Here's Why You Should Hold John Bean (JBT) in Your Portfolio Now

John Bean Technologies Corporation JBT is well-poised to gain from its focus on developing innovative products and acquisitions to augment product offerings. Solid demand prospects in the food and beverage industry bode well. This is impressive amid supply-chain and inflation headwinds.

Let’s delve deeper and analyze the factors that make this stock worth holding on to at present.

Solid Q3 Results: John Bean Technologies reported adjusted earnings of $1.11 per share in third-quarter 2023, which came in 16% higher than the prior-year quarter. The figure beat the Zacks Consensus Estimate of 99 cents. High order levels, pricing actions and gains from the company’s restructuring actions were instrumental in driving the improved results in the quarter.

Revenues of $404 million increased 1.2% from the year-ago quarter.

Upbeat FY23 Guidance: The company raised its adjusted earnings per share guidance to $3.95-$4.10, higher than the previously stated $3.80-$4.05.

John Bean expects 2023 revenue growth to be 4.5-5.5%. This suggests revenues of $1.66-$1.68 billion. Growth will be aided by contributions from acquisitions and a higher mix of recurring revenues.

Positive Earnings Surprise History: JBT has an average trailing four-quarter earnings surprise of 7.1%.

Effective Strategic Actions: In 2022, John Bean introduced its Elevate 2.0 strategy, which is expected to drive continued growth and margin expansion for the company by capitalizing on the growth trends in the food and beverage processing industry. The industry is poised to continue seeing growth, supported by favorable underlying secular and cyclical trends.

The company sold its AeroTech segment to Oshkosh Corporation on Aug 1, 2023. Effective from the second quarter of 2023, AeroTech's financial results were classified as discontinued operations. AeroTech's divestment complements John Bean's aim of becoming a pure-play provider of food and beverage solutions. The FoodTech franchise operates in highly robust markets. It has an impressive growth outlook and expanding margin profile, and generates a solid free cash flow.

Solid Demand: Digitally enabled customer-centric solutions’ demand, along with offerings that support automation and sustainability initiatives, has been on the rise. Also, during economic recessions and the pandemic-induced recession, the capital spending of food and beverage producers was not severely impacted compared with other sectors. This indicates a stable demand scenario for the company.

John Bean is poised to perform well in the long term, courtesy of the growing middle class, increasing protein, and value-added food and beverage consumption globally. Rising global population and disposable incomes have led to a shift in dietary habits, primarily increased protein consumption.

This is pronounced in emerging markets — Asia, the Middle East, Latin America and Eastern Europe. This trend is likely to favor the company. Food consumption in Asia is expected to be the biggest contributor to growth. In developed markets, ready-to-eat and convenient food consumption will be a key catalyst.

Disciplined Balance Sheet: John Bean maintains a solid and disciplined balance sheet. The free cash flow in the first nine months of 2023 was around $62 million. At the end of the third quarter of 2023, the company's leverage ratio was 0.5X net debt to trailing 12 months’ pro-forma adjusted EBITDA due to the sale of AeroTech.

The company achieved a 107% free cash flow conversion in the third quarter of 2023 and expects the conversion rate to be more stable as a pure-play business. The net proceeds from the sale of the AeroTech segment will go toward JBT’s stated capital allocation priorities, including debt reduction and continued disciplined FoodTech inorganic expansion. This will solidify the company’s balance sheet.

Near-Term Concerns

John Bean has been witnessing material inflation, supply-chain and logistic disruptions, and higher labor costs. The shortages of critical raw materials (particularly electronic components) and labor have impeded its production and deliveries.

These also increased the overall costs of running the business. These factors are expected to dent the company’s margins in 2023. Supply-chain disruptions, high inflation and labor availability challenges will continue to weigh on its margins.

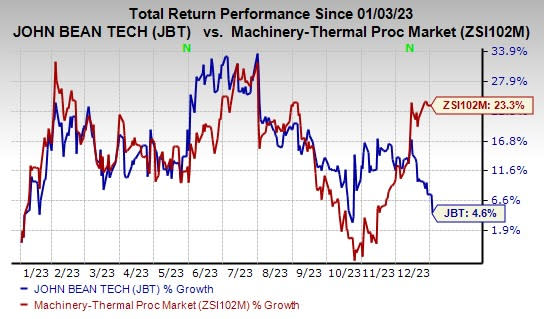

Price Performance

John Bean’s shares have gained 4.6% in the past year compared with the industry’s growth of 23.3%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Alamo Group Inc. ALG, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS. ALG currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alamo Group’s 2023 earnings per share is pegged at $11.59. The consensus estimate for 2023 earnings has moved north by 5% in the past 60 days. The company has a trailing four-quarter average earnings surprise of 19.8%. ALG shares have rallied 47.6% year to date.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 2% in the past 60 days. The company’s shares have gained 37.7% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days and suggests year-over-year growth of 20.4%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 40.8% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report