Here's Why You Should Hold Onto Eastman Chemical (EMN) for Now

Eastman Chemical Company EMN is gaining from cost-cutting and productivity actions as well as its innovation-driven growth model amid certain headwinds including soft demand and consumer de-stocking.

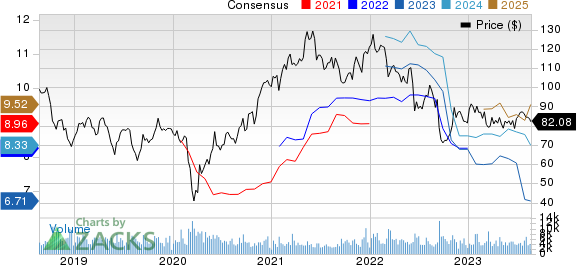

Shares of this leading chemical maker are down 15% over the past year compared with the 0.4% rise of its industry.

Image Source: Zacks Investment Research

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

Cost Actions and Innovation Aid EMN

Eastman is benefiting from its actions to manage costs. The company is expected to benefit from lower operating costs from its operational transformation program. EMN was able to offset $1.3 billion in inflation from higher raw material, energy and distribution costs through price increases in 2022. It is on track to reduce manufacturing, supply chain and non-manufacturing costs by more than $200 million for 2023, net of inflation. Pricing initiatives and lower raw material and energy costs are also expected to support the company’s bottom line.

The company should also gain from its strategic acquisitions. The growth initiatives have been greatly expedited by the acquisition of Solutia, which has provided excellent growth potential in the Asia-Pacific region. Additionally, the buyout of BP Plc’s aviation turbine engine oil business has enabled Eastman to better serve the needs of the global aviation industry.

The acquisition of PremiumShield has strengthened company’s automotive base in North America, Europe and the Middle East and boosted its paint protection film pattern development capabilities. The acquisition of AiRed Technology (Dalian) Co., Ltd. will also boost growth in the paint protection films market.

Moreover, Eastman's goal is to increase new business revenues by utilizing its innovation-driven growth strategy. Due to the company's competence in specialty products, it generated around $550 million in new business revenues from innovation in 2022. Sales volumes are expected to be supported, in 2023, by the innovation and market development initiatives.

Eastman Chemical also remains focused on maintaining a disciplined approach to capital allocation. Its operating cash flow increased to $410 million in the second quarter of 2023 from $245 million in the year-ago quarter. The company returned $144 million to shareholders in the second quarter of 2023 through dividends and share repurchases. Furthermore, it expects to deliver $1.4 billion in operating cash flow in 2023.

Weak Demand, De-stocking Ail

Lingering effects from customer inventory de-stocking are expected to adversely impact Eastman Chemical’s performance in the second half of 2023. The company saw soft demand and consumer de-stocking for its consumer durables, building & construction, consumables and agriculture end markets in the second quarter. The impacts of de-stocking are likely to be felt on the company’s volumes and top line in the third quarter.

EMN has lowered its demand growth forecast and now expects primary demand in several of its end markets to be stable compared with the first half. It also expects consumer de-stocking to persist. The company anticipates that adjusted EPS in the second half of 2023 will be lower than the first half.

Higher pension costs and lower capacity utilization are also expected to hurt company’s bottom line in 2023. EMN estimates pension and other post-employment benefits headwind of around $110 million for 2023. The company also sees a headwind of roughly $75 million due to lower asset utilization to reduce inventory in 2023.

Eastman Chemical Company Price and Consensus

Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Carpenter Technology Corporation CRS, Hawkins, Inc. HWKN and PPG Industries, Inc. PPG.

The Zacks Consensus Estimate for current fiscal-year earnings for CRS is currently pegged at $3.48, implying year-over-year growth of 205.3%. Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has a trailing four-quarter earnings surprise of roughly 10%, on average. The stock has rallied around 51% in a year.

Hawkins currently carrying a Zacks Rank #1. It has a projected earnings growth rate of 18.9% for the current year.

Hawkins has a trailing four-quarter earnings surprise of roughly 25.6%, on average. HWKN shares are up around 33% in a year.

PPG Industries currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for PPG's current-year earnings has been revised 3.6% upward over the past 60 days.

PPG Industries’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 7.3%, on average. PPG shares have gained around 8% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report