Here's Why Hold Strategy is Apt for Crestwood (CEQP) Stock Now

Crestwood Equity Partners LP CEQP has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days.

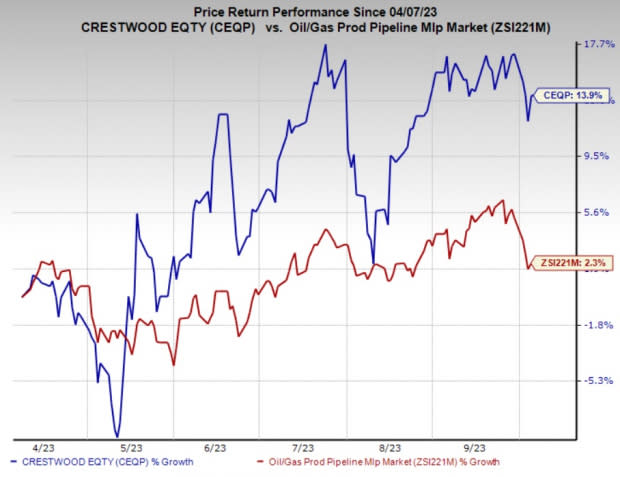

The Zacks Rank #3 (Hold) stock has gained 13.9% in the past six months compared with the industry’s 2.3% growth.

Image Source: Zacks Investment Research

What’s Favoring the Stock?

Crestwood offers infrastructure solutions in key U.S. shale plays, such as the Bakken Shale, Delaware Basin and Marcellus Shale. The company is strategically poised for expansion due to its extensive pipeline network for natural gas gathering and processing. With 2 Bcf/d of natural gas gathering and 1.4 Bcf/d of processing capacity, Crestwood is well-prepared to facilitate the transition toward low-carbon development initiatives.

Crestwood is least exposed to commodity price fluctuations since the partnership generates stable fee-based revenues from diverse midstream energy assets via long-term contracts. Notably, the partnership's substantial storage capacity includes 35 Bcf of natural gas, 2.1 million barrels (MMBbls) of crude oil and 10 MMBbls of natural gas liquids (NGLs), making it well-positioned to benefit from the anticipated growth in upstream activities in the United States.

Crestwood has completed the acquisition of Oasis Midstream Partners for $1.8 billion, significantly expanding its presence in the Williston and Delaware Basins. Furthermore, the partnership has unveiled a set of transactions valued at $1.2 billion, which will substantially increase its natural gas processing capacity in the Delaware Basin, more than doubling its capabilities.

Crestwood is steadfast in its commitment to allocating all free cash flow, following distributions, toward reducing debt throughout 2023. This commitment is particularly noteworthy, considering the anticipated significant rebound in the broader energy sector in the United States this year, which is expected to result in Crestwood’s capacity to generate increased distributable cash flow.

As the overall energy environment in the United States is expected to significantly recover this year, it is commendable that Crestwood is generating higher distributable cash flow.

Risks

CEQP has a notable level of debt capital exposure than other companies in the same industry. This highlights a vulnerability in the partnership's balance sheet and raises concerns about its capacity to fulfill its debt obligations, especially considering the additional debt burden from recent acquisitions.

Stocks to Consider

Investors interested in the energy sector may look at some top-ranked companies mentioned below. All three companies presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Patterson-UTI Energy PTEN is one of the largest North America-based land drilling contractors, having a large, high-quality fleet of drilling rigs. The company has a comfortable debt maturity profile with no major debt outstanding until 2028.

Patterson-UTI has witnessed upward earnings estimate revisions for 2023 and 2024 in the past seven days. The consensus estimate for PTEN’s 2023 and 2024 earnings per share is pegged at $1.52 and $1.68, respectively.

APA Corporation APA boasts a large, geographically diversified reserve base with multi-year trends in reserve replacement. The company is using the excess cash to reward shareholders with dividends and buybacks. APA bought back 1.3 million shares at $33.72 apiece in the second quarter. The company also shelled out $77 million in dividend payments.

APA Corp has witnessed upward earnings estimate revisions for 2023 and 2024 in the past seven days. The consensus estimate for APA’s 2023 and 2024 earnings per share is pegged at $4.64 and $6.28, respectively.

Matador Resources Company MTDR is among the leading oil and gas explorers in the shale and unconventional resources in the United States. MTDR’s prime priorities include lowering debt, delivering free cashflows and maintaining or increasing dividends.

Matador Resources has witnessed upward earnings estimate revisions for 2023 and 2024 in the past seven days. The consensus estimate for MTDR’s 2023 and 2024 earnings per share is pegged at $6.40 and $8.64, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Patterson-UTI Energy, Inc. (PTEN) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Crestwood Equity Partners LP (CEQP) : Free Stock Analysis Report