Here's Why Hold Strategy is Apt for Axon (AXON) Stock Now

Axon Enterprise AXON is poised for growth on the back of strong demand for its TASER 7 device and Axon Fleet 3 systems. However, headwinds from the escalating cost of sales, hefty investments in research and development and reduced demand for the TASER X-series continue to be a drag on the company’s operations.

Let’s delve deeper to unearth the factors that are aiding this Zacks Rank #3 (Hold) company.

Strong Demand for TASER 7 Energy Device: Axon’s TASER segment is thriving on the back of strong demand for its latest generation energy device — TASER 7. Strong sales from virtual reality training services also support the segment’s growth. Revenues from the segment jumped 15.5% year over year in the first half of 2023.

In January 2023, AXON launched its next-generation energy device, TASER 10, which has a 10-probe capacity and a maximum range of 45 feet. As a result, this energy weapon creates more distance for officers to de-escalate and resolve conflicts. The launch of this product is aligned with Axon’s "moonshot" goal to cut down gun-related deaths between police and the public by 50% over the next decade. Shipment of this product began earlier this year, and the already strong customer response is contributing to growth of the TASER segment. This game-changing weapon is expected to expand the TASER segment’s gross margin over time. The company expects strong order volumes of TASER 10 throughout 2023.

Axon’s acquisition of Sky-Hero (July 2023), an innovator in drones and ground-based vehicles, expands its Axon Air portfolio, which consists of the company’s drone software and hardware portfolio. The buyout expands AXON’s capabilities to protect life and helps the company move ahead in its moonshot goal.

Solid Demand for Axon Fleet 3 in-car cameras: Strong demand for Axon Cloud SaaS solutions and Axon Fleet 3 systems is aiding the Software & Sensors segment. Revenues from the segment surged 46.8% year over year in the first half of 2023. Higher shipments of Axon Fleet 3 in-car cameras are also driving the segment’s growth. Axon introduced its next-generation body-worn camera, Axon Body 4, in April. With upgraded features such as a bi-directional communications facility and a point-of-view camera module option, this body camera is expected to generate significant demand, thus bolstering the segment’s growth. Shipment of this body camera began in June, and customer response has been strong so far.

Bullish 2023 Guidance: With the strong initial response for Axon Body 4 camera and TASER 10 device, Axon has improved its 2023 guidance. The company expects revenues of $1.44-$1.46 billion compared with $1.43 billion anticipated earlier. The guided range reflects an approximate 27-29% year-over-year increase. AXON expects adjusted EBITDA of $302-$306 million compared with $288-$292 million anticipated earlier. Adjusted EBITDA margin is expected to be 20% in 2023.

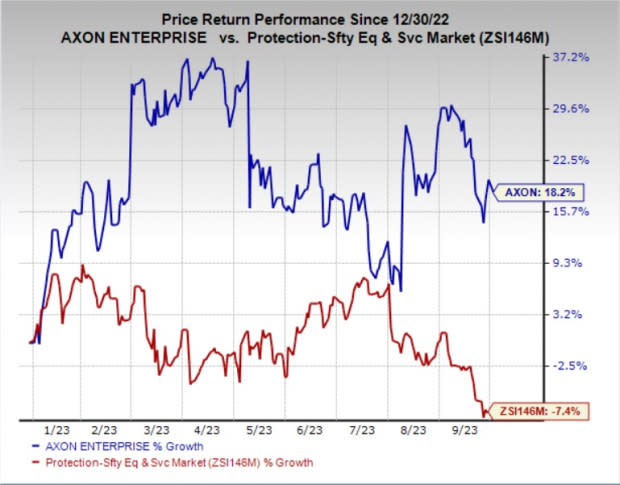

Price Performance: Due to the abovementioned tailwinds, shares of AXON have outperformed its industry so far this year. The stock gained 18.2% against the industry’s 7.4% decrease.

Image Source: Zacks Investment Research

Northbound Estimate Revision: The Zacks Consensus Estimate for Axon’s 2023 earnings has been revised upward by 13.8% in the past 60 days.

Key Picks

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Graham Corporation GHM currently flaunts a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 243.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Graham has an estimated earnings growth rate of 400% for the current fiscal year. The stock has rallied around 68% so far this year.

Applied Industrial Technologies AIT currently sports a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 15%, on average.

Applied Industrial has an estimated earnings growth rate of 3.1% for the current fiscal year. The stock has gained 22.7% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report