Here's Why Cboe Global (CBOE) is Investors' Favorite Now

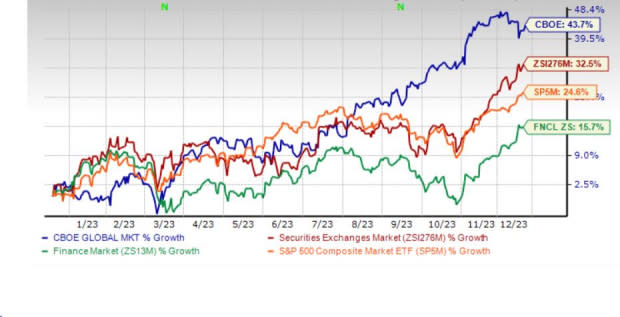

Cboe Global Markets CBOE shares have rallied 43.7% year to date, outperforming the industry’s increase of 32.5%, the Finance sector’s rise of 15.7% and the Zacks S&P 500 composite’s rally of 24.6%. With a market capitalization of $18.7 billion, the average volume of shares traded in the last three months was 0.9 million.

Its strong market position, global reach, proprietary products’ strength and solid capital position continue to drive CBOE shares. The consensus estimate for 2024 earnings of this Zacks Rank #1 (Strong Buy) company has moved up 0.4% in the past seven days, reflecting analysts’ optimism.

CBOE has a solid history of delivering earnings surprises in the last four reported quarters. Its earnings grew 13.7% in the last five years, better than the industry average of 10.5%.

Return on invested capital hovered around 10% over the last few years. The company has raised its capital investment significantly, reflecting CBOE’s efficiency in utilizing funds to generate income.

Image Source: Zacks Investment Research

What’s Driving the Stock?

The Zacks Consensus Estimate for 2024 earnings is pegged at $8.02, suggesting a year-over-year increase of 5.6% on 5.3% higher revenues of $2 billion. The expected long-term earnings growth rate is 10.2%, better than the industry average of 7.4%. It has a Growth Score of B.

CBOE is the largest stock exchange operator by volume in the United States and a leading market globally for ETP trading. A diversified business mix with recurring revenues, accelerated growth acceleration banking on recurring non-transaction revenues, use of technology and prudent buyouts poise it well for growth.

CBOE’s strength lies in organic growth, as reflected in its revenue growth story. We estimate the 2025 top line to witness a three-year CAGR of 1.1%, largely driven by transaction fees. CBOE estimates organic total net revenue growth between 7% and 9% in 2023. A volatile market drives trading volume, which, in turn, fuels transaction fees.

The company’s top line has been benefiting from recurring non-transaction revenues. CBOE estimates Data and Access Solutions organic net revenue growth in the range of 7%-10% in 2023. We estimate access and capacity fees in 2025 to witness a three-year CAGR of 6.3% and 2025 market data revenues to register a three-year CAGR of 4.5%.

Its inorganic growth story is also impressive. Acquisitions have helped it achieve a greater global breadth of services and products as well as new distribution channels apart from generating revenue and cost synergies.

CBOE is focusing on improving margins through cost management. It lowered its 2023 expense guidance to the range of $754 million to $762 million from $766 million to $774 million, guided earlier.

A solid capital management policy aids the company in making strategic investments that drive growth as well as pay back its shareholders. CBOE increased dividends for 13 straight years and has $390 million left under its current share repurchase authorization.

Other Stocks to Consider

Some other top-ranked stocks from the finance sector are Deutsche Boerse DBOEY, Coinbase Global COIN and Berkshire Hathaway Inc. (BRK.B), each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Deutsche Boerse’s 2024 earnings per share indicate a year-over-year increase of 4%. Year to date, DBOEY has gained 15.7%. The expected long-term earnings growth rate is 10.2%, better than the industry average of 7.4%.

Coinbase has a decent track record of beating earnings estimates in three of the last four quarters and missing in one, the average being 62.95%. COIN stock has climbed 360.8% Year to date. The Zacks Consensus Estimate for COIN’s 2024 earnings per share indicates a year-over-year increase of 30.4%.

Berkshire delivered a trailing four-quarter average earnings surprise of 0.20%. Year to date, the stock has risen 19.8%. The Zacks Consensus Estimate for BRK.B’s 2024 earnings suggests a year-over-year rise of 11.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE) : Free Stock Analysis Report

Deutsche Boerse AG (DBOEY) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report