Here's Why You Should Consider Buying Hess (HES) Stock Now

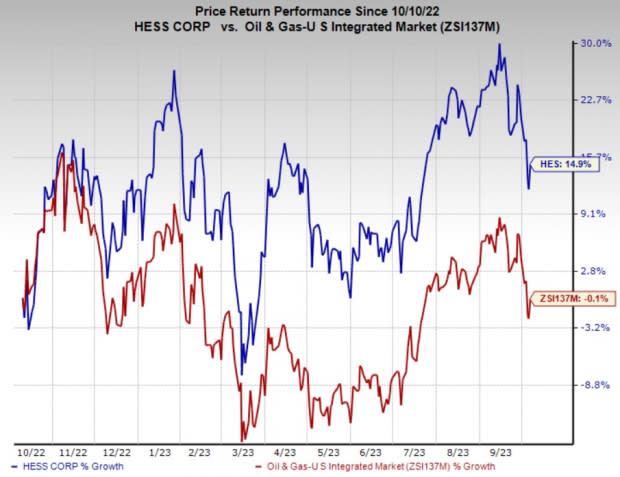

Hess Corporation HES has gained 14.9% in the past year against the 0.1% decline of the composite stocks belonging to the industry.

The company, currently carrying a Zacks Rank #2 (Buy), beat the Zacks Consensus Estimate in the prior four quarters, the average surprise being 7.4%.

Image Source: Zacks Investment Research

Let’s delve into the factors behind the stock’s price appreciation.

What’s Favoring the Stock?

The West Texas Intermediate crude oil price has reached $85 per barrel, underscoring a robust commodity pricing environment. The current oil pricing landscape is highly favorable and is expected to continue, indicating a favorable business environment for Hess’ exploration and production operations.

The company has made several remarkable oil discoveries in the Stabroek Block, situated offshore Guyana. These findings contribute to more than 11 billion barrels of oil equivalent (Boe) in gross recoverable resources within the block. This is bolstering the company’s production outlook, consequently resulting in enhanced profitability.

In the prolific Bakken shale play, the leading upstream energy firm holds a significant reserve of top-tier drilling locations. With a scheduled four-rig drilling initiative in this region, Hess expects to bring around 110 new wells online in 2023, bolstering its production outlook.

Furthermore, the company anticipates oil production from the country’s upcoming three production vessels to exceed their projected capacities. By the end of 2027, HES aims to operate six FPSOs, boasting a combined gross output capacity surpassing 1.2 million barrels per day.

Hess expects substantial growth in the free cash flow in the coming years, and intends to allocate it toward reducing debt burden and returning capital to its shareholders. The company projects a 25% annual increase in cash flow over the next five years, assuming a crude oil price of $75 per barrel.

Additionally, HES plans to allocate 75% of its annual free cash flow to shareholders through a combination of dividend increases and share buybacks. This underscores its firm dedication to delivering value and returning capital to its shareholders.

Numerous factors are aiding the stock price increase for HES and are creating more room for upside.

Other Stocks to Consider

Investors interested in the energy sector may look at some other top-ranked companies mentioned below. All three companies presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Patterson-UTI Energy PTEN is one of the largest North America-based land drilling contractors, having a large, high-quality fleet of drilling rigs. The company has a comfortable debt maturity profile with no major debt outstanding until 2028.

Patterson-UTI has witnessed upward earnings estimate revisions for 2023 and 2024 in the past seven days. The consensus estimate for PTEN’s 2023 and 2024 earnings per share is pegged at $1.56 and $1.84, respectively.

APA Corporation APA boasts a large, geographically diversified reserve base with multi-year trends in reserve replacement. The company is using the excess cash to reward shareholders with dividends and buybacks. APA bought back 1.3 million shares at $33.72 apiece in the second quarter. The company also shelled out $77 million in dividend payments.

APA Corp has witnessed upward earnings estimate revisions for 2023 and 2024 in the past seven days. The consensus estimate for APA’s 2023 and 2024 earnings per share is pegged at $4.68 and $6.38, respectively.

USA Compression Partners USAC is a leading energy infrastructure provider, which specializes in large-horsepower applications. The stability in cash flow for USA Compression Partners has enabled it to maintain a steady quarterly distribution of 52.50 cents since the second quarter of 2015.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 58 cents, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Patterson-UTI Energy, Inc. (PTEN) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report