Here's Why You Should Buy Zimmer Biomet (ZBH) Stock Now

Zimmer Biomet ZBH is likely to grow in the coming quarters, backed by the implementation of meaningful strategic pillars within its Knee business. The company is benefitting from improved procedural volumes in a gradually stabilizing global musculoskeletal market. Zimmer Biomet is also bolstering its foothold in emerging markets for long-term growth opportunities, buoying optimism.

Meanwhile, unfavorable solvency and an intense competitive landscape remain concerning for the company.

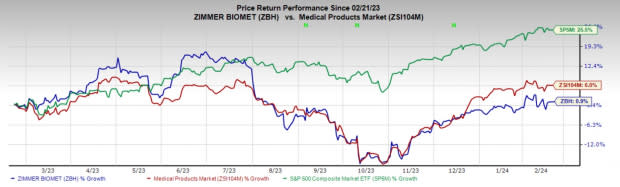

In the past year, this Zacks Rank #2 (Buy) stock has increased 0.9% compared with the 6% rise of the industry and the 25.5% growth of the S&P 500 composite.

The leading musculoskeletal healthcare company has a market capitalization of $26.1 billion. The company has an earnings yield of 6.46% against the industry’s -1.35%. Zimmer Biomet surpassed estimates in three of the trailing four quarters and broke even in one, delivering an average earnings surprise of 4.99%.

Let’s delve deeper.

Tailwinds

Four-Pillar Strategy to Expand the Knee Business: Zimmer Biomet has implemented four meaningful pillars inside its Knee business to drive pricing stability, mix benefit and competitive conversions. Under the first pillar, the company is focusing on the ROSA Robotic Platform combined with its Persona Cementless Knee.

Image Source: Zacks Investment Research

The second pillar is focused on Persona revision, which provides a meaningful conversion and mix opportunities inside the revision category. Under the third pillar, Zimmer Biomet plans to work on the overall shift of the company’s legacy knee systems to a fully rounded-out Persona portfolio. The fourth pillar will focus on the development of the world's first and only Smart Knee- Persona iQ, which is still in limited launch per its current status.

Promising Market Opportunities: Zimmer Biomet is diligently working to strengthen its foothold in internationally developed and emerging markets that provide long-term opportunities for growth. The company has made strategic investments in these regions over the past several quarters to improve operational and sales performance, which are yielding results.

In particular, a strong presence in emerging markets with an extended portfolio that includes upper and lower joints has greatly benefited its business. Within emerging markets, we note that strength in the Asia Pacific market has continued to drive strong revenue growth so far.

Gradually Stabilizing Market: Despite challenging market conditions in the form of pricing pressure, the last few quarters witnessed gradual stability in the global musculoskeletal market with better-than-expected sales growth in certain geographies, banking on improved procedural volumes.

In the fourth quarter of 2023, the company witnessed strong growth, driven by continued procedure recovery, strong execution and solid momentum with the new innovation. ZBH saw another positive quarter of year-over-year momentum in large joints, with the overall global Knees, Hips and S.E.T. business growing 9.4%, 3.6% and 3.3%, respectively.

Downsides

Leveraged Capital Structure: Zimmer Biomet exited the fourth quarter of 2023 with cash and cash equivalents of $415.8 million and a near-term payable debt of $900 million. This is a matter of concern for investors, as during the period of global economic uncertainties, its cash and cash equivalent are not sufficient even for short-term debt repayment. Meanwhile, total long-term debt came up to $5.77 billion compared to the year-ago figure of $5.69 billion.

Competitive Landscape: The presence of a large number of players has made the medical device market intensely competitive. The orthopedic industry, in particular, is highly competitive with the presence of players like Stryker and Medtronic. Zimmer Biomet needs to constantly introduce or acquire new products to withstand competitive pressure and maintain its market share.

Estimate Trend

The Zacks Consensus Estimate for Zimmer Biomet’s 2024 earnings per share (EPS) has moved up from $7.95 to $8.06 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2024 revenues is pegged at $7.76 billion. This suggests a 4.9% rise from the year-ago reported number.

Other Key Picks

Some other top-ranked stocks in the broader medical space are Cardinal Health CAH, Stryker SYK and DaVita DVA.

Cardinal Health has a long-term estimated earnings growth rate of 15.9% compared with the industry’s 11.8%. CAH’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%. Its shares have increased 34.9% compared with the industry’s 11.3% rise in the past year.

CAH carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker, carrying a Zacks Rank #2 at present, has an earnings yield of 3.39% against the industry’s -0.89%. Shares of the company have increased 33.4% compared with the industry’s 6% rise over the past year.

SYK’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 5.09%. In the last reported quarter, it delivered an average earnings surprise of 5.81%.

DaVita, sporting a Zacks Rank #1 at present, has an estimated long-term earnings growth rate of 12.1% compared with the industry’s 11.5%. Shares of DVA have rallied 48% compared with the industry’s 11.6% rise over the past year.

DVA’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 35.6%. In the last reported quarter, it delivered an average earnings surprise of 22.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report