Here's Why You Should Hold on to IDEXX (IDXX) Stock Right Now

IDEXX Laboratories, Inc. IDXX is well poised for growth in the coming months, backed by the premium instrument placements, continued solid new business gains and sustained high growth in recurring veterinary software revenues. The company’s ProCyte One supports long-term growth goals in international markets. However, foreign exchange woes impede the company’s growth.

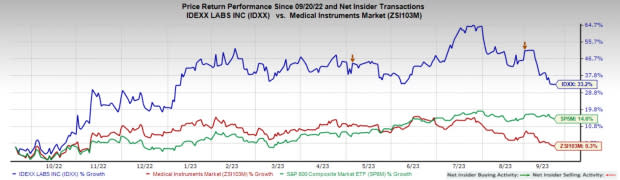

In the past year, this Zacks Rank #3 (Hold) stock has increased 33.2% compared with the 0.3% rise of the industry and a 14.6% rise of the S&P 500 composite.

The renowned medical device company has a market capitalization of $37.38 billion. IDEXX has an estimated long-term earnings growth rate of 17.6% compared with the industry’s 15.4%.

Let’s delve deeper.

Upsides

Strong Global Performance: IDEXX continues to demonstrate solid growth globally. International revenues are primarily aided by a gain in CAG and Water businesses. Globally, IDEXX continues to achieve strong organic revenue growth across its modalities.

IDEXX’s consumable gains are aided by a growth in the global premium instrument installed base, reflecting solid gains across its catalysts and premium hematology. In lieu of this, in Q2, IDEXX VetLab consumables revenues increased 15% organically, with double-digit gains in the United States and international regions.

ProCyte One: A Long-Term Growth Component: IDEXX’s ProCyte One is the latest, easy-to-use premium hematology platform. The expanding installed base in hematology facilitates the flow-through of recurring revenues and propels the clinic business. These amplified impacts helped sustain the robust 15% global rise in catalyst placements attained in Q2. Additionally, ProCyte One supports the company’s long-term growth goal in international markets.

Upbeat Guidance: IDEXX expects total revenues in the range of $3.660-$3.715 billion (the earlier projection was in the band of $3.615-$3.700 billion), indicating growth of 8.5-10% on a reported and organic basis from the earlier projected growth of 7.5-10%. The Zacks Consensus Estimate for the same is currently pegged at $3.66 billion.

Image Source: Zacks Investment Research

IDEXX’s full-year EPS guidance is now pegged in the range of $9.64-$9.90 (from the previous band of $9.33-$9.75). This updated guidance indicates reported growth of 20-23%, up from the previous projected growth of 16-22%. The Zacks Consensus Estimate for full-year EPS is currently pegged at $9.64.

Downsides

Foreign Exchange Headwind: The majority of IDEXX’s consolidated revenues are derived from the sale of products in international markets (international revenues account for 35.2% of total revenues in 2022). The strengthening of the rate of exchange for the U.S. dollar relative to other currencies had a negative impact on the company’s revenues derived in currencies other than the U.S. dollar and on profits from products manufactured in the United States and sold internationally.

Weak Solvency and Capital Structure: IDEXX exited the second quarter of 2023 with cash and cash equivalents of $132.8 million compared with $112.5 million in first-quarter 2023. The total debt (including the current portion) at the end of the second quarter of 2023 was $771.8 million compared with the total debt of $769.4 million at the end of the first quarter of 2023. As the company’s debt is much higher than available cash in hand, IDXX is likely to face a challenge repaying its obligations.

Estimate Trends

IDEXX has been witnessing a positive estimate revision trend for 2023. The Zacks Consensus Estimate for 2023 earnings per share (EPS) has moved up from $9.65 to $9.82 in the past 90 days.

The Zacks Consensus Estimate for the company’s 2023 revenues is pegged at $3.68 billion. This suggests an 9.3% rise from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Haemonetics HAE, HealthEquity, Inc. HQY and SiBone SIBN. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Haemonetics’ stock has risen 19.9% in the past year. Earnings estimates for Haemonetics have increased from $3.56 to $3.74 in 2023 and $3.96 to $4.07 in 2024 in the past 30 days. It currently carries Zacks Rank #2 (Buy).

HAE’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.39%. In the last reported quarter, it posted an earnings surprise of 38.16%.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 3.9% compared with the industry’s 10.2% decline over the past year.

Estimates for SiBone’s2023 loss have narrowed from $1.42 to $1.27 per share in the past 30 days. Shares of the company have increased 31% in the past year compared with the industry’s rise of 1.9%. It currently carries Zacks Rank #2.

SIBN’s earnings beat estimates in all the trailing four quarters, the average surprise being 20.37%. In the last reported quarter, SiBone delivered an earnings surprise of 26.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

SiBone (SIBN) : Free Stock Analysis Report