Here's Why You Should Add DuPont (DD) to Your Portfolio Now

DuPont de Nemours, Inc. DD is benefiting from innovation-driven investment and its productivity and pricing actions. We are positive on the company’s prospects and believe that the time is right for you to add the stock to portfolio as it looks promising and is poised to carry the momentum ahead.

Let’s take a look into the factors that make this Zacks Rank #2 (Buy) stock an attractive choice for investors right now.

Healthy Growth Prospects

The Zacks Consensus Estimate for earnings for 2024 for DuPont is currently pegged at $3.92, reflecting an expected year-over-year growth of around 13.3%. The company also has an expected long-term earnings per share growth rate of 8.7%.

Impressive Earnings Surprise History

DuPont has outpaced the Zacks Consensus Estimate in each of the trailing four quarters. In this time frame, it has delivered an earnings surprise of 7.1%, on average.

Capital Allocation

The company remains focused on driving cash flow and shareholder value. It looks to boost cash flow through working capital productivity and earnings growth. DuPont, in September 2023, completed the $3.25 billion accelerated share repurchase (ASR) transaction launched in November 2022. It also launched a new $2 billion ASR in September 2023 and plans to complete it during the first quarter of 2024. DuPont also expects to return roughly $650 million in dividends for full-year 2023.

Productivity, Innovation & Spectrum Buyout to Aid Results

DuPont remains focused on driving growth though innovation and new product development. Its innovation-driven investment is focused on several high-growth areas. DD remains committed to drive returns from its R&D investment.

The company, in August 2023, completed the buyout of leading manufacturer of specialty medical devices and components, Spectrum Plastics Group from AEA Investors for $1.75 billion. The acquired business, with annual sales of around $500 million, has been integrated into the industrial solutions line of business within the Electronics & Industrial segment.

The acquisition strengthens DuPont’s existing position in stable and fast-growing healthcare end markets. It is also in sync with its focus on high-growth, customer-driven innovation for the healthcare market. The addition of Spectrum is expected to boost revenues in the Electronics & Industrial segment.

Moreover, DuPont is benefiting from cost synergy savings and productivity improvement actions. Its structural cost actions are contributing to its bottom line. DD also continues to implement strategic price increases in the wake of cost inflation. These actions are likely to support its results. DuPont is also planning additional restructuring actions and expects savings from these actions to be realized from the first quarter of 2024.

The company is also managing its portfolio with an aim for value creation. It is divesting non-core assets to focus more on high-growth, high-margin businesses.

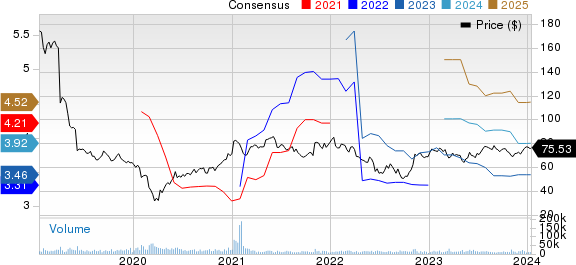

DuPont de Nemours, Inc. Price and Consensus

DuPont de Nemours, Inc. price-consensus-chart | DuPont de Nemours, Inc. Quote

Stocks to Consider

Other top-ranked stocks worth a look in the basic materials space include, Cameco Corporation CCJ, Carpenter Technology Corporation CRS and Cabot Corporation CBT.

Cameco has a projected earnings growth rate of 184% for the current year. The Zacks Consensus Estimate for CCJ’s current-year earnings has been revised upward by 18.3% over the past 60 days. The stock is up around 96% in a year. CCJ currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Carpenter Technology’s current fiscal year earnings is pegged at $3.96, indicating a year-over-year surge of 247.4%. CRS, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 14.3%. The company’s shares have rallied 54% in the past year.

The consensus estimate for Cabot’s current fiscal-year earnings is pegged at $6.58, indicating a year-over-year rise of 22.3%. CBT, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in three of the last four quarters while missed once, with the average earnings surprise being 2.3%. The company’s shares are up around 6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report