Here's Why Hold Strategy is Apt for Affirm (AFRM) Stock Now

Affirm Holdings, Inc. AFRM is well-poised to grow on the back of rising active merchant numbers and Gross Merchandise Volume (GMV). Its growing transaction volumes and interest income are major positives. Over the year-to-date period, the stock has surged 109.5%, outperforming the industry average of 9%.

Affirm — with a market cap of almost $6 billion — is a platform for digital and mobile-first commerce, which offers financial products. Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth retaining in your portfolio at the moment.

Let’s delve deeper.

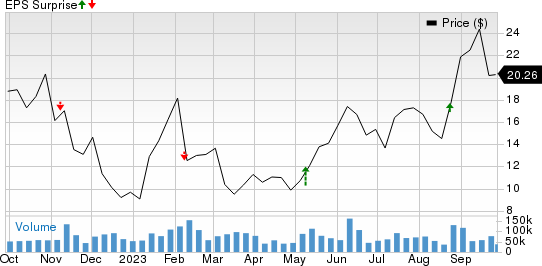

The Zacks Consensus Estimate for AFRM’s current year earnings indicates 15.9% year-over-year improvement. The stock has witnessed five upward estimate revisions in the past 60 days against one in the opposite direction. Affirm beat on earnings in two of the last four quarters and missed twice, the average surprise being 7.5%. This is depicted in the graph below.

Affirm Holdings, Inc. Price and EPS Surprise

Affirm Holdings, Inc. price-eps-surprise | Affirm Holdings, Inc. Quote

The company expects to reach full year profitability milestone in the current year on an adjusted operating income basis. It anticipates adjusted operating margin to be more than 2% in fiscal 2024, signaling a huge improvement from negative 4.6% witnessed last year.

The consensus mark for current-year revenues is pegged at nearly $2 billion, suggesting a 22.8% rise from the prior-year’s reported number. Rising GMV and transactions are likely to support top-line growth. Management expects fiscal 2024 GMV of more than $24 billion, implying a jump from the year-ago level of $20.2 billion. It projects revenues as a percentage of GMV to be similar to the fiscal 2023 level of 7.9%, which means that revenues will see a definite increase this year.

Disciplined performance in the past few quarters is fueling its network growth. The Zacks Consensus Estimate for AFRM’s current year merchant network revenues indicates 13.9% year-over-year growth. Moreover, the consensus mark for current-year card network revenues predicts a 17.8% rise from the year-ago period.

Rising interest income is also benefiting its top line. Last year, the metric jumped 30% to $685.2 million. The Zacks Consensus Estimate for current year interest income suggests 44.2% year-over-year jump.

Key Risks

However, there are a few factors that investors should keep an eye on. Rising competition in the buy now, pay later space can affect AFRM’s growth trajectory. Also, higher funding costs due to multiple factors including high interest rates and limited consumer loans appetite from the secondary market are pushing the company toward loans with longer durations.

Although it can easily manage the situation with enough capital in its kitty, but this can expose the company to interest rate and credit risk. Nevertheless, we believe that a systematic and strategic plan of action will drive Affirm’s growth in the long term.

Key Picks in Business Services

Some better-ranked stocks in the broader Business Services space are Shift4 Payments, Inc. FOUR, Paysafe Limited PSFE and FirstCash Holdings, Inc. FCFS. While Shift4 Payments currently sports a Zacks Rank #1 (Strong Buy), Paysafe and FirstCash carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Shift4 Payments’ current-year bottom line suggests 100.7% year-over-year growth. Based in Allentown, PA, FOUR beat earnings estimates in all the past four quarters, with an average surprise of 21.9%.

The Zacks Consensus Estimate for Paysafe’s current-year bottom line implies a 5.8% year-over-year rise. Headquartered in London, PSFE beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 154%.

The Zacks Consensus Estimate for FirstCash’s current-year earnings indicates a 6.7% year-over-year gain. Fort Worth, TX-based FCFS beat earnings estimates in all the past four quarters, with an average surprise of 7.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

Shift4 Payments, Inc. (FOUR) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report