Here's Why You Should Add ALLETE (ALE) to Your Portfolio Now

ALLETE Inc. ALE, an energy company, is focused on providing competitively-priced energy, making consistent investments in infrastructure and clean energy.

Let’s explore the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment.

Growth Projections

The Zacks Consensus Estimate for ALE’s 2023 earnings per share (EPS) is pegged at $3.67, increasing 1.1% in the past 60 days.

The Zacks Consensus Estimate for 2023 sales is pegged at $1.79 billion, indicating a year-over-year improvement of 13.9%.

The company’s long-term (three to five-year) earnings growth is pegged at 8.1%.

Debt Position

ALLETE’s total debt to capital was 34.73% as of Jun 30, 2023, which is better than the industry’s average of 59.36%.

The current ratio of ALE was 1.17 as of Jun 30, 2023, compared with the industry’s 0.83. This implies that the company is able to meet its short-term debt with its current assets.

Dividend History

The utility company has been consistently paying dividends to its shareholders. ALLETE’s current quarterly figure is 68 cents per share, resulting in an annual payout of $2.72. The company raised its dividend five times in the past five years.

ALE’s current dividend yield is 4.94%, better than the Zacks S&P 500 Composite’s 1.66%.

Focus on Clean Energy

ALLETE plans to add 700 megawatts (MW) of wind and solar and 500 megawatt-hours of battery storage to its portfolio.

The ALLETE Clean Energy already has a renewable platform of 1500 MW. ALLETE’s unit, Minnesota Power, aims to be 100% carbon-free by 2050. It has successfully retired seven of its nine coal facilities.

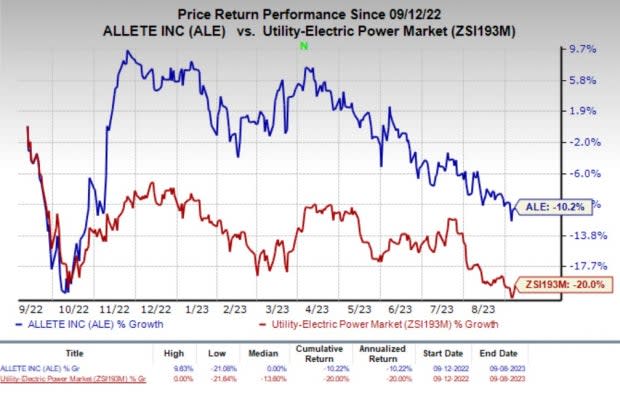

Price Performance

In the past year, shares of ALE have lost 10.2% compared with the broader industry’s 20% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks in the same industry are Vistra Corp. VST, PNM Resources Inc. PNM and FirstEnergy Corp. FE. VST sports a Zacks Rank #1 (Strong Buy) while PNM and FE carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vistra’s 2023 EPS is pinned at $3.11, indicating a year-over-year improvement of 205.8%. The Zacks Consensus Estimate for 2023 sales suggests an increase of 46.2% from the 2022 figure.

PNM’s long-term earnings growth rate is 4.5%. The Zacks Consensus Estimate for 2023 sales implies an increase of 17.2% from the 2022 figure.

FirstEnergy’s long-term earnings growth rate is 6.4%. The Zacks Consensus Estimate for 2023 sales indicates an increase of 4.7% from the 2022 figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

PNM Resources, Inc. (PNM) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report