Here's Why Hershey (HSY) is Marching Ahead of Its Industry

The Hershey Company HSY has exhibited a decent run on the bourses in the past six months, owing to its pricing strategies, innovation and marketing techniques to drive growth.

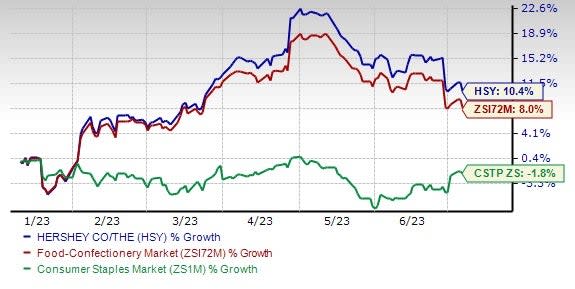

The stock has outpaced the industry over time. This Zacks Rank #3 (Hold) stock has rallied 10.4% in the past six months compared with the industry’s growth of 8%. This largest producer of quality chocolate products in the United States has also outperformed the Consumer Staples sector’s decline of 1.8%.

Additionally, the Zacks Consensus Estimate for sales for 2023 and 2024 is pegged at $11.29 billion and $11.79 billion, indicating year-over-year increases of 8.4% and 4.4%, respectively. Moreover, the Zacks Consensus Estimate for 2023 and 2024 earnings is pinned at $9.49 and $10.31, implying year-over-year increases of 11.4% and 8.6%, respectively.

Let's dig into the details.

Image Source: Zacks Investment Research

Strong Brand Portfolio

Hershey is a well-established and leading producer of quality chocolate and sugar confectionery products, with widespread consumer acceptance. The company's core brands, including Hershey’s, Reese’s and Jolly Rancher, have shown strong growth, aided by advertising investments, in-store merchandising, programming and innovation.

The company has been making strategic buyouts to strengthen its portfolio and boost revenues. This April, it agreed to buy two production facilities from Weaver Popcorn Manufacturing, a well-known leader in popcorn production, and co-packing and a co-manufacturer of HSY’s SkinnyPop brand. The move will likely help Hershey sustain its robust growth in the SkinnyPop brand through supply-chain expansion.

In 2021, Hershey acquired Dot's Pretzels and Pretzels Inc., expanding its snacking capabilities. They also acquired Lily's in 2021 to focus on better-for-you confectionery. Previous acquisitions include ONE Brands, Pirate Brands, Amplify Snack Brands and bark THINS. Hershey is investing in capacity expansion, including a new chocolate-making facility in Pennsylvania. The company aims to optimize output, margin, utilization rates and service levels.

Successful Pricing Strategies

Strategic pricing initiatives have contributed positively to Hershey’s organic net sales growth across different segments. In first-quarter 2023, organic price contributed 8.9% to organic net sales growth.

In the North America Confectionery unit, organic price contributed 9.5% to organic net sales growth. For the Salty Snacks segment, organic price contributed 10.9% to organic net sales growth. Meanwhile, in the International segment, organic price contributed 0.1% to organic net sales growth.

Responsive to Consumer Preferences

Hershey’s focus on creating a strong portfolio of better-for-you confectionery products shows its responsiveness to changing consumer preferences and health-conscious trends. The acquisitions of Lily's and other BFY brands align with the company's multi-pronged strategy to cater to health-conscious consumers and tap into a growing market segment.

Investments in capacity expansion, such as the construction of a chocolate-making facility in Hershey, PA, demonstrate its commitment to optimizing output, margins, utilization rates and service levels. The expansion positions the company for future growth and increased production capacity.

Finishing Up

Hershey has demonstrated a strong strategic approach to ensure its continued growth, and success in the highly competitive confectionery and snacking market.

By emphasizing quality, innovation, digital infrastructure, sustainability and global expansion, the company has established itself as a trusted and forward-thinking brand. Its commitment to meet evolving consumer preferences and industry trends has positioned it for long-term success.

By staying adaptable and responsive to market changes, Hershey is well-prepared to navigate the dynamic landscape of the industry and maintain its leading position.

3 Promising Stocks

Here we have highlighted three better-ranked stocks, namely Nomad Foods NOMD, Celsius Holdings CELH and Walmart WMT.

Nomad Foods, a frozen food product company, currently sports a Zacks Rank #1 (Strong Buy). NOMD has a trailing four-quarter earnings surprise of 8.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Nomad Foods’ current financial-year sales suggests growth of 8% from the year-ago reported figure.

Celsius Holdings, which offers functional drinks and liquid supplements, currently sports a Zacks Rank #1. CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 69.6% and 154.4%, respectively, from the year-ago reported numbers.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 5.5%.

The Zacks Consensus Estimate for Walmart’s current financial-year sales suggests growth of 4.2% from the year-ago period’s actual. WMT has a trailing four-quarter earnings surprise of 12%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Hershey Company (The) (HSY) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report