Here's Why You Should Hold on to Envestnet (ENV) Stock for Now

Envestnet, Inc. ENV is gaining from strategic partnerships, collaborations and platform improvements. The company has been working on strong recurring revenue growth backed by asset-based and subscription-based models. Customer concentration is a cause of concern.

Factors in Favor

Envestnet, a key player in financial solutions, expands through strategic partnerships. In collaboration with Morningstar Retirement, it plans a managed IRA service powered by IRALOGIX. Envestnet's advanced ecosystem is now available to First Command Financial Services' advisors. An investment of $28.36 million in partnerships and the acquisition of 401kplans.com LLC in 2022 reinforce its commitment to the retirement plan sector, thus enhancing advisor productivity in the Envestnet Wealth Solutions segment.

Envestnet has partnered with iconik, a voting technology provider, to improve proxy voting for Sustainable Quantitative Portfolios, allowing investors to express views effectively. This collaboration meets the demand for choice, aiding advisors in retention and promoting long-term capital stewardship, thus enhancing the company's competitive edge.

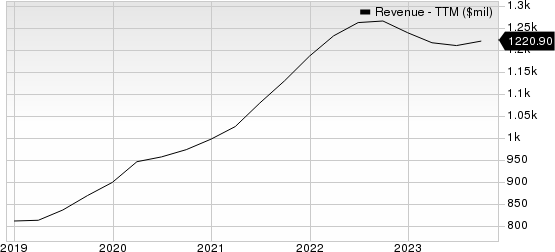

Envestnet, Inc Revenue (TTM)

Envestnet, Inc revenue-ttm | Envestnet, Inc Quote

Envestnet has exhibited strong recurring revenue growth, primarily fueled by asset-based and subscription-based models. Adopting a business-to-business-to-consumer approach, the company enables financial service clients to offer its platform solutions. With a 4.5% YoY increase in 2022, following gains of 20.2% in 2021 and 10.2% in 2020, Envestnet's recurring revenues have shown consistent growth.

Envestnet's current ratio at the end of third-quarter 2023 was pegged at 0.75, higher than the previous quarter's current ratio of 0.73 and the year-ago quarter's current ratio of 0.77. Increasing the current ratio indicates the company is not likely to face any problems meeting its short-term obligations.

Risks

Envestnet’s revenues are concentrated on a few customers, which implies the termination of one contract with such clients will have a major impact on the company’s revenues. For the fiscal years ending Dec 31, 2022, 2021 and 2020, Envestnet's revenues linked to the association with Fidelity, specifically FMR LLC, accounted for approximately 16%, 17% and 15%, respectively, of its total revenues. The top ten clients constituted around 34%, 33% and 29% of the total revenues during these periods.

The company has a negative times interest earned of 3.4. Times interest earned ratio (TIE) is a solvency ratio indicating the company’s ability to pay all interest on business debt obligations. TIE is calculated as EBIT (earnings before interest and taxes) divided by total interest expense. This implies the company has lower EBIT than its interest charges, which poses a risk of default.

ENV is currently having Zacks Rank #3 (Hold).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector that may be considered:

Gartner IT: The Zacks Consensus Estimate of Gartner’s 2023 revenues indicates 7.9% growth from the year-ago figure, while earnings are expected to decline 1.9%. The company has beaten the consensus estimate in all four quarters, with an average surprise of 34.4%.

IT sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

FTI Consulting FCN: The Zacks Consensus Estimate of FCN’s 2023 revenues indicates 12.1% growth from the year-ago figure, while earnings are expected to grow 3.4%. The company has beaten the consensus estimate in three of the four quarters and missed on one instance, the average surprise being 8.5%.

FCN holds a Zacks Rank #2 (Buy).

Broadridge Financial Solutions BR: The Zacks Consensus Estimate of Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago figure, while earnings are expected to grow 10.1%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR holds a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report