Here's Why You Should Hold Global Payments (GPN) Stock Now

Global Payments Inc. GPN is well poised to grow on the back of rising transaction volumes, strategic acquisitions and partnerships. However, increasing costs are likely to hurt margins.

Global Payments — with a market cap of $33 billion — is a payment solutions provider based in Atlanta, GA. It provides innovative software and services all around the globe. The payments technology company has a massive network including North America, Latin America, Europe and the Asia Pacific.

Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth holding on to at the moment.

Where do the Estimates Stand?

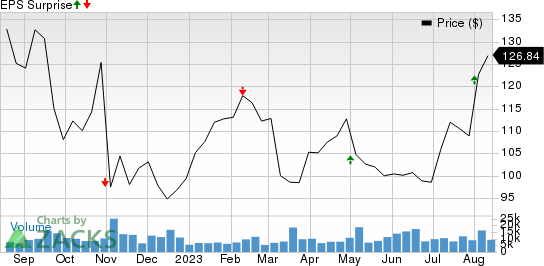

The Zacks Consensus Estimate for Global Payments’ 2023 earnings is pegged at $10.39 per share, indicating an 11.5% year-over-year rise. The company beat earnings estimates in two of the last four quarters and missed on the other occasions, with an average surprise of 1.1%.

Global Payments Inc. Price and EPS Surprise

Global Payments Inc. price-eps-surprise | Global Payments Inc. Quote

Furthermore, the consensus mark for revenues is pegged at $8.7 billion for 2023, indicating a 7.2% year-over-year rise.

2023 Performance View

The continuously increasing demand for digital payment methods is expected to support Global Payments’ transaction volume growth. Also, its EVO business acquisition is expected to boost revenues in the coming quarters. It expects adjusted net revenues to be between $8,660 million and $8,735 million in 2023, the midpoint of which implies an improvement of 7-8% from the 2022 reported figure.

GPN estimates adjusted net revenue growth in the Merchant Solutions business to grow in the 15-16% range in 2023. Meanwhile, the Issuer Solutions segment’s adjusted net revenues are expected to grow 5-6% year over year.

Improving operations are expected to boost its profits, which triggered the company to increase its bottom-line guidance. It now expects adjusted EPS to be between $10.35 and $10.44 this year, which suggests 11-12% growth from the 2022 figure. It predicts the adjusted operating margin to increase up to 120 bps year over year in 2023.

Increasing sales figures and vertical market growth will likely aid its Merchant Solutions business in 2023. Core issuer growth and expanding commercial card transactions are expected to benefit its Issuer Solutions unit.

GPN’s financial flexibility enables the company to focus on strategic investments and return capital to shareholders. It exited the second quarter with cash and cash equivalents of $1,919.6 million, way above the current portion of long-term debt of $75.7 million. In the first six months of 2023, GPN generated operating cash flows of $1,164.5 million.

The company’s prudent acquisitions and top-tier strategic partnerships will not only grow its business but also future-proof its underlying technology. Alliances with major players like Alphabet and Amazon Web Services are expected to help in this regard. It also does not shy away from divesting non-core assets. It closed the consumer business divestment in the second quarter. A growing presence in the Asia Pacific market will position the company for long-term growth.

Key Concerns

There are a few factors that can hinder the stock’s growth.

Despite implementing multiple cost-control measures, the company's operating expenses are on the rise. We expect its operating costs to increase 5% year over year in 2023, primarily due to higher selling, general and administrative expenses. This can dent the company's profit levels.

Also, rising competition in the payment market is noteworthy. The emerging payment companies with significant growth potential are capturing markets at a significantly faster rate. Nevertheless, we believe that a systematic and strategic plan of action will drive GPN’s long-term growth.

Better-Ranked Players

Some better-ranked stocks in the broader Business Services space are Paysafe Limited PSFE, FirstCash Holdings, Inc. FCFS and PagSeguro Digital Ltd. PAGS. While Paysafe currently sports a Zacks Rank #1 (Strong Buy), FirstCash and PagSeguro carry a Zacks Rank #2 (Buy) each, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Paysafe’s current year bottom line suggests 1.3% year-over-year growth. Headquartered in London, PSFE beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 190.5%.

The Zacks Consensus Estimate for FirstCash’s current year earnings indicates a 6.4% year-over-year increase. Fort Worth, TX-based FCFS beat earnings estimates in all the past four quarters, with an average surprise of 7.3%.

The Zacks Consensus Estimate for PagSeguro’s current year bottom line suggests 12% year-over-year growth. Based in Sao Paulo, Brazil, PAGS beat earnings estimates in all the past four quarters, with an average surprise of 36.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

PagSeguro Digital Ltd. (PAGS) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report