Here's Why You Should Buy Edward Lifesciences (EW) Stock Now

Edwards Lifesciences Corporation EW is gaining from its commitment to advance its leadership position in surgical structural heart therapies. The SAPIEN 3 Ultra RESILIA platform also continues its strong uptake in the United States.

Elevated expenses and foreign exchange headwinds are a concern for EW’s business.

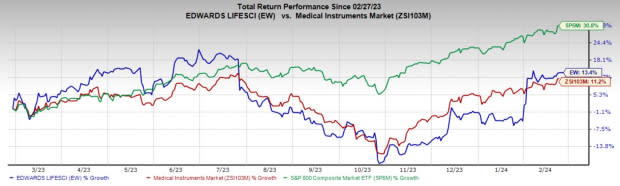

In the past year, this Zacks Rank #2 (Buy) stock has gained 13.4% compared with 11.2% rise of the industry and 30.8% growth of the S&P 500 composite.

The renowned global medical device company has a market capitalization of $52.75 billion. Edward Lifesciences’ earnings surpassed estimates in two of the trailing four quarters and broke even in two, delivering an average surprise of 0.80%.

Let’s delve deeper.

Upsides

Surgical Structural Heart, a Promising Business: The business pioneered the innovative RESILIA tissue, which is backed by more than 40 years of the company’s tissue technology leadership. The RESILIA portfolio has been widely adopted because of the excellent durability of its proven tissue technology. The company is firmly optimistic about the future of this technology as it continues to expand the body of RESILIA evidence. In the fourth quarter of 2023, the business benefitted from the strong global adoption of Edwards' premium RESILIA technology and overall procedural volumes. By the end of 2024, Edwards expects to treat half a million patients with the RESILIA-based heart valve.

TAVR Holds Potential: In the past few quarters, TAVR sales have been driven by the strong performance of the Edwards SAPIEN 3 Ultra valve in the United States, Europe and the Rest of the World, the Edwards SAPIEN 3 Ultra RESILIA valve in the United States and the Edwards SAPIEN 3 in Japan. The business closed the fourth quarter of 2023 with strong 12% year-over-year growth, driven by a broad portfolio of innovative therapies.

Strong Solvency and Capital Structure: Edwards Lifesciences has a solid balance sheet position. As of the end of the fourth quarter of 2023, cash and cash equivalents (including short-term investments) totaled $1.64 billion, with no near-term debt payable. Long-term debt of $596.8 million remained almost in line with the reported figure at the end of 2022.

Image Source: Zacks Investment Research

During the fourth quarter of 2023, the company repurchased 6.0 million shares through an accelerated repurchase agreement and a pre-established 10b5-1 plan. As of Dec 31, 2023, it has approximately $1 billion remaining under the current share repurchase authorization.

Downsides

Foreign Exchange Headwinds: Foreign exchange is a major headwind for Edwards Lifesciences due to a considerable percentage of its revenues coming from outside the United States (in 2023, 42% of the company’s net sales were derived from international regions). We remain worried about the significant challenges Edward Lifesciences had to face owing to the unfavorable impact of foreign currency that has been affecting the company’s gross margin in the past few quarters.

Competitive Landscape: The medical technology industry is highly competitive, with the presence of several competent players. In TAVR, the company’s primary competitors include Medtronic, Abbott Laboratories and Boston Scientific Corporation. Within TMTT, apart from Abbott, there are a considerable number of large and small companies with development efforts in these fields.

Estimate Trend

The Zacks Consensus Estimate for Edwards Lifesciences’ 2024 earnings per share (EPS) has moved down from $2.81 to $2.76 in the past 90 days.

The Zacks Consensus Estimate for the company’s 2024 revenues is pegged at $6.52 billion. This suggests an 8.5% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks from the broader medical space are Stryker Corporation SYK, Cencora, Inc. COR and Cardinal Health CAH.

Stryker, carrying a Zacks Rank #2, reported a fourth-quarter 2023 adjusted EPS of $3.46, beating the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion outpaced the consensus estimate by 3.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker has an estimated earnings growth rate of 11.5% for 2025 compared with the S&P 500’s 9.9%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 5.1%.

Cencora, carrying a Zacks Rank #2, reported a first-quarter fiscal 2024 adjusted EPS of $3.28, which beat the Zacks Consensus Estimate by 14.7%. Revenues of $72.3 billion outpaced the Zacks Consensus Estimate by 5.1%.

COR has an earnings yield of 5.75% compared with the industry’s 1.85%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 6.7%.

Cardinal Health, carrying a Zacks Rank #1, reported second-quarter fiscal 2024 adjusted earnings of $1.82, which beat the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion improved 11.6% on a year-over-year basis and also topped the Zacks Consensus Estimate by 1.1%.

CAH has a long-term estimated earnings growth rate of 15.3% compared with the industry’s 11.8% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report