Here's Why SITE Centers (SITC) is an Apt Portfolio Pick Now

A portfolio of well-located properties in suburban and high-household-income regions of the United States, with maximum concentrations in Florida, Georgia and North Carolina, positions SITE Centers’ SITC well for growth. Also, focus on tenants with necessity-based businesses and an aggressive capital-recycling program bode well.

A remote working scenario and consumers’ shifting toward the suburbs have been increasing the demand for this retail real estate investment trust’s (REIT) properties, driving consistent traffic. Also, working from home has led to increased weekday traffic. This positive trend has been aiding SITC to generate decent cashflows and is likely to continue in the upcoming quarters.

In addition, the majority of SITC’s tenants at its shopping centers are essential to retail businesses that serve day-to-day consumer needs. Of the 99 wholly-owned shopping centers, 67% were either anchored by a grocer or a high-quality discounter. This helps the company to generate stable revenues during uncertain times.

To enhance its portfolio, SITE Centers has adopted an aggressive capital-recycling program through which it disposes of slow-growth assets and redeploys the proceeds to acquire premium U.S. shopping centers.

In second-quarter 2022, SITE Centers disposed of 14 shopping centers and one parcel at a wholly-owned shopping center for $268.1 million ($94.6 million at company share). From the beginning of 2022 through Jul 22, 2022, SITE Centers acquired nine shopping centers for an aggregate purchase price of $269.7 million. Such match-funding initiatives reflect the company’s prudent capital-management practices and relieve pressure from its balance sheet.

SITE Centers has a decent balance-sheet position with ample liquidity. It exited second-quarter 2022 with $864 million of liquidity and an average pro-rata net debt to adjusted EBITDA of 5.4X.

SITC also enjoys investment-grade credit ratings of BBB-/Baa3/BBB with a stable outlook from S&P/ Moody's/ Fitch, respectively, giving it favorable access to the debt market. With strong financial footing and enough financial flexibility, it is well-placed to capitalize on long-term growth opportunities.

Analysts seem bullish on this Zacks Rank #2 (Buy) stock. The Zacks Consensus Estimate for the company’s 2022 funds from operations (FFO) per share has been revised marginally upward over the past two months to $1.16.

However, given the conveniences of online shopping, rising e-commerce adoption is concerning for SITE Centers. Online retailing will likely remain a popular choice among customers, adversely impacting the market share for brick-and-mortar stores.

SITE Centers also faces stiff competition from several real estate companies and developers, limiting its ability to raise rental rates, including renewal rates and filling vacancies.

Further, a hike in interest rate will raise borrowing costs for SITC and could affect its ability to purchase or develop real estate.

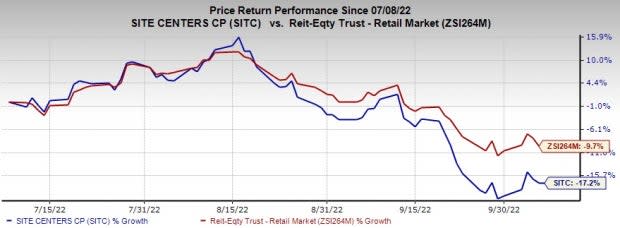

Shares of SITC have lost 17.2% in the past three months compared with the industry’s decline of 9.7%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the REIT sector are Kimco Realty KIM, Regency Centers REG and Kite Realty Group Trust KRG, each carrying a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kimco Realty’s current-year FFO per share has moved 1.3% northward in the past two months to $1.56.

The Zacks Consensus Estimate for Regency Centers’ ongoing year’s FFO per share has been raised 1.8% over the past two months to $3.96.

The Zacks Consensus Estimate for Kite Realty Group Trust’s 2022 FFO per share has moved 1.6% upward in the past two months to $1.85.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Regency Centers Corporation (REG) : Free Stock Analysis Report

Kite Realty Group Trust (KRG) : Free Stock Analysis Report

SITE CENTERS CORP. (SITC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research