock currently sports a Zacks Rank #1 and has a Growth Score of B. You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA Corporation NVDA, carrying a Zacks Rank #2, is benefiting from growing investments in generative AI. The generative AI revolution is likely to create huge demand for its next-generation high computing powerful chips. Considering surging AI investments across the data center end market, NVDA expects its fourth-quarter fiscal 2024 revenues to reach $20 billion from $6.05 billion in the year-ago quarter.

NVIDIA is dominating the market for AI chips. The company’s GPUs are already being applied in AI models. This is expanding NVDA’s footprint in untapped markets like automotive, healthcare and manufacturing. Collaborations with Mercedes-Benz and Audi are likely to advance NVIDIA’s presence in autonomous vehicles and other automotive electronics space.

The consensus mark for fiscal 2024 earnings has been revised upward by 22 cents to $12.29 per share over the past 30 days, indicating a whopping 268% increase from fiscal 2023. The stock has a Growth Score of A and has a long-term earnings growth expectation of 13.5%.

CrowdStrike Holdings, Inc. CRWD carries a Zacks Rank #2 and has a Growth Score of A. The company is benefiting from the rising demand for cyber-security solutions due to a slew of data breaches and the increasing need for security and networking products amid the growing hybrid working trend.

Continued digital transformation and cloud migration strategies adopted by organizations are key growth drivers. The company’s portfolio strength, mainly the Falcon platform’s 10 cloud modules, boosts its competitive edge and helps add users. Additionally, strategic acquisitions such as Bionic and Reposify are expected to fuel growth.

The Zacks Consensus Estimate for CrowdStrike’s fiscal 2024 earnings has been revised upward by 12 cents in the past 30 days to $2.94 per share, which calls for an increase of 90.9% on a year-over-year basis. The long-term expected earnings growth rate for the stock is pegged at 36.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report