Here's Why You Should Hold Green Dot (GDOT) Stock for Now

Green Dot Corporation GDOT is currently benefiting from strength in its GO2bank business and long-standing relationship with Walmart. Recent platform conversions have positioned the company for annualized cost savings.

Future Potential Should Outperform Current Headwinds

Green Dot’s bottom line stayed weak in the third quarter of 2023 due to revenue softness, higher expenses and losses associated with customer disputes. We expect the company’s bottom line to gain strength going forward, driven by cost savings from platform conversions completed recently and investments in product, business development and compliance infrastructure. The company currently targets an annualized cost savings of $35 million.

We believe GO2bank will be the key driver of GDOT’s revenues going forward. The company is in the process of restructuring its business in order to ensure long-term sustainable growth. This involves sunsetting several old products and moving customers to GO2bank. Currently, GO2bank constitutes a considerable majority of active accounts and its growth will likely have a major positive impact on the company’s top line going forward.

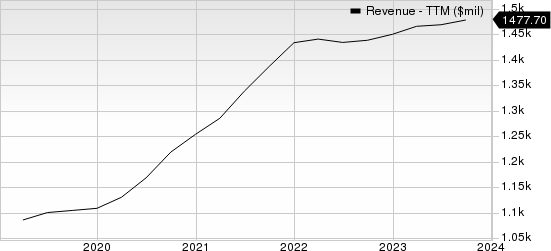

Green Dot Corporation Revenue (TTM)

Green Dot Corporation revenue-ttm | Green Dot Corporation Quote

Green Dot has a long-standing relationship with Walmart. The company designs and delivers Walmart MoneyCard products and provides program support that includes network IT, website functionality, regulatory and legal compliance, customer service and loss management. It also sells certain Walmart-branded open-loop gift cards. Walmart provides Green Dot with shelf space to offer Green Dot-branded and GoBank checking account products.

Green Dot’s operating revenues derived from products and services offered through Walmart represented 21%, 24% and 27% of total operating revenues for 2022, 2021 and 2020, respectively. While it offers some concentration risk, the partnership remains a key driver of GDOT’s operating revenues.

Zacks Rank and Stocks to Consider

Green Dot currently carries a Zacks Rank #3 (Hold).

Here are some better-ranked stocks from the broader Business Service sector.

Rollins ROL currently carries a Zacks Rank #2 (Buy). For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at 21 cents, indicating year-over-year growth of 23.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ROL has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 7.2%.

FTI Consulting FCN also carries a Zacks Rank of 2 at present. The consensus mark for fourth-quarter 2023 earnings is pegged at $1.57 per share, indicating 3.3% year-over-year growth.

FCN has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and missing once, the average surprise being 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report