Here's Why 2024 Could be Great for REITs: 4 Stocks to Buy Now

For most of 2023, persistent macroeconomic uncertainties and a high interest rate environment kept the performance of the real estate investment trust (REITs) industry under pressure. However, the Fed’s latest decision to keep interest rates steady and an indication of three rate cuts in 2024 cheered REIT investors. The FTSE NAREIT All REIT Index rose 11.92% in November and 8.17% through Dec 26, outperforming the S&P 500’s rise of 9.13% and 4.18%, respectively.

As economic activity rebounds are in full swing, the REIT industry seems well-poised for a recovery in the coming year. In this article, we discuss the factors that are likely to drive the industry’s recovery and also present our top four picks.

Factors to Drive REITs’ 2024 Performances

As we dive into 2024, the Fed’s accommodative approach to tackling inflation is likely to provide an impetus to the REIT sector, which depends highly on the debt market to carry out business activities. These companies benefit from lower borrowing costs. Moreover, low interest rates contribute to higher valuations.

Also, REITs are widely known for their regular dividends. With rate cuts on the line in the coming year, dividend yields for REITs are likely to be on the attractive side compared with the yields on fixed-income and money-market accounts. This will make REITs desirable to investors.

Apart from these broad-based factors, economic activity continues to gain pace from its pandemic lows and remains resilient. A favorable job market seems encouraging. Robust demand for certain real estate categories, such as that for data centers and need-based asset categories, is likely to keep the momentum going for REITs in 2024.

Sectors in the Spotlight

The retail real estate market fundamentals remained solid in 2023 and the trend is likely to continue in 2024. Retailers are expected to continue renting out more physical store spaces, along with expanding their omni-channel retailing model. Several retail REITs are focusing on developing mixed-use assets to tap the growth opportunities in areas where people prefer to live, work and play.

Lower expected construction deliveries in the coming year will keep the retail availability rate down, aiding occupancy levels at existing spaces. Per a CBRE Group report, 2024 will likely see the demand for open-air suburban retail centers increase at a faster pace than other retail formats, as traditionally mall-based retailers explore new formats for expansion.

Although the U.S. industrial real estate market is expected to stabilize in 2024, the demand for such spaces is likely to remain buoyant, given the improvements in industries and an expanding e-commerce market. Also, with companies’ efforts to improve supply-chain efficiencies, the demand for logistics infrastructure and efficient distribution networks will drive healthy leasing activities across these spaces in the upcoming period.

As for the residential real estate space, the high costs of homeownership in several markets relative to rents and the flexibility that renting apartment units offers will drive demand and keep occupancy rates high despite an elevated supply. Specialty sectors, including self-storage, data centers, medical office, life sciences facilities and seniors housing, witnessed solid demand in the last couple of years, and investments in these alternative asset classes are rising steadily.

In this digital era, the high demand for inter-connected data center spaces by enterprises and service providers will continue as they integrate artificial intelligence (AI) into their strategies and offerings, and advance their digital transformation agendas. As the implementation of AI becomes more prevalent, the sector is likely to see more investments in 2024, enhancing the growth prospects for data center REITs.

Stock Picks

Here we have picked four REITs using the Zacks Screener. Apart from having robust fundamentals, these REITs have higher chances of market outperformance. Further, these stocks are witnessing upward estimate revisions, reflecting analysts’ optimism.

Equinix, Inc. EQIX provides a global, vendor-neutral data center, inter-connection and edge solutions platform. Global enterprises, service providers and business ecosystems of industry partners depend on the company’s International Business Exchange data centers and expertise for safe housing of their critical IT equipment. Platform Equinix allows customers to directly and securely interconnect to networks, clouds and contents that enable today's information-driven global digital economy.

This Redwood City, CA-based company currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for its 2023 funds from operations (FFO) per share has been revised marginally upward over the past two months and suggests year-over-year growth of 8.5%. For 2024, the consensus mark has been raised marginally over the past month and implies a year-over-year increase of 7.7%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Realty Income Corporation O, headquartered in San Diego, CA, is structured as a REIT and has earned its reputation as “The Monthly Dividend Company”. It is engaged in the acquisition and management of freestanding commercial properties, which reap rental revenues under long-term net lease agreements.

O’s portfolio comprises major industries that sell essential goods and services, and derives most of its annualized retail contractual rental revenues from tenants with a service, non-discretionary and/or low-price-point component to their business. This assures stable cashflows, even during economic downturns.

The REIT has a Zacks Rank #2 at present. The Zacks Consensus Estimate for the retail REIT’s 2023 FFO per share has been unchanged over the past month. Despite this, the estimate figure suggests year-over-year growth of 2.3%.The consensus mark for 2024 FFO per share has moved marginally northward over the past month, indicating a year-over-year increase of 4.1%. Although the stock has been an underperformer in 2023, given the solid fundamentals of the retail real estate market, the dip marks a good entry point in the stock now.

EastGroup Properties, Inc. EGP, a Ridgeland, MS-based industrial REIT, is engaged in the acquisition, development and operation of industrial properties, the majority of which are clustered around key transportation hubs in supply-constrained submarkets of major Sunbelt regions. Its core markets include the states of Florida, Texas, Arizona, California and North Carolina. Given the strategic location of EGP’s high-quality distribution facilities, it is expected to benefit from the healthy secular fundamentals of the industrial real estate market.

EGP currently carries a Zacks Rank #2. The Zacks Consensus Estimate for EGP’s 2023 FFO per share has moved marginally northward over the past two months, indicating a year-over-year increase of 10%. The consensus mark for 2024 FFO per share has been raised marginally over the past month and implies a year-over-year rise of 7.4%.

Stag Industrial, Inc. STAG is engaged in the acquisition, ownership and operation of industrial properties throughout the United States. The Boston, MA-based company enjoys a diversified portfolio in terms of market, tenant industry and tenant credit, which is likely to help it tide through the current market conditions and aid in stabilizing rental revenues.

The REIT has a Zacks Rank #2 at present. The Zacks Consensus Estimate for STAG’s 2023 FFO per share has been raised 1.3% over the past two months, indicating a year-over-year improvement of 3.2%. The consensus estimate for 2024 FFO per share has been moved up marginally over the past two months and suggests year-over-year growth of 4%.

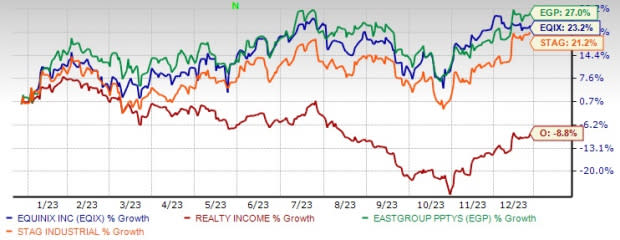

Here’s how the above-mentioned stocks have performed so far this year.

Image Source: Zacks Investment Research

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

Stag Industrial, Inc. (STAG) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report