Here's What Shopify's Stock Split Means for Investors

Shopify's (NYSE:SHOP) stock has rallied amid a proposed 10-to-1 stock split of both its Class A and Class B shares. If the company's internal governance and its shareholders approve of the split, existing shareholders will receive nine additional shares on June 28.

Investors are often confused about the advantages and disadvantages of a stock split. Is anything really changing about the company just because the stock is split? If nothing other than the share count is changing, then why does the announcement of a stock split usually have an effect on the stock price? In this article, I take a look at what a split could mean for Shopify.

What are stock splits?

Stocks splits are sometimes considered a type of dividend. A split is usually executed when the company's management considers its financial prospects to be robust and, in turn, wants to bring a more investable stock to the market. People are typically more likely to invest in stocks with a lower share price due to cognitive biases.

Stock splits have no economic effect on shareholders; however, it's been discovered by a University of Cambridge published study that stock splits lead to an excess annual return of approximately 3.38%, meaning that investors in Shopify could hold an asset with a better risk-return profile.

Shopify's valuation and earnings

Shopify is undervalued at its current share price, in my opinion. At face value, you might say that we're looking at an overvalued stock because it's trading at a price-earnings ratio of 93.95. However, we need to consider how the valuation compares to growth with the PEG ratio.

Shopify's PEG ratio of 0.03 is well below the fair value threshold of 1.00. The undervalued PEG ratio suggests that Shopify's earnings per share growth rate has leapfrogged its share price growth by 33.3 times. This indicates that the company's fair value per share exceeds its market price per share.

Shopify's latest earnings report shows just why its stock is undervalued relative to its earnings per share growth.

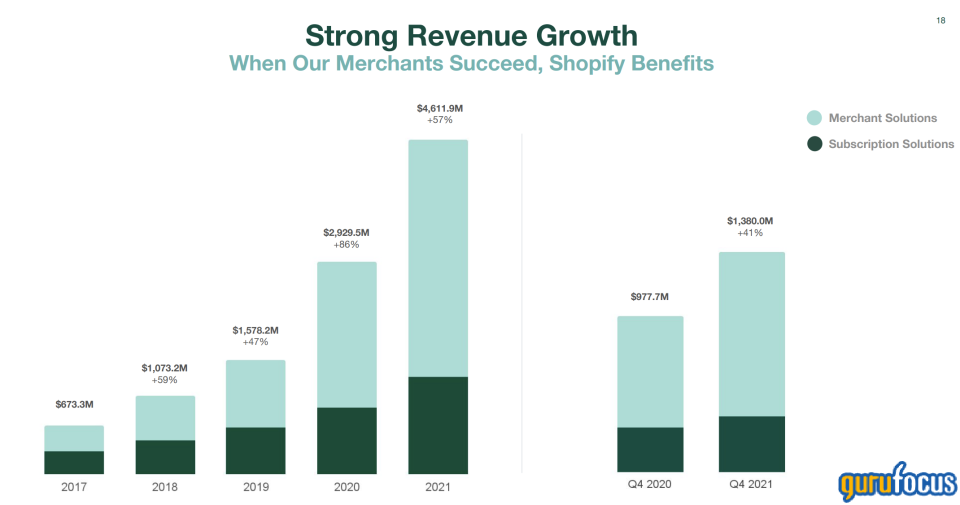

Shopify generated a 41% year-over-year improvement in revenue during the quarter as its merchant and subscription solutions yielded stellar results with 41% and 26% growth, respectively. Furthermore, Shopify's gross profits grew by 37% year-over-year, suggesting that its vertically integrated business model is yielding cost-saving results.

Source: Shopify earnings presentation

Looking forward, I anticipate robust growth to continue across all its segments amid a 9.8% surge in small and medium enterprise (SME) growth between 2017 and 2021. Additionally, I believe inflation is likely to cool down during 2022, meaning that businesses could re-adopt heavier spending on technology subscriptions and ancillary applications to boost their top-line sales.

The bottom line

Shopify remains a well-rounded business in a growing market. Its stock is undervalued based on its PEG ratio and growth prospects, and a stock split could be the key to unlocking the stock's true value, as its shares will be easier to access for market participants.

This article first appeared on GuruFocus.