Here's Why You Can Add KalVista (KALV) Stock to Your Portfolio

Cambridge, MA-based KalVista Pharmaceuticals KALV is a clinical-stage biotech, which makes oral, small molecule protease inhibitors.

Here we discuss some reasons why investing in this Zacks Rank #2 (Buy) stock now is a good idea.

KalVista Pharmaceuticals is developing sebetralstat as an oral on-demand therapy for hereditary angioedema (HAE) attacks. There is a significant unmet need for efficacious oral treatments for HAE. Enrollment is ongoing in the pivotal phase III KONFIDENT study, with KalVista having already enrolled more than 50% of the targeted number of patients.

Data from the KONFIDENT study are expected to be reported in the second half of 2023, which, if positive, would lead KalVista to file a new drug application in the first half of 2024. In 2021, data from a phase II efficacy study showed that sebetralstat led to statistically and clinically significant responses across all primary and secondary endpoints.

KalVista Pharmaceuticals completed a $58 million financing (via a registered direct offering) in 2022 that will fund the company into 2025, well beyond its phase III data readout timeline.

In addition to saebetralstat, KalVista is also developing an oral Factor XIIa inhibitor for the prophylactic treatment of HAE for which phase I studies are expected to begin in 2023

With a strong cash position and pivotal data readout expected this year, investor focus remains on KALV stock

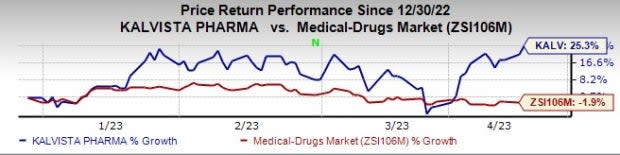

The stock of KalVista Pharmaceuticals has risen 25.3% this year so far against a decrease of 1.9% for the industry.

Image Source: Zacks Investment Research

Estimates for KalVista Pharmaceuticals’ 2023 loss per share have narrowed from $3.90 per share to $3.76 per share over the past 60 days while that for 2024 have narrowed from $3.38 per share to $3.07 per share over the same timeframe.

KalVista Pharmaceuticals beat earnings expectations in all the trailing four quarters. The company delivered a four-quarter earnings surprise of 12.88%, on average.

Other Stocks to Consider

Some other top-ranked small drugmakers are Surrozen SRZN, Larimar Therapeutics LRMR and Nektar Therapeutics NKTR. While Surrozen and Larimar Therapeutics (LRMR) have a Zacks Rank of 1 (Strong Buy), Nektar Therapeutics has the same rank as KalVista Pharmaceuticals. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Surrozen’s 2023 loss per share have narrowed from $1.18 per share to $1.00 per share over the past 60 days while that for 2024 has narrowed from 68 cents per share to 52 cents per share over the same timeframe. Surrozen’s stock has declined 78.8% in the past year.

Surrozen beat earnings expectations in all the trailing four quarters. The company delivered a four-quarter earnings surprise of 43.85%, on average.

For Nektar Therapeutics, the consensus estimate for 2023 loss has narrowed from $1.01 per share to 90 cents per share over the past 60 days. For 2024, the loss estimates have narrowed from $1.00 per share to 88 cents per share over the same timeframe. The stock has declined 83.7% in the past year.

Nektar Therapeutics beat earnings expectations in all the trailing four quarters. The company delivered a four-quarter earnings surprise of 31.40%, on average.

Larimar Therapeutics’ loss estimates for 2023 have narrowed from $2.07 per share to $1.08 per share over the past 60 days while that for 2024 have narrowed from $2.28 per share to $1.15 per share over the same timeframe.

The stock of Larimar Therapeutics has risen 37.4% in the past year

Larimar Therapeutics beat earnings expectations in each of the trailing four quarters. The company delivered a four-quarter earnings surprise of 36.06%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nektar Therapeutics (NKTR) : Free Stock Analysis Report

KalVista Pharmaceuticals, Inc. (KALV) : Free Stock Analysis Report

Larimar Therapeutics, Inc. (LRMR) : Free Stock Analysis Report

Surrozen, Inc. (SRZN) : Free Stock Analysis Report