Here's Why You Should Hold on to Baker Hughes (BKR) Stock Now

Baker Hughes Company BKR has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days.

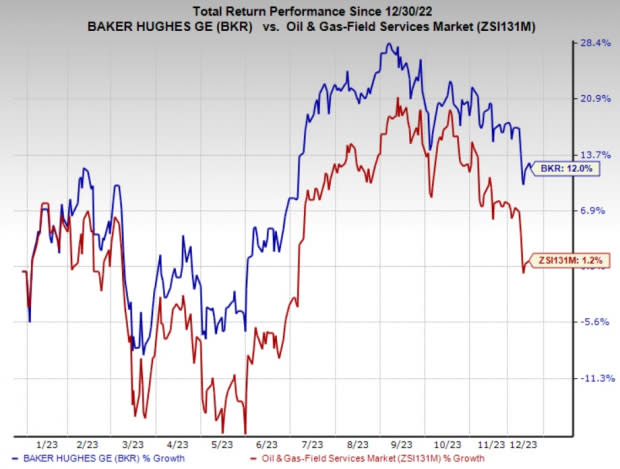

The company, currently carrying a Zacks Rank #3 (Hold), has gained 12% year to date compared with 1.2% growth of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Factors Favoring the Stock

Baker Hughes, as an energy technology company, has a well-rounded portfolio, which extends across the energy and industrial value chain. The broad range enables BKR to capitalize on opportunities in different sectors, while minimizing risks linked to reliance on a singular market segment.

Baker Hughes demonstrated a robust performance in order acquisition and backlog management, particularly in Integrated Energy Technology and Subsea & Surface Pressure Systems. The company secured substantial awards in the LNG and subsea sectors, contributing to a resilient business outlook.

The company has experienced substantial growth in revenue, showcasing a strong financial performance. In the nine months leading up to Sep 30, 2023, total revenues amounted to $18,671 million, a notable increase from $15,251 million during the corresponding period in 2022. This upward trend underscores the company’s expansion in goods and services sales.

BKR boasts a sound balance sheet, with total assets reaching $36,550 million as of Sep 30, 2023. A substantial portion of these assets is represented by $3,201 million in cash and cash equivalents. The strong financial foundation enhances the company’s operational capabilities and provides a solid platform for strategic flexibility.

The company has consistently delivered value to its shareholders through dividend payments, with the most recent dividend standing at $0.58 per share. This underscores the company’s dedication to providing returns to shareholders and highlights its capacity to generate substantial cash flow.

Baker Hughes exhibited a robust financial performance by generating $2,130 million in net cash flows from operating activities for the nine months as of Sep 30, 2023. This substantial cash flow is instrumental in supporting operational needs, pursuing growth initiatives and facilitating returns to shareholders.

Given these tailwinds, Baker Hughes, one of the leading oilfield service players in the United States, is poised for an upside in the coming days.

Risks

Oil and gas companies are highly exposed to commodity price fluctuations, thereby making business for oilfield service providers extremely volatile. This is because oilfield service players like Baker Hughes help upstream energy players efficiently set up oil and gas wells. Baker Hughes’ beta of 1.40 further confirms that the company experiences greater volatility than the broader market.

Stocks to Consider

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

EOG Resources EOG boasts an appealing growth profile, delivers upper-quartile returns and is guided by a disciplined management team.

EOG Resources has a strong focus on returning capital to shareholders. From 1999 through 2024, the company has been committed to raising its regular dividend at a compound annual growth rate of 21%. EOG has never suspended or lowered its dividend, even during business turmoil, reflecting its solid underlying business.

Matador Resources Company MTDR is among the leading oil and gas explorers in the shale and unconventional resources in the United States.

Matador has raised its fixed quarterly cash dividend by 33% to 20 cents per share (80 cents per share annually). This marks the fourth increment in the company’s fixed dividend since its introduction in the first quarter of 2021. The decision to once again increase the dividend underscores Matador's growing financial and operational strength.

Antero Midstream Corporation AM is a leading provider of integrated and customized midstream services.

Antero Midstream stands out in the industry with its impressive environmental record. With a mere 0.031% methane leak loss rate, it boasts one of the lowest rates in the industry. This demonstrates a strong commitment to minimizing its environmental impacts and reducing greenhouse gas emissions. Additionally, an impressive 86% of wastewater received is either reused or recycled, showcasing their dedication to sustainable water management practices.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Antero Midstream Corporation (AM) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report