Here's Why Construction Partners (ROAD) is Soaring Recently

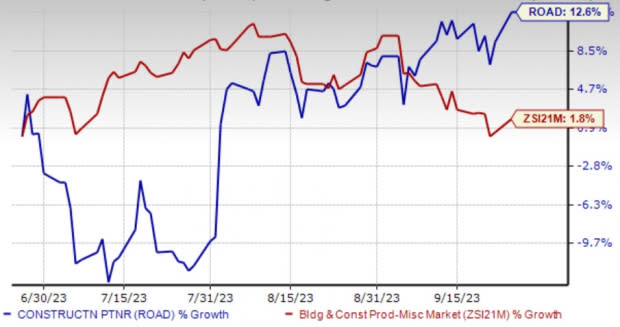

Construction Partners, Inc. ROAD is gaining of late. The stock rose 12.6% over the past three months compared with the Zacks Building Products - Miscellaneous industry’s 1.8% growth.

This civil infrastructure company has been riding high on the back of solid demand for infrastructure services throughout end markets in both private and public sectors. Consistent execution of its business model and margin-related growth strategies are added positives.

Its earnings estimate for fiscal 2023 has been upwardly revised to 84 cents from 70 cents over the past 60 days, suggesting that customer sentiments toward Construction Partners are moving in the right direction. The upwardly revised estimate reflects 104.9% growth year over year on 19.4% higher revenues.

The company’s earnings have surpassed the consensus estimate in four of the five trailing quarters.

Image Source: Zacks Investment Research

Impressively, ROAD has a long-term earnings growth rate of 48.4% and a VGM Score of A, making us confident in its inherent strength.

Let’s find out the fueling factors supporting this Zacks Rank #2 (Buy) stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Solid Public Infrastructural Spending

The company and its peers are expected to benefit from strong global trends in infrastructure modernization, energy transition, national security and a potential super-cycle in global supply-chain investments. The U.S. administration’s endeavor to rebuild the nation’s deteriorating roads and bridges and fund new climate resilience and broadband initiatives is expected to aid industry players.

Meanwhile, the company’s business prospects are highly correlated with the U.S. housing market conditions and the R&R activity. Solid momentum in the R&R markets and improving residential construction markets are expected to drive growth. Builders are now cautiously optimistic for 2023 as the lack of existing inventory is shifting demand to the new home market, thereby driving the demand for company products in the industry.

Strong Growth Opportunities

Construction Partners’ organic and inorganic growth opportunities in the attractive Southeastern U.S. road construction/repair market are expected to help the company generate higher revenues. Revenues grew 11% year-over-year in the third quarter of fiscal 2023. Excluding the impact of approximately $10 million of additional revenues from higher state liquid asphalt price index reimbursements in the third quarter of fiscal 2022, revenues rose 14% year over year.

Adjusted EBITDA increased 50% and adjusted EBITDA margin expanded by 350 bps from last year.

Growth was fueled by strong operational performance and effective project execution throughout the markets served via effectively utilizing hot mix asphalt plants and equipment and continued strong demand for infrastructure services throughout the end markets served in both the private and public sectors.

Project backlog was $1.59 billion at Jun 30, 2023 compared with $1.33 billion at Jun 30, 2022 and $1.52 billion at Mar 31, 2023.

Robust Acquisition Moves

Construction Partners has been bolstering inorganic growth and market expansion over the last few quarters. On Aug 1, ROAD announced that it acquired a hot-mix asphalt plant in Myrtle Beach, SC, from C.R. Jackson, Inc. It has also established a new greenfield hot-mix asphalt plant and market in Waycross, Georgia. On May 1, the company acquired the Huntsville, AL, operations of Southern Site Contractors, LLC.

Construction Partners’ organic and inorganic growth opportunities in the attractive Southeastern U.S. road construction/repair market are expected to help the company generate higher revenues.

Upbeat View

Given its solid top-line revenue performance in the third quarter, a solid backlog and a strong project demand environment, ROAD expects revenues to be in the range of $1.535-$1.555 billion compared with $1.30 billion reported in fiscal 2022. Net income is now anticipated in the range of $41-$46 million, almost double from $21.4 million generated in the previous year. Adjusted EBITDA is expected in the range of $161-$169 million, up from $111.2 million reported a year ago.

Other Key Picks

Some other top-ranked stocks sporting a Zacks Rank #1 in the same space are:

Installed Building Products, Inc. IBP is a leading installer of insulation and complementary building products. It primarily banks on a robust pipeline of acquisition opportunities across multiple geographies, products and end markets.

Installed Building’s earnings for 2023 are expected to grow by 5%. The same has moved north to $9.40 per share from $8.68 per share over the past 60 days, reflecting analysts’ optimism for its growth potential.

Gibraltar Industries, Inc. ROCK manufactures and distributes products to the industrial and buildings market. The company is benefiting from material cost alignment, field operations efficiency, price management, business mix, 80/20 initiatives and the share repurchase program.

The Zacks Consensus Estimate for ROCK’s 2023 earnings has moved north to $3.97 per share from $3.76 in the past 30 days. ROCK’s expected earnings growth rate for 2023 is 16.8%.

TopBuild Corp. BLD is an installer and distributor of insulation and other building products to the U.S. construction industry. It benefits from strong demand, strategic acquisitions and a favorable mix of installation business.

BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates growth of 3.3% and 6.1%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Installed Building Products, Inc. (IBP) : Free Stock Analysis Report

Construction Partners, Inc. (ROAD) : Free Stock Analysis Report