Here's Why Diageo (DEO) Looks Well-Poised Despite Cost Headwinds

Diageo Plc DEO has been benefiting from its diversified footprint, advantaged portfolio, strong brands and favorable industry trends of premiumization. The company has been witnessing solid business momentum, strong consumer demand and market share gains, which have been boosting its performance. Effective marketing and exceptional commercial execution bode well.

Robust sales growth, organic operating margin expansion and productivity savings have been aiding DEO’s results for a while. Price/mix has been gaining from a positive mix due to robust growth in super-premium-plus brands, particularly scotch, tequila and Chinese white spirits.

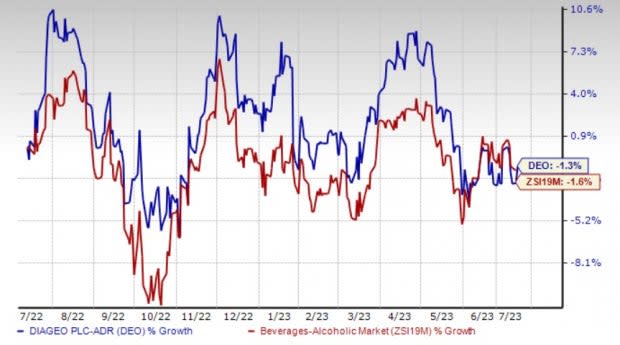

Shares of the Zacks Rank #3 (Hold) company have lost 1.3% in the past year compared with the industry’s decline of 1.6%.

However, inflation, stemming from higher glass, ocean freight and transportation costs, has been a headwind. Also, currency headwinds are concerning.

Image Source: Zacks Investment Research

What Keeps Diageo Strong?

DEO is anticipated to retain the strength in its business through constant premiumization efforts, recovery across markets, pricing actions and supply productivity savings. The company’s premium plus brands contributed 57% to net sales growth and 65% to organic sales growth in the first half of fiscal 2023. Its super-premium-plus brands aided organic net sales by 12%.

Diageo is confident about the long-term growth potential of the beverage alcohol sector. It expects to expand its value share by 50% in the sector to 6% by 2030. DEO is on track to deliver on its medium-term guidance for fiscal 2023-2025 of 5-7% organic sales growth and 6-9% organic operating profit growth. Diageo expects to invest strongly in marketing and innovation, and leverage its revenue growth management capabilities, including strategic pricing actions.

DEO is well-poised for growth from effective marketing and extraordinary commercial execution. It is likely to invest strongly in marketing and innovation, and leverage its revenue growth management capabilities, including strategic pricing actions. This is likely to support DEO in the near and long terms.

The company’s margin trends were favorable in the first half of fiscal 2023, thanks to its premiumization efforts, ongoing recovery in markets, pricing actions and disciplined cost management. Organic operating profit benefited from leverage in operating costs, driven by disciplined cost management. Growth was driven by supply productivity savings and price increases, which more than offset the higher cost inflation on the gross margin.

In fiscal 2023, the company anticipates organic operating margin to benefit from continued premiumization trends, everyday efficiencies and operating expense leverage, offset by strong investments in marketing.

For fiscal 2023, DEO anticipates organic net sales growth across North America to normalize through the second half of fiscal 2023, whereas it reported double-digit growth in the year-ago period. In Europe, organic net sales growth is likely to moderate in the second half of fiscal 2023 as the company laps the on-trade channel re-opening and recovery in the prior year. It anticipates continued organic net sales growth for the Asia Pacific, Latin America, and the Caribbean and Africa in the second half of fiscal 2023, although at a moderated pace than strong growth reported in fiscal 2022.

Hurdles to Overcome

Diageo suffers from persistent inflationary pressures from higher commodity costs, particularly agave, energy expenses and supply disruptions. As a substantial portion of the company’s business comes from international operations, exchange rate fluctuations have been hampering its sales for a while.

DEO expects to continue its revenue management initiatives, including pricing actions, throughout fiscal 2023, to overcome the challenging inflationary environment.

In the second half of fiscal 2023, the company expects cost inflation pressure to persist and is committed to investing in its brands to deliver sustainable growth. DEO expects marketing investment to increase more than sales growth in the second half of fiscal 2023.

Stocks to Consider

We highlighted some better-ranked stocks from the beverages space, namely The Duckhorn Portfolio NAPA, Molson Coors TAP and Coca-Cola FEMSA KOF.

Duckhorn currently has a Zacks Rank #2 (Buy). NAPA has a trailing four-quarter earnings surprise of 14.2%, on average. Shares of NAPA have declined 32.4% in the past year.

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Duckhorn’s current financial-year sales and earnings suggests growth of 8.3% and 4.8%, respectively, from the year-ago period's reported figures. NAPA has an expected EPS growth rate of 6.6% for three-five years.

Molson Coors currently carries a Zacks Rank #2. The company has an expected EPS growth rate of 4.3% for three to five years. Shares of TAP have rallied 10.6% in the past year.

The Zacks Consensus Estimate for Molson Coors’ sales and earnings per share for the current financial year suggests growth of 5.3% and 10.2%, respectively, from the year-ago period’s reported figures. TAP has a trailing four-quarter negative earnings surprise of 32.1%, on average.

Coca-Cola FEMSA has a trailing four-quarter earnings surprise of 33.8%, on average. It currently carries a Zacks Rank #2. Shares of KOF have rallied 50.4% in the past year.

The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and earnings suggests growth of 19.5% and 14.6%, respectively, from the year-ago period's reported figures. KOF has an expected EPS growth rate of 13.5% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Diageo plc (DEO) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

The Duckhorn Portfolio, Inc. (NAPA) : Free Stock Analysis Report