Here's Why Hold Strategy is Apt for Allegion (ALLE) Stock

Allegion plc ALLE is gaining from operational performance, technological expertise, innovation capabilities and strong price realization strategies despite adversities from the high cost of sales and foreign exchange headwinds. Stable end markets and steady demand are also aiding the company.

What’s Aiding ALLE?

Business Strength: ALLE’s Allegion Americas segment is benefiting from strength in non-residential, residential and electronics end markets. The Access Technologies acquisition also bodes well for the segment. The segment’s revenues increased 32.4% in the first six months of 2023. Accretive pricing policies to curb inflationary pressures, coupled with productivity gains and investments, are other tailwinds for the company.

Accretive Acquisitions: Acquired assets are strengthening ALLE’s top line. The company acquired Plano Group through one of its subsidiaries in January 2023. The acquisition expanded ALLE’s Interflex portfolio and AWFM business with new capabilities in SaaS models and recurring revenue solutions. In July 2022, Allegion acquired Stanley Black & Decker, Inc.’s Access Technologies Business. With this buyout, the company has been able to enhance its access, egress and access control solutions offerings. In the second quarter of 2023, acquisitions boosted ALLE’s sales by 12.5%.

Shareholder-Friendly Policies: Allegion’s efforts to reward its shareholders through dividend payments and share repurchases are noteworthy. The company’s dividend payments totaled $143.9 million in 2022. ALLE bought back 0.5 million shares for $61 million in the same period. Dividends paid out totaled $79.3 million in the first six months of 2023, reflecting an increase of 10.9% from the previous year’s level. In February 2023, the company announced a 10% hike in its quarterly dividend rate, which now stands at 45 cents per share.

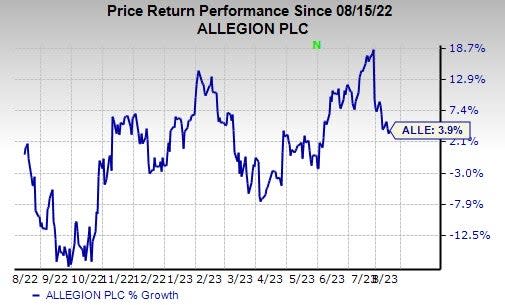

In light of the above-mentioned positives, we believe, investors should hold on to the Allegion stock for now, as suggested by its current Zacks Rank #3 (Hold). Shares of the company have gained 3.9% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Caterpillar Inc. CAT presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

CAT’s earnings surprise in the last four quarters was 18.5%, on average. In the past 60 days, estimates for Caterpillar’s earnings have increased 8.4% for 2023. The stock has gained 45.5% in the past year.

A. O. Smith Corp. AOS presently carries a Zacks Rank #2 (Buy). AOS’ earnings surprise in the last four quarters was 10.5%, on average.

In the past 60 days, estimates for A. O. Smith’s earnings have increased 2.9% for 2023. The stock has gained 11.3% in the past year.

Alamo Group Inc. ALG presently carries a Zacks Rank of 2.ALG’s earnings surprise in the last four quarters was 13%, on average.

In the past 60 days, estimates for Alamo’s 2023 earnings have increased 1.1%. The stock has gained 21.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report