Here's Why Crestwood (CEQP) is an Attractive Investment Bet

Crestwood Equity Partners LP CEQP has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days.

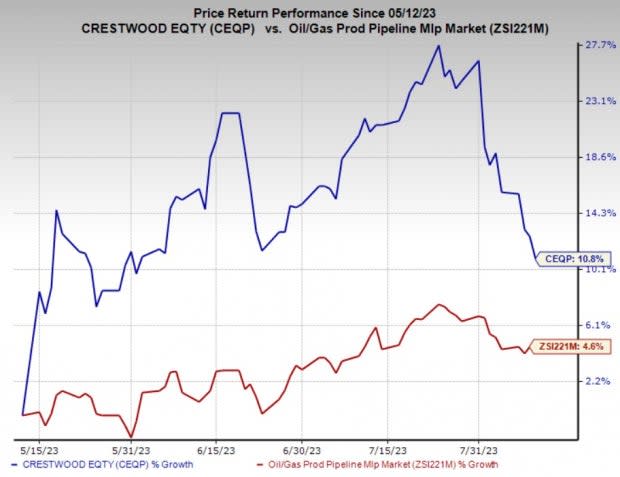

The stock, with a Zacks Rank #2 (Buy), has gained 10.8% in the past three months compared with the industry’s 4.6% growth.

Image Source: Zacks Investment Research

What’s Favoring the Stock?

Crestwood provides infrastructure solutions in major U.S. shale plays like the Bakken Shale, Delaware Basin, Marcellus Shale and others. With a market cap of $2.7 billion, the partnership is engaged in creating long-term value for unitholders.

Crestwood is well-positioned for growth on the back of an extensive network of pipelines used for natural gas gathering and processing. Its 2 Bcf/d of natural gas gathering and 1.4 Bcf/d of processing capacity will be extensively used to shift to low-carbon development pathways.

Crestwood is least exposed to commodity price fluctuations since the partnership generates stable fee-based revenues from diverse midstream energy assets via long-term contracts. The partnership’s storage capacity of 35 Bcf of natural gas, 2.1 million barrels (MMBbls) of crude oil and 10 MMBbls of NGLs are praiseworthy, as upstream activities in the United States are expected to increase.

Crestwood has completed the acquisition of Oasis Midstream Partners for $1.8 billion, which boosted its footprint in Williston and Delaware Basins. The partnership announced a series of transactions worth $1.2 billion, which more than doubles its natural gas processing capabilities in the Delaware Basin.

For 2023, Crestwood expects adjusted EBITDA of $780-$860 million, suggesting an improvement from the $762.1 million reported in 2022. The partnership expects a free cash flow after paying distributions of $10-$90 million. Crestwood pledges to allocate all free cash flow after distributions toward debt reduction during 2023.

As the overall energy environment in the United States is expected to significantly recover this year, Crestwood generating higher distributable cash flow is commendable.

Other Stocks to Consider

Investors interested in the energy sector may look at other top-ranked companies mentioned below. All three companies presently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TC Energy TRP reported second-quarter 2023 adjusted earnings of 71 cents per share, which missed the Zacks Consensus Estimate of 73 cents. This underperformance resulted from weak results in the Liquids Pipelines, and Power and Storage segments.

By 2024, TRP plans to maintain business growth at 3-5% and limit annual net capital expenditure to C$6-C$7 billion. It also considers lowering leverage and returning additional capital to shareholders.

Oceaneering International OII reported a second-quarter 2023 adjusted profit of 18 cents per share, which missed the Zacks Consensus Estimate of 30 cents. This underperformance was due to a lower-than-expected operating income from the Subsea Robotics and Manufactured Products segments.

For 2023, Oceaneering projects consolidated EBITDA of $2275-$310 million and a continued free cash flow generation of $90-$130 million.

Motor fuel retailer Murphy USA MUSA announced second-quarter 2023 earnings per share of $6.02, which missed the Zacks Consensus Estimate of $6.09. The underperformance resulted from a fall in the retail gasoline price and fuel contribution, partly offset by higher-than-expected petroleum product sales.

MUSA is committed to returning excess cash to its shareholders through continued share buyback programs. As part of this initiative, the fuel retailer recently approved a repurchase authorization of up to $1.5 billion following the completion of the existing $1-billion mandate. The move underscores MUSA’s sound financial position and commitment to rewarding its shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

TC Energy Corporation (TRP) : Free Stock Analysis Report

Crestwood Equity Partners LP (CEQP) : Free Stock Analysis Report