Here's Why You Should Hold on to Lennar (LEN) Stock Now

Lennar Corporation LEN is benefiting from profitable business strategies, digital marketing initiatives and a dynamic pricing model.

This homebuilding and financial services company delivered a trailing four-quarter earnings surprise of 19.3%, on average. Earnings estimates for fiscal 2023 have moved north to $13.33 per share from $12.57 per share over the past 30 days. Also, for fiscal 2024 the same has increased to $14.55 per share from $13.08 per share, over the above-mentioned time frame. The company is benefiting from the increased demand for new homes accompanied with improving supply chain and labor market.

Furthermore, the company solidifies this growth prospect, with a VGM Score of B, backed by a Value and Momentum Score of A. The positive trend signifies bullish analysts’ sentiments, robust fundamentals, and the continuation of an outperformance in the near term.

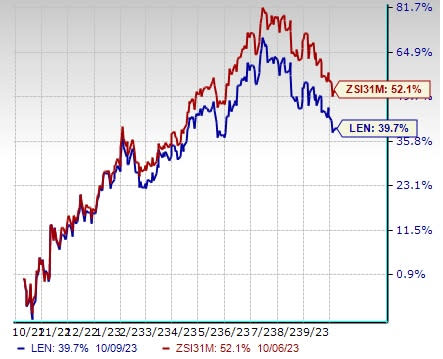

Shares of this Zacks Rank #3 (Hold) company have gained 39.7% in the past year, underperforming the Zacks Building Products - Home Builders industry’s 52.1% growth.

Image Source: Zacks Investment Research

Lennar’s growth prospects are hurt by high costs and expenses as well as the frequent increase in interest rates.

What Makes the Stock Appealing?

Profitable Strategies: Lennar tends to pivot around accretive strategies, which aid it to reduces costs, and improve margins and cash flow. The strategies include playbook and land-lighter strategies. Its focus on playbook strategies will help it to reduce the direct construction cost, deliver gross margin improvement and maintain construction starts. The company prioritized collaboration with trade partners to streamline the cost structure according to the prevailing sales price environment, aiming to speed up construction and reduce supply-chain disruptions. As a result, the company achieved improved profit margins sequentially and had more construction-ready homes available for delivery.

Also, its land-lighter strategy, wherein it continues to emphasize on refining its land acquisition and management, focusing on optimizing land and land bank strategy, bodes well. At the third quarter of fiscal 2023 end, controlled homesites, as a percentage of total owned and controlled homesites, increased to 73% from 79% in the year-ago period. As a result, the year’s supply owned improved to 1.5 years at the end of the fiscal third quarter from 2.2 years in the prior year.

Digital Marketing: LEN’s focus on digital marketing has notably contributed to its growth. It has increasingly integrated its marketing strategy via digital channels. It strategically invests in companies involved in technology initiatives, which help it to enhance the homebuying experience, reduce SG&A expenses and boost innovation. Also, through its digital sales machine, the company intends on driving customer access and boosting customer engagement.

Strategic Pricing Model: The company is also using its dynamic pricing model, which enables it to set prices according to the evolving market conditions. Courtesy of this strategy, LEN had earlier taken advantage of the strong demand trend, which helped it to maximize cash flow and return on inventory.

Factors Impeding Growth

High Costs: Lennar has been witnessing challenges related to raw material shortages and municipal delays. Also, labor inflation remains a woe. These factors are directly hitting the company’s margins. Moreover, labor shortages are leading to higher wages and delays in construction, which will eventually hurt the number of homes delivered. Also, land prices are increasing due to limited availability.

During fiscal third-quarter 2023, the gross margin on home sales was 24.4%, down 480 bps from the year-ago quarter. The downside was caused by a decline in revenues per square foot on a year-over-year basis as the company priced homes to market.

Frequent Rate Hikes: The Fed's determination to curtail inflation through interest rate increases and quantitative tightening has slowed down sales in the house market across the country. The increase in borrowing costs, processed to curtail inflation, through mortgage rate hike, has significantly impacted the highly interest-rate-sensitive housing sector in the US.

As the housing industry is cyclical and affected by consumer confidence levels, prevailing economic conditions and interest rates, federal government’s actions related to economic stimulus, taxation and borrowing limits will continue to affect the industry.

Key Picks

Some better-ranked stocks from the Construction sector are TopBuild Corp. BLD, Sterling Infrastructure, Inc. STRL and Fluor Corporation FLR.

TopBuild currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BLD delivered a trailing four-quarter earnings surprise of 14.1%, on average. Shares of the company have risen 40.5% in the past year. The Zacks Consensus Estimate for BLD’s 2023 sales and earnings per share (EPS) indicates growth of 3.3% and 8.4%, respectively, from the previous year’s reported levels.

Sterling currently sports a Zacks Rank of 1. STRL delivered a trailing four-quarter earnings surprise of 14.9%, on average. Shares of the company have surged 236% in the past year.

The Zacks Consensus Estimate for STRL’s 2023 sales and EPS indicates growth of 3.9% and 29.4%, respectively, from the previous year’s reported levels.

Fluor currently sports a Zacks Rank of 1. FLR delivered a trailing four-quarter negative earnings surprise of 5.3%, on average. Shares of the company have gained 29.7% in the past year.

The Zacks Consensus Estimate for FLR’s 2023 sales and EPS indicates growth of 12.6% and 159.8%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report