Here's Why You Should Add DexCom (DXCM) Stock to Your Portfolio

DexCom, Inc. DXCM has been gaining on the back of its slew of favorable coverage decisions for its G6 CGM System over the past few months. A robust second-quarter 2021 performance, along with a solid international foothold, is expected to contribute further. However, stiff competition and reimbursement risks persist.

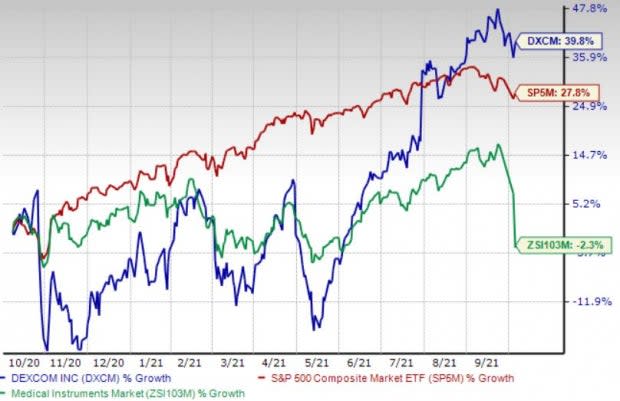

Over the past year, this Zacks Rank #2 (Buy) stock has gained 39.8% compared with 27.9% rise of the S&P 500 composite. The industry fell 2.3% in the said time frame.

The renowned medical devices company and provider of continuous glucose monitoring (“CGM”) systems has a market capitalization of $52.42 billion. The company projects 15.3% growth for the next five years and expects to maintain its strong performance. DexCom’s earnings surpassed the Zacks Consensus Estimates in three of the trailing four quarters and broke even in one, delivering an earnings surprise of 32.52%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Favorable Coverage Decisions: We are upbeat about the slew of favorable coverage decisions for DexCom’s G6 CGM System over the past few months. The company, in September, announced that people with type 1 diabetes who are of 25 years of age or below may now be eligible for provincial coverage of the G6 CGM System via Manitoba Health and Seniors Care. Manitoba joins the ranks of British Columbia, Yukon, Quebec and Saskatchewan in regard to providing public coverage of CGM systems under provincial health plans.

The same month, DexCom announced that its G6 CGM System is now covered by the Non-Insured Health Benefits Program for diabetics aged between two and 19 requiring intensive insulin therapy.

Solid International Foothold: We are optimistic about DexCom’s continued focus on international markets. In second-quarter 2021, the company registered strong international year-over-year revenues. During the quarter, international growth was broad-based throughout all markets, including core markets like Germany, the U.K., Canada, Australia and the Nordic region. DexCom’s international market expansion initiatives are all progressing according to plan, thereby driving high volume growth. Therefore, international growth remains strong and presents great opportunity for the future, backed by improving global access and awareness.

Strong Q2 Results: DexCom’s solid second-quarter 2021 results buoy optimism. Impressive contribution from the Sensor and other revenue segments, and domestic and international revenue growth were key catalysts. DexCom’s prospects in alternative markets, such as the non-intensive diabetes management space, are likely to provide it a competitive edge in the MedTech space. Apart from making continued advancements with respect to key strategic objectives, the company ended the quarter with new patient additions as well. DexCom’s slew of tie-ups and buyouts are encouraging. Expansion in both gross and operating margins is also a positive.

Downsides

Reimbursement Risk: Reimbursement risk is somewhat high due to the efforts to control healthcare expenses. The company has noted that most of the Type 1 patients (above 65) pay 100% of their CGM costs out of their own pockets. Unless payers (both government and private insurers) provide sufficient coverage and reimbursement, commercial success for DexCom will be limited, in our view.

Stiff Competition: The market for blood glucose monitoring devices is highly competitive, subject to rapid change and significantly affected by new product introductions. DexCom’s competitors manufacture and market products for the single-point finger stick device market, and collectively account for substantially all of the worldwide sales of self-monitored glucose testing systems, currently.

Estimate Trend

DexCom is witnessing a positive estimate revision trend for 2021. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 13.4% north to $2.46.

The Zacks Consensus Estimate for the company’s third-quarter 2021 revenues is pegged at $612.2 million, suggesting a 22.2% improvement from the year-ago quarter’s reported number.

Other Key Picks

A few other top-ranked stocks from the broader medical space are AMN Healthcare Services Inc AMN, Omnicell, Inc. OMCL and West Pharmaceutical Services, Inc. WST, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare’s long-term earnings growth rate is estimated at 10.5%.

Omnicell’s long-term earnings growth rate is estimated at 16%.

West Pharmaceutical’s long-term earnings growth rate is estimated at 27.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research