Here's How Skechers (SKX) is Staying Ahead of Its Industry

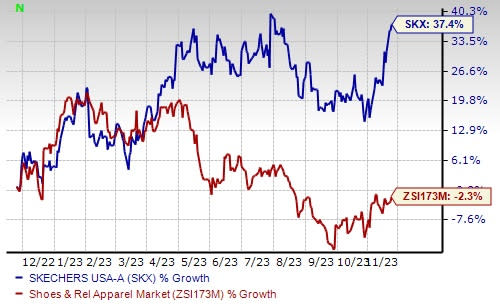

Skechers U.S.A., Inc. SKX has exhibited a decent run on the bourses in the past year. The stock has outpaced the Zacks Shoes and Retail Apparel industry, thanks to its operational initiatives focused on designing and developing products, global expansion through the opening of company-owned and third-party stores, and digital initiatives. In the said period, shares of this Zacks Rank #2 (Buy) company have gained 37.4% against the industry’s decline of 2.3%.

Additionally, an uptrend in the Zacks Consensus Estimate echoes a positive sentiment. The consensus estimate for the current and the next financial years has increased by 1 penny each to $3.44 and $3.99, respectively, over the past seven days.

Image Source: Zacks Investment Research

Let’s Introspect

Skechers, one of the recognized names in the footwear space, maintains its commitment to offering a diverse range of footwear, spanning fashion, athletic, non-athletic and work categories, all at appealing price points. Recent emphasis has been placed on comfort-centric footwear and apparel to align with the prevailing trend of consumers adopting a more relaxed lifestyle, both in professional and casual settings.

The company has unveiled three capsules from the Snoop Dogg collaboration, strategically expanding its footprint in North America, Europe and other key markets. Collaborations with notable figures like Martha Stewart and the Rolling Stones contributed to enhanced brand visibility.

Skechers' dedication to innovation is evident in diverse collections such as Hands-Free Slip-ins and Arch Fit, complemented by targeted marketing campaigns featuring global influencers, emphasizing the brand's commitment to both comfort and style.

The direct-to-consumer (DTC) business has proven to be a significant revenue driver for Skechers. In the third quarter of 2023, DTC sales experienced a substantial year-over-year increase of 23.8%, reaching $850.4 million, constituting 42% of the total sales. This growth is further detailed by a 14.1% increase in domestic DTC sales and a significant 33.3% rise in international DTC sales. Notably, DTC unit volume saw an 18.8% increase, accompanied by a 4.3% rise in the average selling price.

Skechers has expanded its physical presence with the opening of 72 company-owned stores in the third quarter, with a notable focus on China and other international markets. Additionally, the company added 324 third-party stores, bringing the global store count to 4,992.

Internationally, Skechers' business continues to drive sales growth, with international sales accounting for 61% of overall sales in the third quarter. The EMEA and APAC regions demonstrated year-over-year growth of 2.3% and 14.4%, respectively.

Digital initiatives are integral to Skechers' growth strategy, with continuous enhancements to online presence, mobile applications and loyalty programs. The implementation of omnichannel features, such as "Buy Online, Pick-Up in Store" and "Buy Online, Pickup at Curbside," reflects the company's commitment to improving customer engagement.

The strategic acquisition of its long-term Scandinavia distributor has further fortified Skechers' brand presence in the Nordic region, contributing to a strengthened online and offline presence.

Promising Outlook

Skechers is optimistic about reaching its target of $10 billion in annual sales by 2026. Markedly, management is actively investing in various avenues, including the opening of stores, enhancing omnichannel capabilities and expanding distribution capacity in key markets such as India, China and Chile.

In 2023, the management aims to achieve sales of $7.95-$8.05 billion, whereas it reported $7.44 billion last year. The company anticipates earnings per share between $3.33 and $3.43, compared with the earlier mentioned $3.25-$3.40. Notably, it reported earnings of $2.38 last year.

3 Other Promising Stocks

A few other top-ranked stocks in the same space are The Gap, Inc. GPS, Deckers Outdoor Corporation DECK and Abercrombie & Fitch Co. ANF.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. The company currently sports a Zacks Rank #1 (Strong Buy). GPS delivered a significant earnings surprise in the last reported quarter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Gap’s current fiscal-year earnings implies growth of 347.5% from the previous year’s reported number. GPS has a trailing four-quarter average earnings surprise of 137.9%.

Deckers Outdoor is a leading designer, producer and brand manager of innovative, niche footwear and accessories. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Deckers’ current fiscal-year earnings and sales indicates growth of 20.9% and 11.4%, respectively, from the previous year’s reported figures. DECK has a trailing four-quarter average earnings surprise of 26.3%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently carries a Zacks Rank #2. ANF delivered a 60.5% earnings surprise in the last reported quarter.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales implies growth of 10.4% from the previous year’s reported number. ANF has a trailing four-quarter average earnings surprise of 713%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report