Here's Why You Should Add Corcept (CORT) Stock to Your Portfolio

Corcept Therapeutics CORT, a biotechnology company, is focused on development and commercialization of therapies targeting severe metabolic, psychiatric and oncology disorders that are associated with the activity of cortisol, also known as the stress hormone.

The company derives revenues on net sales of its only marketed drug, Korlym (mifepristone), approved for the once-daily oral treatment of hyperglycemia — secondary to hypercortisolism — in adult patients with endogenous Cushing’s syndrome, who are suffering from type II diabetes or glucose intolerance and have already failed surgery or are unsuitable for the same.

Currently, Corcept carries a Zacks Rank #2 (Buy).

Below, we discuss a few reasons why adding CORT stock to your portfolio may prove beneficial in 2023.

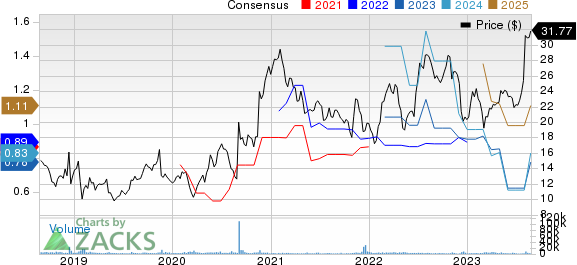

Favorable Share Price Movement and Rising Estimates: Corcept’s shares have outperformed the industry year to date due to Korlym’s performance and progress of CORT’s pipeline candidates. The stock has rallied 56.4% year to date against the industry’s 4.3% decline.

Image Source: Zacks Investment Research

In the past 90 days, the Zacks Consensus Estimate for Corcept’s earnings has gone up from 62 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 61 cents to 83 cents for 2024 during the same time frame

Promising Prospects for Korlym: Corcept’s lead drug, Korlym, has been a consistent revenue driver since its approval in 2012. The company has significantly expanded its sales force and is targeting Cushing’s disease patients who would benefit from the drug but have not yet started taking it.

Korlym enjoys an Orphan Drug status in the United States and Europe for addressing endogenous Cushing’s syndrome. The drug recorded sales of $401.9 million in 2022 and $223.4 million in the first half of 2023. Along with the second-quarter results, the company raised its revenue guidance for 2023 to a range of $455-$470 million, up from the previously estimated band of $435-$455 million, reflecting growth in Korlym.

Relacorilant Studies Progressing Well: Corcept’s lead pipeline candidate, relacorilant, is being evaluated in phase III GRACE and GRADIENT studies to treat Cushing’s syndrome. Both the studies are progressing well. A new drug application is also likely to be submitted in the second quarter of 2024 based on GRACE study. Relacorilant has been designated as an Orphan Drug for the treatment of Cushing’s syndrome by the FDA and the European Commission.

Corcept is also evaluating relacorilant in combination studies for treating solid tumors.A phase Ib study is evaluating relacorilant in combination with Merck’s MRK blockbuster PD-1 checkpoint inhibitor, Keytruda (pembrolizumab), for treating patients suffering from adrenal cancer along with cortisol excess. Merck’s biggest revenue generator, Keytruda, is approved for treating several types of cancer indications. MRK continues to study Keytruda for addressing more cancer indications.

Successful development and the potential approval of relacorilant for any of the above indications should lend a boost and lower the company’s heavy dependence on Korlym for growth.

Other Promising Candidates: Other candidates in Corcept’s pipeline are dazucorilant and miricorilant.

The company is evaluating miricorilant in an early-stage study for the treatment non-alcoholic steatohepatitis (NASH). This market has great potential. NASH is a progressive liver disease and a leading cause of liver-related death. The condition represents an advanced stage of non-alcoholic fatty liver disease, which affects a significant number of individuals around the world.

A recent finding from the study showed that patients who received miricorilant experienced an impressive reduction of approximately 30% in liver fat as assessed by magnetic resonance imaging-proton density fat fraction. These patients also experienced improved liver enzymes and markers of liver disease.

The successful development of miricorilant as a breakthrough treatment for NASH could be a huge boost for the company. There are currently no approved medications for NASH.

The company is evaluating patients in the phase II DAZALS study of its selective cortisol modulator dazucorilant in patients with Amyotrophic Lateral Sclerosis (ALS). Approval of these candidates is key to long-term growth of Corcept, given the lucrative market that it targets.

Other Stocks to Consider

Corcept Therapeutics Incorporated Price and Consensus

Corcept Therapeutics Incorporated price-consensus-chart | Corcept Therapeutics Incorporated Quote

A couple of other top-ranked stocks in the same industry are ANI Pharmaceuticals ANIP and Annovis Bio ANVS. While ANIP sports a Zacks Rank #1 (Strong Buy), ANVS carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 90 days, the Zacks Consensus Estimate forANI Pharmaceuticals has gone up from $3.31 per share to $3.73 for 2023. The bottom-line estimate has gone up from $4.32 to $4.35 for 2024 during the same time frame. Shares of the company have rallied 57.5% year to date.

ANIP’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise 91.56%.

In the past 90 days, the Zacks Consensus Estimate for Annovis Bio has narrowed from a loss of $4.89 per share to a loss of $4.38 for 2023. The bottom-line estimate has narrowed from a loss of $3.18 to $2.77 for 2024 during the same time frame. Shares of the company have lost 6.2% year to date.

ANVS’ earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 13.40%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report