Here's Why You Should Hold Centene (CNC) in Your Portfolio

Centene Corporation’s CNC improving medical membership, growing top line, pursuit of buyouts, numerous contract wins and continued data-driven innovation make it worth retaining in one’s portfolio. Also, its favorable growth estimates are confidence boosters for investors.

The company is one of the largest Medicaid health insurers in the United States, catering to 16 million Medicaid recipients in 29 states as of 2022-end. CNC provides access to high-quality healthcare, health solutions and innovative programs that help families stay healthy.

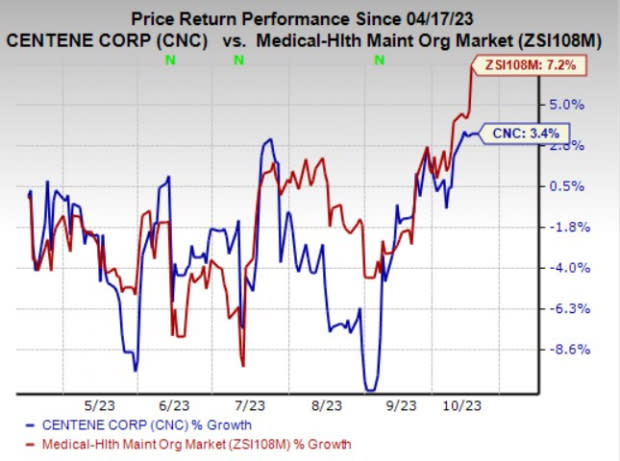

Zacks Rank & Price Performance

CNC currently carries a Zacks Rank #3 (Hold). In the past six months, the stock has gained 3.4% compared with the industry’s rise of 7.2%.

Image Source: Zacks Investment Research

Rising Estimates

The Zacks Consensus Estimate for CNC’s 2023 earnings is pegged at $6.46 per share, indicating an 11.8% increase from the year-ago reported figure of $5.78. The same for 2024 earnings is pegged at $6.62 per share, suggesting a 2.4% increase from the year-ago estimated figure.

The company beat earnings estimates in two of the past four quarters and missed twice, the average surprise being 0.6%.

Key Drivers

Centene’s total revenues are expected to increase 2.6% in 2023 due to Medicaid membership growth, several acquisitions, growth in Medicare business and expansion into new states. This figure is expected to grow further as the company continues to grow its operations organically and inorganically through buyouts. Centene also estimates 2023 adjusted earnings per share of $6.45, suggesting an 11.6% increase from the 2022 reported level.

Centene specializes in providing health services to Medicaid and Medicare recipients. Its total membership increased 7.5% in the second quarter. Centers for Medicare & Medicaid Services estimates the total Medicaid market to grow $1.1 trillion by 2029. In addition, Medicaid spending is expected to increase 5.6% annually through 2031. Premium and service revenues are currently forecasted to be between $137 billion and $139 billion for 2023.

Net Investment income rose around nine times in the second quarter of 2023. Riding on increasing interest rates, investment income should continue to rise.

CNC does not shy away from grabbing opportunities to grow inorganically through buyouts and partnerships. CNC also believes in streamlining its business to focus on its core areas. The company divested Apixio to boost its core business. It divested Circle Health Group to intensify its focus on growing its Managed Care business. Disciplined executions like this will result in reduced distraction and better performance in the future.

Centene is expanding into new markets through numerous contract wins. CNC will start serving in California from the beginning of 2024 and will strengthen its relationship with the state. CNC will be providing managed care for Oklahoma Health Care Authority’s SoonerSelect and SoonerSelect Children’s Specialty programs. Moreover, the company aims to introduce its Medicare Advantage plans in 21 new counties in 2024. All these moves will fuel growth in the form of more premium and service revenues in the future.

CNC is executing well on its value-creation plan, which aims to drive margin expansion by generating profitable growth. The company closed a multi-year contract with Express Scripts to manage pharmacy benefits for 20 million Centene members. This is a major milestone achieved under the value creation plan, which positions it to generate significant value for shareholders. The company also continues to streamline the organization through portfolio rationalization.

The company manages its excess capital well through share repurchases and debt repayment. It bought back shares worth $400 million in the second quarter of 2023. It also focuses on reducing financial leverage by repaying its debts. This should instill confidence in shareholders.

The company has a VGM Score of A.

Key Concerns

There are a few factors that have been impeding the stock’s growth lately.

CNC’s total expenses rose 1% in the second quarter of 2023 due to higher medical costs. Rising costs can trim its margins.

Centene’s return on equity (ROE) undermines its growth potential. The company’s trailing 12-month ROE of 14.2% compares unfavorably with the industry average of 23.2%, indicating that it is less efficient in utilizing its shareholders’ funds. Nevertheless, we believe that a systematic and strategic plan of action will drive growth in the long term.

Stocks to Consider

Some better-ranked stocks from the broader medical sector are Select Medical Holdings Corporation SEM, Molina Healthcare, Inc. MOH and Alcon Inc. ALC. Select Medical presently sports a Zacks Rank #1 (Strong Buy), while Molina Healthcare and Alcon carry a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Select Medical’s 2023 bottom line suggests a 56.9% increase from the prior-year levels. SEM has witnessed one upward estimate revision in the past month against none in the opposite direction. The Zacks Consensus Estimate for SEM’s 2023 revenues suggests a 4.2% increase from the past year's reported figures.

The bottom line of Molina Healthcare outpaced estimates in each of the last four quarters, the average surprise being 7.2%. The Zacks Consensus Estimate for MOH’s 2023 earnings and revenues suggests an improvement of 15.3% and 3.4%, respectively, from the corresponding year-ago reported figures. The consensus mark for MOH’s 2023 earnings has moved 1.8% north in the past 30 days.

The bottom line of Alcon outpaced estimates in three of the last four quarters, meeting once, the average surprise being 8%. The Zacks Consensus Estimate for ALC’s 2023 earnings and revenues suggests an improvement of 21.4% and 9%, respectively, from the corresponding year-ago reported figures. The consensus mark for ALC’s 2023 earnings has moved 3% north in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Select Medical Holdings Corporation (SEM) : Free Stock Analysis Report