Here's Why You Should Hold BD (BDX) Stock in Your Portfolio

Becton, Dickinson and Company BDX, popularly known as BD, is well-poised for growth in the coming quarters, courtesy of its series of product launches over the past few months. The optimism led by a solid third-quarter fiscal 2023 performance and its continued focus on research and development (R&D) are expected to contribute further. However, concerns over forex volatility and stiff competition persist.

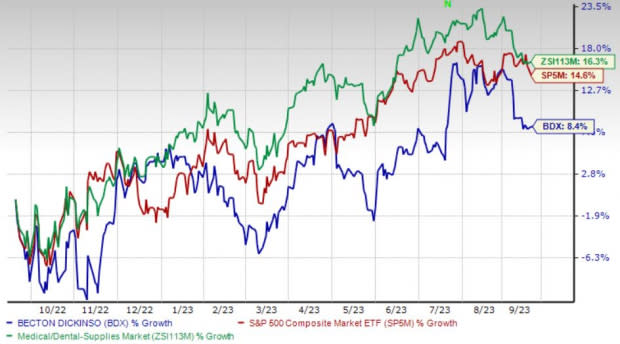

Over the past year, this Zacks Rank #3 (Hold) stock has gained 8.4% compared with the 16.3% rise of the industry and 14.6% growth of the S&P 500.

The renowned medical technology company has a market capitalization of $76.75 billion. It projects 9.9% growth for the next five years and expects to maintain its strong performance. BD has delivered an earnings surprise of 4.7% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Continued Focus on R&D: A significant element of BD’s strategy is to increase revenue growth by focusing on innovation and new product development, raising our optimism. New product development requires significant investment in R&D, clinical trials and regulatory approvals. BD’s focus on its R&D activities is enabling the company to develop new products and launch them. This, in turn, is enabling BD to solidify its foothold and beat the competition.

Product Launches: We are upbeat about BD’s slew of product launches in recent times. In June, the company announced the worldwide commercial launch of a new automated instrument, BD FACSDuet Premium Sample Preparation System.

In May, BD announced expanded customer availability of an all-in-one prefilled flush syringe with an integrated disinfection unit designed to reinforce compliance with infection prevention guidelines and simplify nursing workflow.

Strong Q3 Results: BD’s solid third-quarter fiscal 2023 results buoy our optimism. The company registered solid top-line and bottom-line results, along with improvements in the overall base revenues. Robust performances by the majority of its segments and both geographic regions were also recorded. Strength in BD’s segment’s business units during the reported quarter was also seen.

Downsides

Stiff Competition: BD, being a global company, faces significant competition from a wide range of companies, including large medical device companies with multiple product lines. Some of these companies may have greater resources and may be more specialized than BD with respect to particular markets or product lines. Non-traditional entrants, such as technology companies, are also entering the healthcare industry with resources.

Forex Volatility: BD generates a substantial amount of its revenues from international operations. The revenues BD reports with respect to its operations outside the United States may be affected by fluctuations in foreign currency exchange rates. Any exchange rate hedging activities in which BD engages may only offset a portion of the adverse financial impact resulting from unfavorable changes in foreign currency exchange rates.

Estimate Trend

BD is witnessing a positive estimate revision trend for fiscal 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 0.3% north to $12.23.

The Zacks Consensus Estimate for the company’s fourth-quarter fiscal 2023 revenues is pegged at $5.02 billion, suggesting a 5.4% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 9.1% against the industry’s 5.6% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 4.7% compared with the industry’s 7.2% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 28.9% compared with the industry’s 0.3% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report