Here's Why Hold Strategy Is Apt for Barnes (B) Stock Right Now

Barnes Group Inc. B is benefiting from the improvement in operational productivity, favorable pricing policies and inflation-mitigating actions despite adversities from increasing costs and foreign exchange headwinds.

What’s Aiding B?

Healthy aftermarket business, including maintenance, repair, and overhaul sales growth is supporting B’s Aerospace unit. Also, robust Original Equipment Manufacturing (OEM) order bodes well for the segment. Strength in the molding solution business and robust activity in the general industrial and medical end market is driving the growth of the Industrial segment.

The company’s measures to expand operations through asset additions support its top-line growth. In June 2023, Barnes entered into a definitive agreement to acquire MB Aerospace. This acquisition is expected to expand its aerospace business’ global OEM offering and aftermarket repair capabilities. Subject to regulatory approvals and customary closing conditions, the buyout is expected to close in the fourth quarter of 2023. Following the closing, MB Aerospace will be part of Barnes’ Aerospace segment.

Barnes’ commitment to rewarding its shareholders through dividends and share buybacks is encouraging. In 2022, the company paid out dividends worth $32.4 million to its shareholders. In the first three months of 2023, Barnes rewarded its shareholders with dividends of $8.10 million.

B’s efforts to reduce debt levels augur well. Its long-term debts declined 1% year over year to $563.9 million at the end of the first quarter of 2023. It’s worth noting that long-term debts of $44.3 million were repaid in the first three months of 2023.

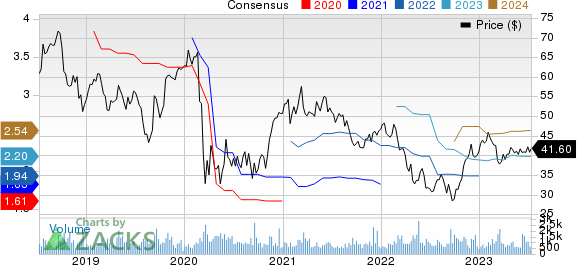

Barnes Group, Inc. Price and Consensus

Barnes Group, Inc. price-consensus-chart | Barnes Group, Inc. Quote

In light of the above-mentioned positives, we believe, investors should retain B stock for now, as suggested by its current Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Greif, Inc. GEF presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

GEF delivered a trailing four-quarter earnings surprise of 7.7%, on average. GEF’s earnings estimates have increased 12.6% for fiscal 2023 (ending October 2023) in the past 60 days. Its shares have risen 5.3% in the year-to-date period.

Allegion plc ALLE presently carries a Zacks Rank #2 (Buy). ALLE’s earnings surprise in the last four quarters was 12.5%, on average.

In the past 60 days, Allegion’s earnings estimates have remained steady for 2023. The stock has gained 15.3% in the year-to-date period.

A. O. Smith Corporation AOS presently carries a Zacks Rank of 2. AOS’ earnings surprise in the last four quarters was 8%, on average.

In the past 60 days, estimates for A. O. Smith’s earnings estimates have remained steady for 2023. The stock has gained 26.1% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report