Here's Why American Eagle (AEO) is a Promising Pick Now

American Eagle Outfitters, Inc. AEO stock is well-poised to tap the positive trends in the fashion arena, thanks to its digital endeavors and other robust strategies, including the Real Power Real Growth Plan. The company is gaining from brand strength and solid demand for its products that resonate well with customers.

Undoubtedly, management is focused on creating a trend-right merchandise assortment, deepening relations with customers via marketing, enhancing the digital commerce agenda and efficiently controlling expenses.

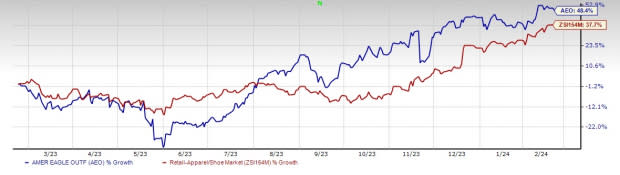

Buoyed by such strengths, shares of this apparel and footwear dealer have gained 48.4% compared with the industry’s 37.7% growth in a year. A VGM Score of B adds strength to this current Zacks Rank #1 (Strong Buy) company.

Let’s Delve Deeper

American Eagle is on track with its Real Power Real Growth value-creation plan, which has been aiding the company’s performance for a while now. The plan is driving profitability through real estate and inventory-optimization efforts, omnichannel and customer focus, and investments to improve the supply chain. As part of the aforesaid initiative, American Eagle will continue to pursue opportunities to grow the Aerie brand through expansion into newer markets, innovation and a wider customer base. Management also expects to undertake initiatives to deliver growth and sustained profitability for the American Eagle brand.

American Eagle’s Aerie brand has also been exhibiting momentum for quite some time now. Sales rose 12% to $393 million for Aerie in third-quarter fiscal 2023 while the brand’s comparable-store sales also improved 12%. Sturdy demand in its core apparel, activewear extension, strength in the OFFLINE brand and renewed momentum in intimates aided the brand’s growth. Strength in its core apparel collection, particularly in fleece, bottoms and tops, is acting as a major growth driver. Also, its activewear extension, OFFLINE by Aerie, bodes well on the back of tops, sports bras, active shorts and fashion items. Management expects 25 store openings in fiscal 2023.

Image Source: Zacks Investment Research

The Aerie brand is a key growth engine for American Eagle and remains on track to reach the next brand milestone of $2 billion in sales. Further, the company’s profit-improvement endeavors have been paying off. This, along with lower delivery, distribution and warehousing costs, aided third-quarter fiscal 2023 margins. Also, higher merchandising margins from lower markdowns stemming from inventory control, and lower transportation and product costs are other positives. Driven by these factors, the gross margin expanded 310 basis points (bps) year over year whereas the operating margin rose 10 bps year over year.

Analysts also seem quite optimistic about Aerie’s parent company. The Zacks Consensus Estimate for fiscal 2024 sales and earnings per share (EPS) is currently pegged at $5.4 billion and $1.51, respectively. These estimates show corresponding growth of 2.5% and 7.6% year over year. Given all the positives, American Eagle stock seems to deserve a place in your investment portfolio.

Eye These Other Solid Picks

We have highlighted three other top-ranked stocks, namely Abercrombie & Fitch ANF, Gap GPS and Hibbett HIBB.

Abercrombie & Fitch, a leading casual apparel retailer, currently sports a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 3.8% from the year-ago reported figure. ANF delivered an earnings surprise of 60.5% in the last reported quarter.

Gap, a fashion retailer of apparel and accessories, currently flaunts a Zacks Rank of 1. The company has a trailing four-quarter earnings surprise of 137.9%, on average.

The Zacks Consensus Estimate for Gap’s current financial-year EPS suggests growth of 387.5%, from the year-ago reported figure.

Hibbett, a key sporting goods retailer, currently carries a Zacks Rank #2 (Buy). HIBB delivered an earnings surprise of 24.2% in the trailing four quarters.

The Zacks Consensus Estimate for Hibbett’s current financial-year sales suggests growth of 1.8% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Hibbett, Inc. (HIBB) : Free Stock Analysis Report