Here's Why You Should Buy Casey's (CASY) Stock Right Now

Casey's General Stores, Inc. CASY is well-poised for growth, courtesy of strength across its end markets, business operating model, strong omnichannel capabilities and private-label offerings. The company remains focused on investing in growth opportunities, solidifying its long-term market position, as well as staying committed to shareholder returns.

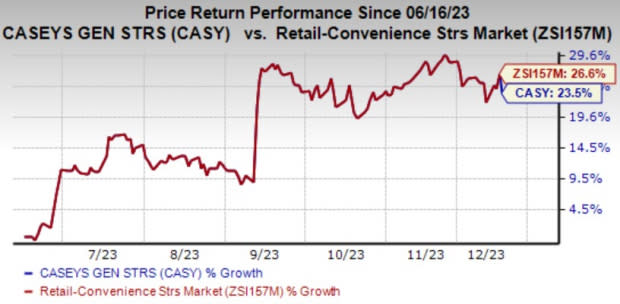

This Zacks Rank #1 (Strong Buy) company has a market capitalization of $10.3 billion. Over the past six months, it has gained 23.5% compared with the industry’s growth of 26.6%.

Image Source: Zacks Investment Research

Let’s delve into the factors that have been aiding the company for a while now.

Business Strength: Casey's General Stores has been benefiting from strength across its Grocery & Prepared Food businesses. For instance, in the second quarter of fiscal 2024, Casey’s inside sales jumped 6.2% to $1,346.9 million and inside same-store sales increased 2.9%. The impressive performance was driven by strength in the prepared food and dispensed beverage category, including bakery, whole pizza pies and dispensed beverages, as well as non-alcoholic and alcoholic beverages in the grocery and general merchandise category.

For fiscal 2024, Casey's estimates inside same-store sales to increase between 3.5% and 5% and inside margin to grow in the band of 40-41%.

Strategic Focus & Initiatives: The company’s focus on technology advancements, inventory management, along with data analytics, positions it well for future growth. It has been strengthening pizza promotions for guests who are seeking meal solutions, as well as enhancing breakfast lineups. CASY aims to broaden its private label offerings further, capitalizing on a selection of more than 300 premium, budget-friendly snacks and beverages carefully tailored to meet the desires and preferences of customers.

The company's strategic focus on price and product optimization, along with efforts to contain costs and improve distribution efficiency, has also been instrumental in driving sales and expanding profit margins. For instance, in the fiscal second quarter, CASY's gross profit increased 9.2% year over year to $885.6 million, while the gross margin expanded 140 basis points to 21.8%.

Shareholder-Friendly Moves: The company’s shareholder-friendly policies, through dividend payouts and share repurchases, also work in its favor. For instance, in the first six months of fiscal 2024, it paid dividends of $31 million and repurchased shares worth $59.5 million. Exiting the fiscal second quarter, it had $340 million remaining under its existing share repurchase authorization.

Store Expansionary Policy: With a strategic vision to expand, CASY aims to add at least 150 stores by the end of fiscal 2024, ensuring that each store is strategically positioned and stocked with the right products to meet customer demands. This growth strategy seamlessly blends organic expansion and strategic acquisitions.

Other Promising Stocks

We have highlighted three other top-ranked stocks, namely Abercrombie & Fitch ANF, American Eagle Outfitters AEO and Gap GPS.

Abercrombie & Fitch, a leading casual apparel retailer, currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial year sales implies growth of 13.3% year over year. ANF delivered an earnings surprise of 713% in the last reported quarter.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently carries a Zacks Rank #2 (Buy). AEO delivered a trailing four-quarter average earnings surprise of 23%.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial year sales and EPS implies growth of 4% and 39.2%, respectively, from that reported a year ago.

Gap, a fashion retailer of apparel and accessories, currently sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 137.9%, on average.

The Zacks Consensus Estimate for Gap’s current financial year earnings per share indicates growth of 387.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report