Here's Why Hold Strategy is Apt for IDEX (IEX) Stock Now

IDEX Corporation IEX benefits from the Fire & Safety/Diversified Products (FSD) segment and accretive acquisitions despite weakness in the Health & Science Technologies unit, rising cost of sales and forex woes.

Let us discuss the factors why investors should retain the stock for the time being.

Growth Catalysts

Business Strength: IEX’s FSD segment is being driven by strong momentum in the fire and rescue businesses. In the third quarter of 2023, the segmental adjusted EBITDA margin increased 210 bps due to strong price cost performance, operational productivity and favorable volume leverage.

Accretive Acquisition: The company’s expansion initiative is expected to drive growth. The acquisition of Iridian Spectral (May 2023) expanded IDEX’s wide array of optical technology offerings. Iridian is part of IDEX Optical Technologies within the Health & Science Technology segment.

In November 2022, the company completed the acquisition of Muon Group, expanding its growing platform of precision technology business within the Health & Science Technologies segment. Commercial synergy potential from the combined entities is expected to boost offerings for new and existing customers. Notably, acquired assets boosted the company’s sales by 3% in the third quarter. The company anticipates buyout synergies to boost sales by 2% in the fourth quarter and 4% in 2023.

Rewards to Shareholders: The company continues to increase shareholders’ value through dividend payments. In the first nine months of 2023, IDEX’s dividend payments totaled $142.3 million (up 7.6% year over year). The current quarterly dividend rate is 64 cents per share (a hike of 7% was announced in May 2023).

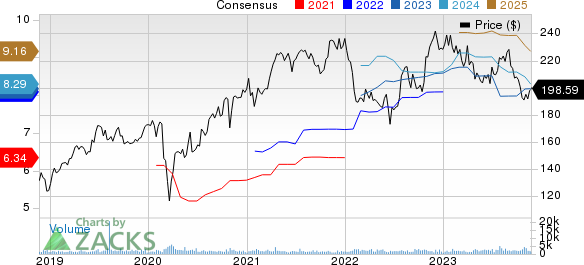

IDEX Corporation Price and Consensus

IDEX Corporation price-consensus-chart | IDEX Corporation Quote

In light of the above-mentioned positives, we believe, investors should retain IEX stock for now, as suggested by its current Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Flowserve Corporation FLS presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

FLS delivered a trailing four-quarter average earnings surprise of 27.3%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2023 earnings has increased 3.1%. The stock has risen 20.5% in the past year.

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 13.9%.

The consensus estimate for AIT’s fiscal 2024 earnings has increased 3.7% in the past 60 days. Shares of Applied Industrial have jumped 22.9% in the past year.

A. O. Smith Corporation AOS currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 14%.

In the past 60 days, the consensus estimate for A. O. Smith’s 2023 earnings has improved 5%. The stock has risen 22.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report