Here's Why You Should Add Xenon (XENE) to Your Portfolio Now

Xenon Pharmaceuticals XENE is a Burnaby, Canada-based clinical-stage biotech company, which develops innovative therapies for neurology indications with a focus on epilepsy. The company currently has no marketed products in its commercial portfolio.

Xenon’s pipeline consists only of its lead product candidate, XEN1101, a differentiated Kv7 potassium channel, which is currently being developed for treating epilepsy and other neurological disorders,includingmajor depressive disorder (MDD).

Let’s delve deeper to discuss four reasons why adding Xenon stock to your portfolio may prove beneficial in 2024.

Focus on XEN1101 for Epilepsy: Xenon’s XEN1101 is in late-stage development for treating focal onset seizures (FOS). Under the phase III epilepsy program, two identical phase III studies, X-TOLE2 and X-TOLE3, are evaluating 15 mg or 25 mg doses of XEN1101 in patients with FOS. The company expects to complete patient enrollment in the X-TOLE2 study in the second half of 2024.

Previous data from a phase IIb study on XEN1101 demonstrated that the long-term efficacy of XEN1101 can lead to overall improvements in patients’ quality of life.

The company is also evaluating XEN1101 for an additional epilepsy indication, primary generalized tonic-clonic seizures, in a phase III X-ACKT study.

The success of these studies will enable the company to submit a regulatory application seeking approval for XEN1101 for epilepsy indications.

Study on XEN1101 for MDD Indication Progressing Well: A phase II proof-of-concept X-NOVA study is currently evaluating 10 mg or 20 mg doses of XEN1101 in patients with MDD.

In November 2023, Xenon reported top-line results from the X-NOVA study of XEN1101 in MDD. Treatment with XEN1101 resulted in a clear dose response and clinically meaningful, though not statistically significant, change in the Montgomery–Åsberg Depression Rating Scale (MADRS). Notably, MADRS is a metric showing the improvement of depressive symptoms in MDD patients compared with placebo after the treatment period.

However, the candidate did achieve another pre-specified endpoint and a key secondary endpoint with statistical significance. The study also demonstrated an early onset of efficacy upon treatment with XEN1101.

Based on the encouraging results, Xenon is assessing various clinical and regulatory pathways to support the late-stage clinical development of XEN1101 in MDD and expects to initiate the phase III study for this indication in 2024.

The company is simultaneously evaluating other potential indications for the future development of XEN1101.

Encouraging Market Opportunity in MDD and Epilepsy: The company has identified several key unmet needs in the MDD space, creating an opportunity for innovative products. There is a need for providing more rapid relief of symptoms, addressing the delayed therapeutic response associated with current standard-of-care treatments. Currently, available therapies also exhibit common safety concerns, particularly related to adverse events, such as sexual dysfunction and significant weight gain. XEN1101, with its novel mechanism of action, could potentially address these concerns. XEN1101 is also an easier-to-use formulation that is administered once daily with food and no titration.

The ability to address these needs collectively creates a compelling product profile and potentially sets XEN1101 apart from existing MDD therapeutics. The efficacy of XEN1101 in MDD can also distinguish it in the epilepsy space, offering a unique solution without the unwanted mood symptoms associated with certain anti-seizure medications.

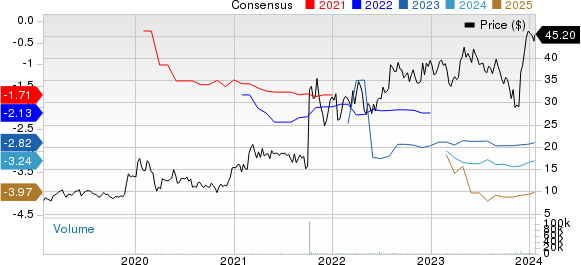

Rising Share Price and Estimates: In the past year, shares of XENE have demonstrated an encouraging price performance, gaining 23.8% against the industry’s 14.1% decline. Xenon carries a Zacks Rank #2 (Buy) at present.

Image Source: Zacks Investment Research

In the past 30 days, the Zacks Consensus Estimate for Xenon’s 2023 loss per share has narrowed from $2.85 to $2.82. During the same time frame, the consensus estimate for the company’s 2024 loss per share has also narrowed from $3.27 to $3.24.

Xenon Pharmaceuticals Inc. Price and Consensus

Xenon Pharmaceuticals Inc. price-consensus-chart | Xenon Pharmaceuticals Inc. Quote

Other Stocks to Consider

Some other top-ranked drug/biotech stocks worth mentioning are Puma Biotechnology, Inc. PBYI, ADMA Biologics ADMA and Acadia Pharmaceuticals ACAD. While PBYI and ADMA sport a Zacks Rank #1 (Strong Buy) each, ACAD carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Puma Biotech’s 2023 earnings per share (EPS) has increased from 72 cents to 73 cents. During the same time frame, the consensus estimate for Puma Biotech’s 2024 EPS has increased from 64 cents to 69 cents. Over the past year, shares of PBYI have gained 9.2%.

PBYI beat estimates in three of the last four quarters while missing on one occasion, delivering a four-quarter average earnings surprise of 76.55%.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2023 loss per share has remained constant at 2 cents. The consensus estimate for ADMA Biologics’ 2024 EPS is pegged at 22 cents. Over the past year, shares of ADMA have rallied 49.9%.

ADMA beat estimates in three of the trailing four quarters and matched in one, delivering an average earnings surprise of 63.57%.

In the past 30 days, the Zacks Consensus Estimate for Acadia’s 2023 loss per share has remained constant at 33 cents. During the same time frame, the consensus estimate for Acadia’s 2024 EPS is pegged at $1.04. Over the past year, shares of ACAD have surged 46.1%.

ACAD beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average earnings surprise of 20.69%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

Xenon Pharmaceuticals Inc. (XENE) : Free Stock Analysis Report