Here's Why You Should Buy Align Technology (ALGN) Stock Now

Align Technologies ALGN is well-poised for growth in the coming quarters, backed by the solid international expansion of the business. Higher subscriptions from the growing installed base of iTero scanners are boosting Service revenues. A strong solvent balance sheet appears highly promising.

However, the exposure of the Invisalign system to several risks may significantly bring down the company’s net revenues. Aggressive competition from other industry players also remains a concern.

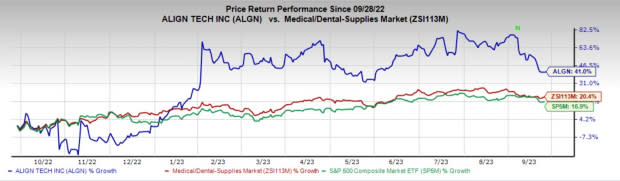

In the past year, this Zacks Rank #2 (Buy) stock has increased 41% compared with the 20.4% rise of the industry and 16.9% growth of the S&P 500 composite.

The renowned medical device company has a market capitalization of $22.81 billion. ALGN projects a long-term estimated earnings growth rate of 17.5% compared with 12.8% of the industry. In the last reported quarter, the company delivered an earnings surprise of 9.90%.

Let’s delve deeper.

Upsides

Geographic Expansion Continues: Align Technology is expanding its sales and marketing by reaching new countries and regions, including new areas within Africa and Latin America. With the opening of its third clear aligner fabrication facility in Wroclaw, Poland, the company now has a manufacturing facility in each of its operating territories — the Americas (Mexico), the APAC (China) and the EMEA (Poland).

Image Source: Zacks Investment Research

The company also performs digital treatment planning and interpretation for restorative cases worldwide, including in Costa Rica, China, Germany, Spain, Poland and Japan, among others. The business expansion is likely to continue in 2023 through investments in resources, infrastructure and initiatives that help drive growth in Invisalign treatment, intraoral scanners and exocad CAD/CAM software in existing and new international markets.

iTero in Focus: Align Technology’s iTero intraoral scanners, as the preferred scanning technology for digital dental scans, and exocad CAD/CAM software, as the dental restorative solution of choice for dental labs, are successfully expanding their foothold in the niche market globally.

In terms of the latest developments with iTero, the company talked about the iTero-exocad Connector, which integrates the iTero intraoral camera and NIRI images with exocad DentalCAD 3.1 software and allows dental professionals to visualize the internal and external structure of teeth. According to the company, the use of iTero scanners for Invisalign case submissions continues to grow and remains a positive catalyst for Invisalign utilization.

Strong Solvency, Attractive Returns to Investors: With no debt on its balance sheet, Align Technology looks quite comfortable from the liquidity point of view. Cash, cash equivalents and short-term marketable securities of $1.01 billion at the end of the second quarter of 2023 compared favorably with $0.88 billion at the end of the first quarter. The company also generated strong cash flow and returned wealth to investors through share buybacks.

Downsides

Overdependence on the Invisalign Technology System: The bulk of Align Technology's net revenues largely depends on the sale of its Invisalign Technology System, primarily Invisalign Technology Full and Invisalign Technology Teen. Therefore, the continued and widespread market acceptance of Invisalign Technology by orthodontists, GPs and consumers is critical to Align Technology’s future success. Management fears that if consumers start preferring a competitive product over Invisalign, the company’s operating results will suffer.

Competitive Landscape: Align Technology faces significant competition from traditional orthodontic appliance (or wires and brackets) players such as 3M’s Unitek, Danaher Corporation’s Sybron Dental Specialties and Dentsply International. The company also competes with products similar to Invisalign Technology, such as products from Ormco Orthodontics, a division of Sybron Dental Specialties.

Estimate Trend

The Zacks Consensus Estimate for Align Technologies’ 2023 earnings per share (EPS) has increased from $8.77 to $8.78 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at 3.98 billion. This suggests a 6.59% rise from the year-ago reported number.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Haemonetics HAE, Intuitive Surgical ISRG and Quanterix QTRX.

Haemonetics has an estimated earnings growth rate of 26.1% in the fiscal 2024 compared with the industry’s 18.7%. HAE’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 19.39%. Its shares have rallied 18.3% against the industry’s 0.5% fall in the past year.

HAE carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intuitive Surgical, carrying a Zacks Rank #2 at present, has a long-term estimated earnings growth rate of 15.7% compared with the industry’s 15.5%. Shares of the company have rallied 51.1% compared with the industry’s 1.8% growth over the past year.

ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 4.19%.

Quanterix, carrying a Zacks Rank #2 at present, has an estimated earnings growth rate of 62.8% for the current year compared with the industry’s 15.2%. Shares of QTRX have surged 145.6% against the industry’s 0.8% decline over the past year.

Quanterix’s earnings surpassed estimates in each of the trailing four quarters, delivering an average earnings surprise of 30.39%. In the last reported quarter, it posted an earnings surprise of 55.56%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Quanterix Corporation (QTRX) : Free Stock Analysis Report