Here's Why Australian Clinical Labs (ASX:ACL) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Australian Clinical Labs (ASX:ACL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Australian Clinical Labs

How Fast Is Australian Clinical Labs Growing Its Earnings Per Share?

Australian Clinical Labs has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Australian Clinical Labs' EPS catapulted from AU$0.40 to AU$0.89, over the last year. It's not often a company can achieve year-on-year growth of 124%. The best case scenario? That the business has hit a true inflection point.

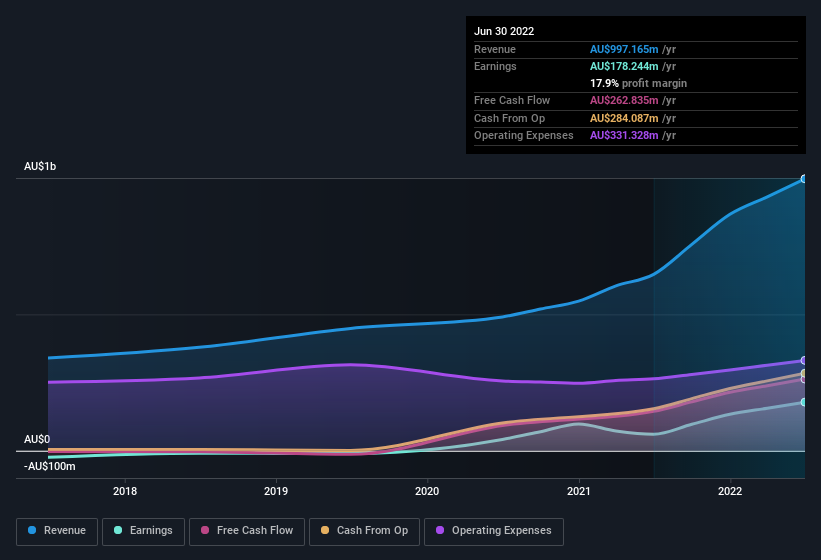

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Australian Clinical Labs shareholders can take confidence from the fact that EBIT margins are up from 20% to 28%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Australian Clinical Labs' forecast profits?

Are Australian Clinical Labs Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Any way you look at it Australian Clinical Labs shareholders can gain quiet confidence from the fact that insiders shelled out AU$511k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. It is also worth noting that it was CEO & Executive Director Melinda McGrath who made the biggest single purchase, worth AU$335k, paying AU$5.06 per share.

On top of the insider buying, it's good to see that Australian Clinical Labs insiders have a valuable investment in the business. Indeed, they hold AU$45m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 4.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Australian Clinical Labs To Your Watchlist?

Australian Clinical Labs' earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Australian Clinical Labs deserves timely attention. What about risks? Every company has them, and we've spotted 2 warning signs for Australian Clinical Labs (of which 1 can't be ignored!) you should know about.

Keen growth investors love to see insider buying. Thankfully, Australian Clinical Labs isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here