Here's Why You Should Hold Lindsay (LNN) in Your Portfolio Now

Lindsay Corporation LNN is poised well to benefit from the rising global demand for food, driven by population growth. The development of technology products and demand for the Road Zipper System will further drive growth.

Let’s delve deeper and analyze the factors that make this stock worth holding on to at present.

Solid FY23 Results: Lindsay delivered record adjusted earnings per share of $6.54 in fiscal 2023, beating the Zacks Consensus Estimate of $5.94. The bottom line improved 10% year over year. It generated revenues of $674 million, down 13% from the $771 million reported in the year-ago quarter. However, the top line surpassed the Zacks Consensus Estimate of $668 million.

Positive Earnings Surprise History: LNN has an average trailing four-quarter earnings surprise of 16.9%.

Upbeat Q1 Outlook: For the first quarter of fiscal 2024, the company expects sales volume levels in developed international markets to remain solid, backed by strong demand in Brazil. Lindsay continues to see project opportunities in developing markets, led by the ongoing global concerns over food security and global grain supplies.

Positive Farm Fundamentals: The U.S. Department of Agriculture projects a net farm income of $141.3 billion for 2023, indicating a 23% decline from that reported in 2022. The decline is mainly due to lower direct government payments. Despite this decline, net farm income in 2023 will be higher than the 2003-2022 average. This will continue to support demand for Lindsay’s irrigation equipment.

Also, the need to replace aging equipment will sustain industry demand. Farm sizes have been on the rise in the United States, which require more laborers. Given the escalation in labor costs every year, farmers are resorting to farming equipment to replace labor. The U.S. agricultural machinery market is projected to reach $52.73 billion by 2027, seeing a CAGR of 3.3% over 2021-2027.

In the years to come, demand for agricultural equipment will be fueled by increased global demand for food, from both population growth and an increasing proportion of the population aspiring for better living standards. Drought and water scarcity issues in the United States and other parts of the world support the need for efficient irrigation.

Solid Demand for Road Zipper System: The company’s Infrastructure segment will benefit from the demand for Road Zipper System going forward. Lindsay’s Road Zipper System is a highly differentiated product that delivers significant advantages by addressing key infrastructure needs, such as reducing congestion, lowering carbon emission, improving commuter travel time and increasing driver safety.

Road Zipper Systems are gaining popularity globally, given their faster implementation and lower costs than constructing new lanes. Management’s “shift left” strategy, focused on customer engagement at the planning and design stage, has accelerated the adoption of the Road Zipper System.

The company launched an advanced Road Zipper Barrier Transfer Machine in January 2023. The modernized barrier transfer machine will ensure improved safety and efficiency with a bold new design and two advanced operator cabins. The Infrastructure Investment and Jobs Act enacted in November 2021 has introduced $110 billion in incremental federal funding for roads, bridges and other transportation projects. This will translate into higher demand for Lindsay’s transportation safety products.

Near-Term Concerns

Lindsay had been witnessing supply-chain constraints, particularly in electronics. Constraints on the availability of raw materials, labor and trucking resources have led to higher lead times for deliveries. It has also been facing higher input costs.

Even though the company is expecting an easing of cost inflation soon, it remains to be seen whether it will materialize. The company continues to introduce appropriate sales price adjustments to combat cost inflation. However, competitive market pressures may affect its ability to pass price adjustments to its customers. These factors will impact margins in the short term.

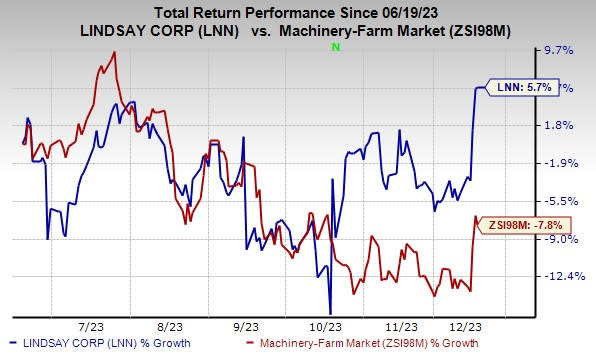

Price Performance

Lindsay’s shares have gained 5.7% in the past six months against the industry’s decline of 7.8%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

LNN currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Crane Company CR, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS.

CR currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Crane Company’s 2023 earnings per share is pegged at $4.18. The consensus estimate for 2023 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 29.8%. CR shares have rallied 36.9% in the past six months.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 27.3% in the past six months.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 12.5% in six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lindsay Corporation (LNN) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report