Here's Why G-III Apparel (GIII) is Poised for Growth in 2024

G-III Apparel Group, Ltd. GIII seems a promising pick, thanks to its robust business strategies with digital expansion and brand strength. The company has been undertaking several strategies, including acquisitions and licensing of well-known brands, to expand its product portfolio. Management is optimistic about the company’s diversified portfolio of key brands, namely DKNY, Donna Karan, Karl Lagerfeld, Vilebrequin, Levi’s, Nautica and Halston.

Let’s delve deeper.

Detailing Strategies

G-III Apparel’s strategic priorities include driving power brands across categories, enhancing its portfolio via ownership of brands and licensing opportunities, expanding its global reach, maximizing omnichannel capabilities and scaling the private label business. G-III Apparel has also been making progress on rightsizing the inventory.

We note that the company has numerous growth opportunities including the repositioning and expansion of the Donna Karan label and a long-term license for the Nautica brand. Nautica is available in nearly 1300 freestanding stores and shops globally as well as boasts a sturdy digital presence in more than 30 countries. The company’s license for Nautica in North America, initially with jeans and later expanding to a wider range of additional categories, is set to launch in early 2024 to more than 200 doors. It looks to install 60 branded shop-in-shops.

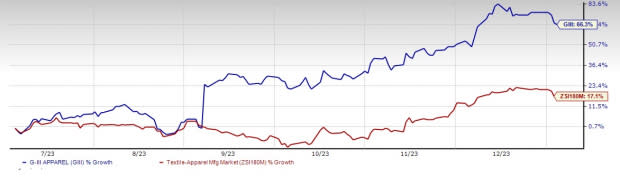

Image Source: Zacks Investment Research

For Donna Karan, it is leveraging the brand’s classic, contemporary and elevated feel, and widening its appeal to a broader consumer base. The company will launch the brand in spring in more than 200 doors. It will build 150 branded shop-in-shops and new licenses to extend the brand's reach. The company has entered into a 25-year agreement with Xcel Brands to design and manufacture all categories with the choice to buy the brand at the end of the licensing term.

Further, a master global license with the option to buy Halston is likely to launch in the fall of 2024. Halston is an American heritage brand with a legacy of glamorous designs across a range of price points. Management had also announced a multi-year license agreement with HanesBrands to manufacture an outerwear collection for the Champion brand. The company will create quality heritage pieces to expand Champions' lifestyle offerings. The product will be distributed via its diverse channels across North America and Champions' global network with first deliveries available for fall of 2024.

What’s More?

Shares of this apparel and accessories designer have surged a whopping 66.3% in the past six months, outperforming the industry’s 17.1% increase. A Momentum Score of B further speaks volumes for this current Zacks Rank #1 (Strong Buy) company.

Analysts seem optimistic about the company. The Zacks Consensus Estimate for fiscal 2024 earnings per share (EPS) is currently pegged at $3.79, showing an increase of 33% year over year. The consensus mark for fiscal 2025 sales and EPS is currently $3.27 billion and $3.84, respectively, reflecting corresponding increases of 3.7% and 1.5% year over year.

Given all the aforesaid tailwinds, we believe G-III Apparel will continue to perform well on the bourses.

Eye These Solid Picks Too

Some other top-ranked companies are Ralph Lauren RL, lululemon athletica LULU and Royal Caribbean RCL.

Ralph Lauren, a footwear and accessories dealer, carries a Zacks Rank #2 (Buy), at present. GIII has a trailing four-quarter earnings surprise of 541.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year EPS suggests growth of 13.1%, respectively, from the year-ago corresponding figure.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank of 2, at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 18.2% and 23.2%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 9.2%, on average.

Royal Caribbean carries a Zacks Rank of 2 at present. RCL has a trailing four-quarter earnings surprise of 28.3%, on average.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates increases of 57.7% and 187.9%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report