Here's Why You Should Add DaVita (DVA) Stock to Your Portfolio

DaVita Inc. DVA has been gaining from its DaVita Kidney Care. The optimism led by a solid second-quarter 2023 performance and its business model are expected to contribute further. However, concerns regarding the strict regulatory environment and integration risks persist.

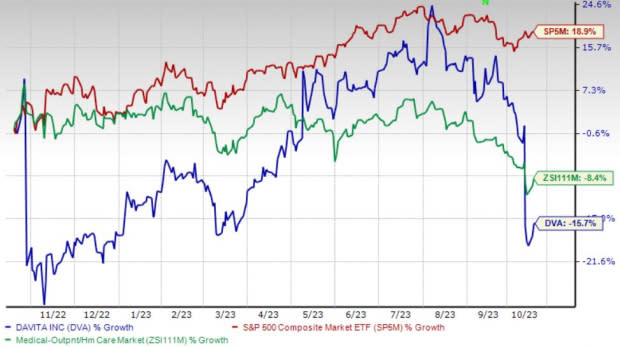

Over the past year, this Zacks Rank #1 (Strong Buy) stock has lost 15.8% compared with the 8.5% decline of the industry. The S&P 500 has witnessed 18.9% growth in the said time frame.

The renowned global comprehensive kidney care provider has a market capitalization of $6.97 billion. The company projects 12.7% growth for the next five years and expects to maintain its strong performance. DaVita’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 21.4%.

Image Source: Zacks Investment Research

Let’s delve deeper.

DaVita Kidney Care: We are optimistic about DaVita Kidney Care, the major revenue-generating segment of DVA. It specializes in a broad array of dialysis services, significantly contributing to the company's top line. With respect to DaVita’s Integrated Kidney Care, as of Jun 30, 2023, the company had approximately 64,000 patients in risk-based integrated care arrangements, representing approximately $5.2 billion in annualized medical spend. DaVita also had an additional 15,000 patients in other integrated care arrangements.

Business Model: DaVita’s patient-centric care model leverages its platform of kidney care services to maximize patient choice in both models and modalities of care, buoying our optimism. Value-based arrangements are proliferating in the kidney health space. These arrangements are allowing for a much larger degree of collaboration between nephrologists, providers and transplant programs, resulting in a more complete understanding of each patient’s clinical needs. Per management, this is expected to lead to better care coordination and earlier intervention.

Strong Q2 Results: DaVita’s solid second-quarter 2023 results buoy optimism. The company registered an uptick in its overall top line and dialysis patient service revenues. An increase in total U.S. dialysis treatments was also seen. The gross margin expansion bodes well for the stock.

Downsides

Strict Regulatory Environment: DaVita’s operations are subject to extensive federal, state and local government laws and regulations. A violation or departure from any of these legal requirements may result in government audits, lower reimbursements, significant fines and penalties, the potential loss of certification, recoupment efforts or voluntary repayments, among other things.

Integration Risks: DaVita’s business strategy includes growth through acquisitions of dialysis centers and other businesses, as well as entry into joint ventures. The company may engage in acquisitions, mergers, joint ventures or dispositions or expand into new business models, which may affect its operations.

Estimate Trend

DaVita is witnessing a positive estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 8.4% north to $7.38.

The Zacks Consensus Estimate for the company’s third-quarter 2023 revenues is pegged at $3 billion, suggesting a 1.9% uptick from the year-ago quarter’s reported number.

Other Key Picks

A few other top-ranked stocks in the broader medical space are Cardinal Health, Inc. CAH, HealthEquity, Inc. HQY and McKesson Corporation MCK.

Cardinal Health, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 14.3%. CAH’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 16%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cardinal Health has gained 31.4% compared with the industry’s 21.8% rise over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 3.5% against the industry’s 6.5% decline over the past year.

McKesson, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 10.7%. MCK’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 8.1%.

McKesson has gained 26.2% compared with the industry’s 21.8% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report