Here's Why AB InBev (BUD) Can Make it Big Despite Cost Headwinds

Anheuser-Busch InBev SA/NV BUD, alias AB InBev, has been benefiting from its unique commercial strategy, strong brand portfolio and investments in operational excellence. Continued business momentum due to relentless execution, investment in its brands and accelerated digital transformation have been key drivers.

Additionally, the company looks well-poised to gain from the expansion of the Beyond Beer portfolio and investments in B2B platforms, e-commerce and digital marketing in the near term. The premiumization of the beer industry has been a key growth opportunity for AB InBev. These have been aiding the company’s top lines over the past few quarters.

However, BUD has been witnessing higher costs and soft margin trends owing to commodity headwinds and higher supply-chain costs in some markets. This has been weighing on the company’s bottom-line results.

The Zacks Consensus Estimate for AB InBev’s 2023 sales suggests growth of 6.6% from the year-ago period’s reported numbers, whereas earnings per share (EPS) estimate indicates a decline of 1.6% year over year.

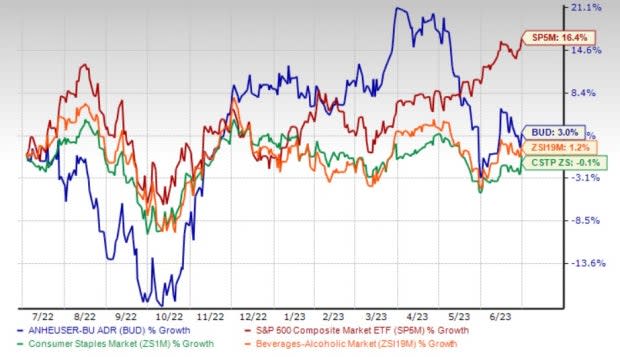

The Zacks Rank #3 (Hold) stock has gained 3% in the past year compared with the industry’s growth of 1.2%. The Consumer Staple sector has declined 0.1%. However, the stock’s performance compared unfavorably against the S&P 500’s growth of 16.4% in the same period.

Image Source: Zacks Investment Research

What Makes BUD Strong?

AB InBev is steadfastly growing its Beyond Beer portfolio, including products like Ready-to-Drink beverages like canned wine and canned cocktails, hard seltzers, cider and flavored malt beverages. The Beyond Beer trend has been recently gaining popularity due to the rise in demand for low-alcoholic or non-alcoholic drinks. The company remains focused on expanding its Beyond Beer portfolio, which has also been aiding the top line.

The Beyond Beer portfolio contributed more than $325 million to the total revenues in first-quarter 2023. The global Beyond Beer business’ revenues improved by low-single digits in the first quarter. The company witnessed 75% revenue growth in Brazil as Beats activated demand during the return of Carnival. In the U.S. spirits-based ready-to-drink segment, the company’s Cutwater and NUTRL vodka seltzer together delivered revenue growth of more than 50%.

AB InBev has been rapidly growing its digital platform, leveraging technology, such as B2B sales and other e-commerce platforms, including BEES and Zé Delivery. The company is witnessing an acceleration in the B2B platforms, e-commerce and digital marketing trends, which has been aiding growth in the past few months.

The company’s digital transformation initiatives have been on track, with B2B digital platforms contributing about 62% of its revenues in the first quarter. Its direct-to-consumer ecosystem, including Ze Delivery, TaDa and PerfectDraft, generated more than $100 million in revenues in first-quarter 2023, reflecting low-teens growth year over year.

Premiumization of the beer industry also places BUD for growth in the long term. It has been investing in developing a diverse portfolio of global, international and crafts and specialty premium brands in its markets. Apart from the premium brands, the company’s global brands lead the way in premiumization. BUD’s above core portfolio grew revenues by mid-teens in first-quarter 2023, driven by continued double-digit growth of Michelob ULTRA in the United States and Mexico and double-digit growth of Original and Spaten in Brazil.

Backed by the continued business momentum, AB InBev outlined its view for 2023. For 2023, the company expects EBITDA growth of 4-8%, which aligns with its medium-term outlook. It anticipates revenue growth to be higher than EBITDA growth, driven by strong volume and pricing.

Headwinds to Overcome

AB InBev continues to fall prey to commodity cost inflation and higher supply-chain costs in some markets. Higher commodity costs mainly resulted from increased aluminum and barley prices. BUD continued to witness higher costs and soft margin trends in the first quarter.

The cost of sales increased 8.8% on a reported basis and 14% on an organic basis in the first quarter. SG&A expenses rose 5.5% year over year and 10.3% on an organic basis. Higher SG&A expenses can be attributed to elevated supply-chain costs.

Consequently, the company’s gross margin contracted 70 basis points (bps) to 54.1%, on a reported basis in the first quarter. On an organic basis, the gross margin declined 35 bps. Normalized EBIT margin contracted 30 bps year over year to 24.6% in the first quarter. On an organic basis, the normalized EBIT margin declined 39 bps.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely The Duckhorn Portfolio NAPA, Monster Beverage MNST and Coca-Cola KO.

Duckhorn has a trailing four-quarter earnings surprise of 14.2%, on average. The company has an expected EPS growth rate of 6.6% for three to five years. It currently carries a Zacks Rank #2 (Buy). Shares of NAPA have declined 35.2% in the past year. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and EPS suggests growth of 8.3% and 4.8%, respectively, from the year-ago period's reported figures. The earnings estimate has moved up by a couple of cents in the past 30 days.

Monster Beverage currently carries a Zacks Rank #2. The company has an expected EPS growth rate of 22.9% for three to five years. Shares of MNST have rallied 21.4% in the past year.

The Zacks Consensus Estimate for Monster Beverage’s current financial-year sales and EPS suggests growth of 12.7% and 37.5%, respectively, from the year-ago period’s reported figures. The earnings estimate has moved down by a penny in the past 30 days. MNST has a trailing four-quarter negative earnings surprise of 4.1%, on average.

Coca-Cola currently has a Zacks Rank #2. KO has a trailing four-quarter earnings surprise of 4.2%, on average. Shares of KO have declined 6.4% in the past year.

The Zacks Consensus Estimate for Coca-Cola’s current financial-year sales and earnings suggests growth of 4.7% and 5.2%, respectively, from the year-ago period’s reported figures. The earnings estimate has been unchanged in the past 30 days. KO has an expected EPS growth rate of 6.8% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Anheuser-Busch InBev SA/NV (BUD) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report