Here's Why The Estee Lauder Companies (EL) Dropped 42.6% YTD

The Estee Lauder Companies Inc. EL is grappling with a persistent inflationary environment. The leading skincare, makeup, fragrance and hair care product provider is seeing weakness in the Asia travel retail business. Unfavorable foreign currency headwinds are a concern.

These factors hurt EL’s fourth-quarter fiscal 2023 profits. Margins also remained soft in the quarter. Management offered a dull view for the fiscal first quarter.

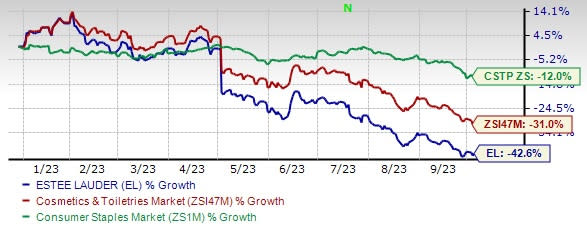

Shares of the Zacks Rank #5 (Strong Sell) stock have slumped 42.6% year-to-date compared with the industry’s 31% decline. The stock has underperformed the Zacks Consumer Staples’s decline of 12% during this time.

Let’s discuss further.

Q4 Margins Hurt

In fourth-quarter fiscal 2023, The Estee Lauder Companies’ adjusted gross profit came in at $2,467 million, down 3% year over year. The gross margin contracted to 67.8% from 71% reported in the year-ago quarter. The downside was caused by the under-absorption of overhead in its plants stemming from the pull-down of production during the year. The company’s operating income fell 66% to $71 million while its operating margin contracted 380 basis points (bps) to 2%. Operating expenses, as a percentage of sales, increased 70 bps, thanks to increased advertising and promotional activities.

Image Source: Zacks Investment Research

Volatile Currency: A Concern

Thanks to The Estee Lauder Companies’ solid international presence, it remains exposed to unfavorable currency fluctuations. Any adverse currency fluctuation will likely dent the company’s operating performance. For fiscal 2024, management projects an unfavorable currency impact of 1% on net sales. Currency headwinds will likely affect net earnings per share (EPS) by nearly 11 cents in fiscal 2024.

Drab Q1 Outlook

In its last earnings call, management highlighted that it is cautious about economic hurdles in China, volatile inflation levels, foreign currency fluctuations and concerns surrounding recession (in several global markets). For the first quarter of fiscal 2024, Estee Lauder anticipates reported and organic net sales to decline 12-10% year over year. The bottom line is envisioned in the band of a loss of 31 cents per share and a loss of 21 cents in the fiscal first quarter. On a constant-currency basis, the bottom line is likely to range between a loss of 29 cents and a loss of 19 cents per share.

Final Thoughts

The Estee Lauder Companies has a strong online business and the company expects it to be a major growth engine for the upcoming years. The company has a strong presence in emerging markets, which insulates it from the macroeconomic headwinds in the matured markets. Management is on track to expand its consumer reach in productive distribution across high-growth channels while strategically expanding brands into new countries.

All said, whether these upsides can help the company keep its growth story alive amid hurdles is yet to be seen.

Top 3 Picks

Inter Parfums IPAR, which manufactures, markets and distributes a range of fragrances and fragrance-related products, carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales indicates 19.7% growth from the year-ago reported figure. IPAR has a trailing four-quarter earnings surprise of 45.9% on average.

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Flowers Foods’ current financial year sales suggests growth of 6.7% from the year-ago period’s actuals. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

Kraft Heinz Company KHC, a food and beverage product company, currently carries a Zacks Rank #2. KHC has a trailing four-quarter earnings surprise of 11.3%, on average.

The Zacks Consensus Estimate for Kraft Heinz’s current fiscal-year sales suggests growth of 2.2% from the corresponding year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report