Here's Why You Should Add Olympic Steel (ZEUS) to Your Portfolio

Olympic Steel, Inc.’s ZEUS shares have rallied around 25% in the past three months, owing to strong third-quarter results and the Central Tube & Bar acquisition.

The stock offers an attractive investment opportunity with strong growth prospects, as reflected in its Zacks Rank #2 (Buy).

Estimates Northbound

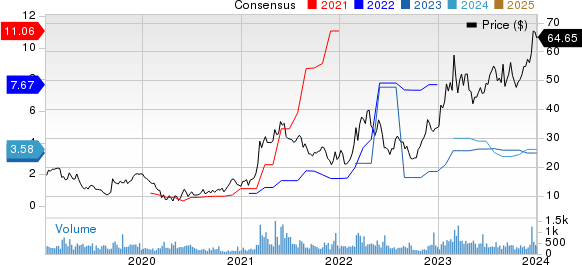

The Zacks Consensus Estimate for Olympic Steel for 2024 has increased by around 3.5% in the past two months. The Zacks Consensus Estimate for 2024 earnings is currently pegged at $3.58, reflecting an expected year-over-year growth of 6.9%.

An Outperformer

Shares of Olympic Steel are up 89.8% in the past year compared with the industry’s rise of 24.2% in the same period.

Image Source: Bigstock

What’s Going in Olympic Steel’s Favor?

Olympic Steel held steady in the third quarter of 2023 despite facing a challenging market. While sales fell year over year to $526 million due to falling metal prices, the company maintained profitability across all segments. Net income inched up to $12.2 million or $1.06 per share compared with $12 million or $1.04 per share in the previous year. EBITDA also showed improvement, rising to $27.1 million from $23.8 million.

The Pipe and Tube business was the primary driver, delivering one of its most profitable quarters ever and fueling the overall positive performance. The Carbon segment also contributed significantly to the quarter’s performance.

Further bolstering its future, Olympic Steel acquired Central Tube & Bar. This strategic move represents the seventh acquisition within the past six years, demonstrating the company's commitment to expanding its portfolio of products and services with a focus on higher margin returns. Central Tube & Bar has consistently demonstrated robust financial performance and its value-added contract manufacturing capabilities, expansive geographic reach in the South-Central United States and aligned corporate culture position it as an excellent fit for the Pipe and Tube business. This acquisition aligns with the company's growth strategy and strengthens its market presence.

Olympic Steel, Inc. Price and Consensus

Olympic Steel, Inc. price-consensus-chart | Olympic Steel, Inc. Quote

Zacks Rank & Other Key Picks

Some other top-ranked stocks in the Basic Materials space are Centrus Energy Corp. LEU, sporting a Zacks Rank #1 (Strong Buy) at present and Axalta Coating Systems Ltd. AXTA and Quaker Chemical Corporation KWR, each currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for LEU’s current-year earnings has been revised upward by 30.5% in the past 60 days. LEU beat the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 47.7%. The company’s shares have increased 53.6% in the past year.

The consensus estimate for AXTA’s current-year earnings is pegged at $1.58, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, the average earnings surprise being 6.7%. The company’s shares have increased 29.1% in the past year.

Quaker Chemical has a projected earnings growth rate of 28.3% for the current year. KWR has a trailing four-quarter earnings surprise of roughly 16.7%, on average. KWR shares have gained 19.1% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quaker Houghton (KWR) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Centrus Energy Corp. (LEU) : Free Stock Analysis Report