Here's Why You Should Add ONE Gas (OGS) to Your Portfolio Now

ONE Gas, Inc. OGS will benefit from its systematic investment and 100% regulated operation. In 2023-2027 period, the company aims to invest $3.6 billion to strengthen its operations. Nearly 70% of the planned capital expenditure will be directed toward system integrity and replacement projects.

New gas rates and improving demand from an expanding customer base should boost the company’s revenues. Given its strong dividend history and growth opportunities, ONE Gas makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment option at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projections & Earnings Growth

The Zacks Consensus Estimate for OGS’ 2023 earnings per share (EPS) has increased 0.2% to $4.13 in the past 60 days. The estimate also implies a year-over-year increase of 1.2%.

The company’s long-term (three- to five-year) earnings growth is pegged at 5%. In the fourth quarter of 2022, it reported EPS of $1.23, which beat the Zacks Consensus Estimate by 2.5%.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing the funds to generate higher returns. Currently, ONE Gas’ ROE is 8.93%, higher than the sector’s average of 5.78%. This indicates that the company has been utilizing the funds more constructively than its peers in the utility sector.

Dividend History

ONE Gas, courtesy of its stable performance, continues to increase shareholders’ value via regular dividend payments. In January 2023, the company’s board of directors declared a quarterly dividend of 65 cents per share. The new annualized dividend for 2023 is $2.6 per share, indicating a 4.8% increase from 2022.

The company expects an average annual dividend increase of 4-6% through 2027, with a target dividend payout ratio of 55-65% of net income, subject to its board of directors' approval. OGS’ current dividend yield is 3.28%, better than the Zacks S&P 500 Composite’s yield of 1.55%.

Systematic Investments & Customer Growth

The company invested $544.3 million and $656.5 million in 2021 and 2022, respectively. Its ongoing capital expenditures are directed toward pipeline integrity, extension of services to new areas, increase in system capacity, pipeline replacements, automated meter reading, government-mandated pipeline relocations, facilities, information technology assets and cybersecurity.

Looking ahead, its capital expenditure is expected to be $675 million for 2023. New gas rates implemented in Oklahoma, Kansas and Texas should boost OGS’ annual revenues. Pending rate cases, once approved, will further boost its top line. Systematic capital expenditure and rate approval from the commission will enable the company to continue with its infrastructure strengthening initiatives.

This 100% regulated natural gas distribution utility has a high percentage of residential customers, providing stability and strong visibility of future earnings. More than 92% of OGS’ customers belong to the residential category.

In 2022, its total customers increased 0.7%, mainly driven by a surge in residential customers. The company has been steadily increasing its customer base every year since 2015 and expects an average annual customer growth of 1% during 2023-2027 across its service territories.

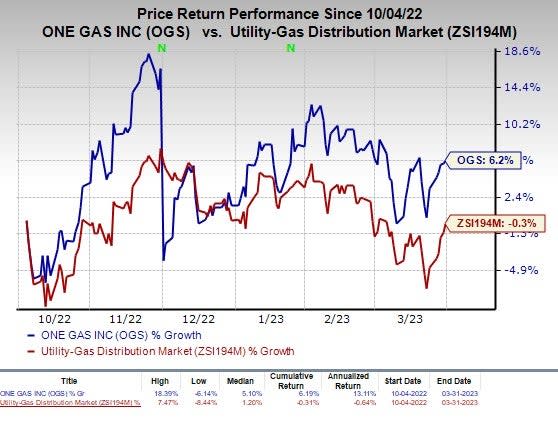

Price Performance

In the past six months, ONE Gas’ shares have gained 6.2% against the industry’s average decline of 0.3%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are New Jersey Resources NJR, Atmos Energy Corporation ATO and Spire, Inc. SR, each holding a Zacks Rank #2 at present.

New Jersey Resources’ long-term (three- to five-year) earnings growth is pegged at 6%. The Zacks Consensus Estimate for the company’s 2023 EPS is $2.63, indicating a year-over-year increase of 5.2%.

Atmos Energy’s long-term earnings growth is pegged at 7.48%. The Zacks Consensus Estimate for the company’s 2023 EPS is $6, indicating a year-over-year increase of 7.14%.

Spire’s long-term earnings growth is pegged at 4.22%. The Zacks Consensus Estimate for the company’s 2023 EPS is $4.22, indicating a year-over-year increase of 9.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

Spire Inc. (SR) : Free Stock Analysis Report

NewJersey Resources Corporation (NJR) : Free Stock Analysis Report

ONE Gas, Inc. (OGS) : Free Stock Analysis Report