Here's Why BankFinancial (NASDAQ:BFIN) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like BankFinancial (NASDAQ:BFIN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide BankFinancial with the means to add long-term value to shareholders.

Check out our latest analysis for BankFinancial

BankFinancial's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, BankFinancial has grown EPS by 5.1% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

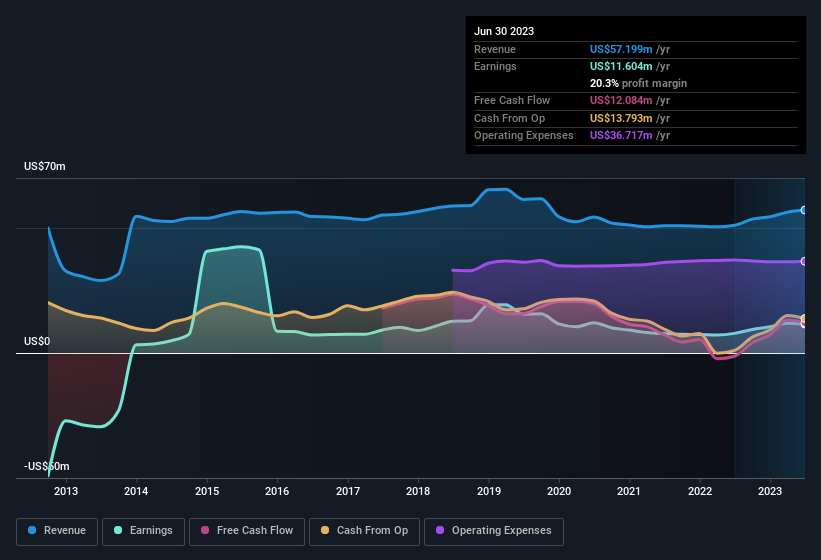

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that BankFinancial's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for BankFinancial remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to US$57m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for BankFinancial's future profits.

Are BankFinancial Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling BankFinancial shares, in the last year. So it's definitely nice that company insider Aaron O'connor bought US$14k worth of shares at an average price of around US$9.36. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in BankFinancial.

It's reassuring that BankFinancial insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to BankFinancial, with market caps under US$200m is around US$749k.

BankFinancial's CEO took home a total compensation package worth US$634k in the year leading up to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does BankFinancial Deserve A Spot On Your Watchlist?

One important encouraging feature of BankFinancial is that it is growing profits. And there's more to love too, with modest CEO remuneration and insider buying interest continuing the positives for the company. If these factors aren't enough to secure BankFinancial a spot on the watchlist, then it certainly warrants a closer look at the very least. If you think BankFinancial might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of BankFinancial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here