Here's Why You Should Add TransAlta (TAC) to Your Portfolio Now

TransAlta TAC is a renowned Canadian energy solutions and power producing company. It is well positioned to shift toward a low-carbon future owing to its focus on sustainable energy projects. Given its growth opportunities, TAC makes for a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #1 (Strong Buy) company a promising investment pick at the moment.

Growth Projections

The Zacks Consensus Estimate for TAC’s 2023 earnings per share (EPS) has increased 48% to $1.45 in the past 90 days.

The consensus estimate for TAC’s sales is pinned at $2.55 billion, indicating a year-over-year improvement of 11.9%.

The company delivered an average earnings surprise of 107.14% in the last four quarters.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing its funds to generate higher returns. Currently, TransAlta’s ROE is 21.41%, higher than the industry’s average of 6.03%. This indicates that the company has been utilizing its funds more constructively than its peers in the electric power utility industry.

Solvency & Liquidity Ratio

The times interest earned (TIE) ratio is a solvency ratio. It is used to measure how well the company can cover its interest obligations. The time to interest earned ratio at the end of second-quarter 2023 was 3.4, which being greater than one indicates that TransAlta is in a good position to meet its interest obligations.

The current ratio at the end of second-quarter 2023 was 1.66. The ratio being greater than one indicates the company’s ability to meet its future short-term liabilities without difficulties.

Free Cash Flow & Dividend History

TransAlta has consistently increased the value of its stockholders by paying dividends. The company generates consistent free cash flow, which it uses to pay dividends and enhance operations. During second-quarter 2023, TAC increased its 2023 free cash flow guidance to $850-$950 million from the previously projected range of $560-$660 million due to strong financial performance.

Currently, its quarterly dividend is 5.5 cents per share, resulting in an annualized dividend of 22 cents per share, up 10% from the previous year’s level of 20 cents. The company’s current dividend yield is 1.69%, better than the Zacks S&P 500 Composite's average of 1.42%.

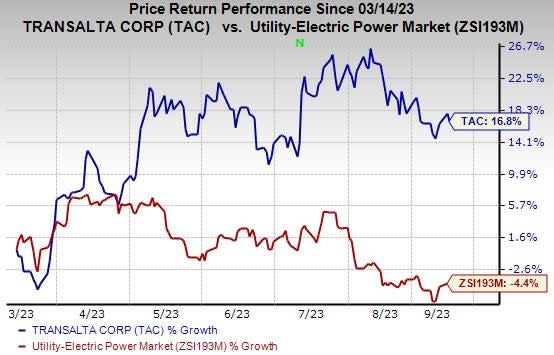

Price Performance

In the past six months, TransAlta’s shares have rallied 16.8% against the industry’s average decline of 4.4%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are Vistra Corp. VST, sporting a Zacks Rank #1, and FirstEnergy Corp. FE and ALLETE Inc. ALE, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vistra’s 2023 EPS indicates a year-over-year increase of 205.8%. The same for sales indicates a year-over-year improvement of 46.2%

FirstEnergy’s long-term (three to five years) earnings growth rate is 6.45%. The consensus estimate for the company’s 2023 EPS indicates year-over-year growth of 5%.

ALLETE’s long-term earnings growth rate is 8.10%. The consensus estimate for the company’s 2023 EPS indicates a year-over-year increase of 8.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report